Why Do Gas Prices Cycle in the Midwest?

Tuesday’s blog post examined the cheapest days of the week for buying gasoline and found that the price of gas in many Midwestern cities, such as St. Louis, follow a regular weekly pattern. A related article took a deeper look at why this pattern exists.

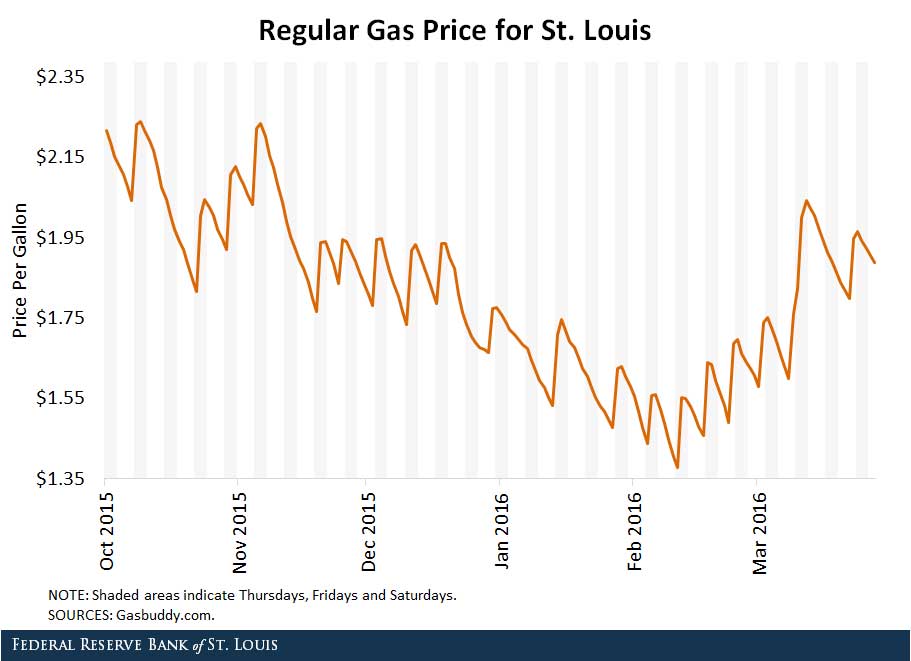

In an Economic Synopses essay, Senior Economist YiLi Chien and Research Associate Paul Morris examined daily gas prices for the period October through March. They found that many Midwestern cities saw a large price jump in gas prices followed by smaller price drops, then followed by another large jump. In addition, the price jumps often occur on a Thursday, Friday or Saturday. The figure below, which was published in Tuesday’s blog post, shows the average daily gas price for St. Louis from October through March.

The authors noted that this cyclical pricing is consistent with what are known as Edgeworth cycles: “Gas stations undercut each other on price to gain business. When retail gas prices approach the wholesale cost of gasoline, a more-dominant firm will increase its prices. Other gas stations follow suit, thereby resetting the cycle.”

Chien and Morris noted that the degree of market concentration seems to play a role in whether gas prices will be cyclical. For instance:

- When a small number of firms dominate a market, these firms have little incentive to decrease gas prices.

- When a market has many firms and greater competition, individual firms have a hard time resetting the cycle by increasing gas prices.

The authors noted that markets with intermediate concentration, however, seem much more likely to support cyclical gas pricing, and many Midwestern cities fit this bill. Chien and Morris cited a paper showing that two specific independent Midwestern retail chains contribute to cyclical gas pricing in such communities.1 These firms have enough influence to act as price leaders, but Chien and Morris suspect that they don’t have enough influence to keep market prices steady.

Days of the Week

As for the timing of the jumps, the authors weren’t sure why prices seem to peak on Thursdays, Fridays and Saturdays. They noted: “It is possible that demand for gasoline is higher during the weekend, and gas stations raise prices to take advantage of this effect.”

Lower Gas Prices

Chien and Morris cited an additional paper suggesting that average gas prices for an area experiencing cycling tend to decline compared with an area with no cyclical pricing, controlling for other factors.2 They noted: “This finding suggests that cyclical pricing is a form of competition. In addition, consumers can save if they identify the cycle floor and buy then.”

Notes and References

1 Lewis, Matthew S. “Price Leadership and Coordination in Retail Gasoline Markets with Price Cycles.” International Journal of Industrial Organization, July 2012, Vol. 30, Issue 4, pp. 342-51.

2 Zimmerman, Paul R.; Yun, John M. and Taylor, Christopher T. “Edgeworth Price Cycles in Gasoline: Evidence from the United States.” Review of Industrial Organization, May 2013, Vol. 42, Issue 3, pp. 297-320.

Additional Resources

- Economic Synopses: Filling the Tank on Fridays May Be a Bad Idea for St. Louisans

- On the Economy: When Should You Buy Gas?

- On the Economy: Why Don’t Gas Prices Always Move in Sync with Oil Prices?

Citation

ldquoWhy Do Gas Prices Cycle in the Midwest?,rdquo St. Louis Fed On the Economy, May 5, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions