If Housing Markets Are Recovering, Why Is the Homeownership Rate Still Falling?

According to many metrics, housing market conditions continued to improve in 2015. For example, nationwide statistics show that:

Yet one important gauge of housing conditions continued to fall in 2015—the homeownership rate.

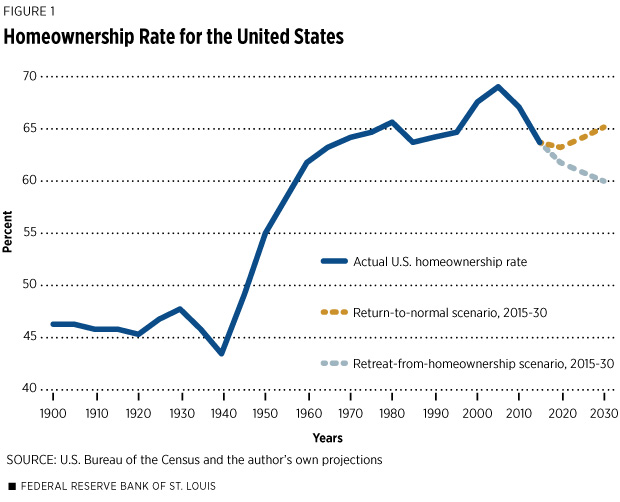

After peaking in 2004 at 69 percent, the national homeownership rate declined in 2015 to 63.7 percent (see Figure 1).

This marks the 11th consecutive year of decline and brings the homeownership rate back to the level it first reached in 1968.

One explanation focuses on the sharp increase in homeownership between 1994 and 2004. Perhaps this period represented an unsustainable shift of many financially weaker families out of rental housing into homeownership, which subsequently reversed with the bursting of the housing bubble and the onset of the Great Recession.

Prior to the late 1990s, the homeownership rate had fluctuated for three decades in a narrow band between 63 and 66 percent. This still might be the range to expect in the future.

Evidence supporting the return-to-normal hypothesis includes greater-than-average declines since 2004 in the homeownership rates of younger, less-educated and nonwhite families— precisely the financially weaker groups that moved into homeownership most rapidly during the housing boom.

Another possible explanation of the ongoing retreat from homeownership is that owning a home isn’t as attractive or feasible as it was for many people during recent decades.

Virtually all homeowners experienced large fluctuations in the value of their housing investments in recent years, while millions lost their entire investments due to foreclosure. In addition, mortgage borrowing today is more difficult and expensive in terms of spreads and fees for many potential homeowners.

Finally, the idea of being “tied down” by a house and all its obligations may not be as attractive to younger people today as it was to their parents and previous generations.

Under this retreat-from-homeownership interpretation of recent experience, the homeownership rate could decline for some time to come—perhaps even to 60 percent or below. After all, homeownership rates in the low- to mid-60 percent range were unprecedented before post-World War II political and social changes turned the U.S. into a majority homeowning society.

It’s too soon to judge whether a long 20-year cycle is nearing its end (the return-to-normal scenario) or we are in the midst of a secular decline that could drive the homeownership rate even lower (the retreat-from homeownership scenario).

Perhaps there are elements of both explanations at work. In any case, it appears unlikely that the U.S. homeownership rate will return to its historic peak of 69 percent anytime soon.

This article originally appeared in our Housing Market Perspectives publication.

Citation

William R. Emmons, ldquoIf Housing Markets Are Recovering, Why Is the Homeownership Rate Still Falling?,rdquo St. Louis Fed On the Economy, March 31, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions