Using PMI to Gauge the U.S.'s and China's Economies

The manufacturing Purchasing Managers’ Index (PMI) is often used as a gauge of the economy, due to being released in a timelier manner than gross domestic product (GDP) data. But how well does the PMI track GDP?

In a recent Economic Synopses essay, Senior Economist YiLi Chien and Research Associate Paul Morris examined this relationship for both the U.S. and China. In both cases, the PMI and GDP growth had strong positive, though not perfect, correlations.

What Is PMI?

The authors noted that the PMI is a diffusion index where a number greater than 50 means more than half of survey respondents reported better economic conditions for the current period than they reported in the previous period, and vice versa. For the PMI, a number higher than 50 means the manufacturing sector generally expanded.

PMI and the U.S.

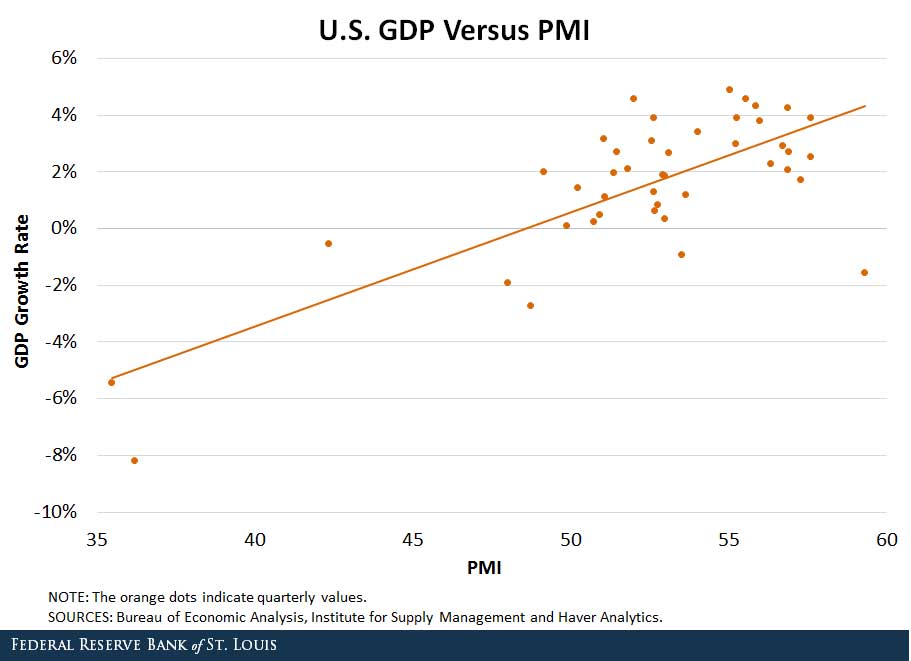

Chien and Morris examined the relationship for the period since the first quarter of 2005. They found that the PMI and GDP growth had a correlation coefficient of 0.75 for the U.S., as seen in the figure below.

Also, when the PMI was above 50 percent for the U.S., GDP growth was more often positive than negative.

PMI and China

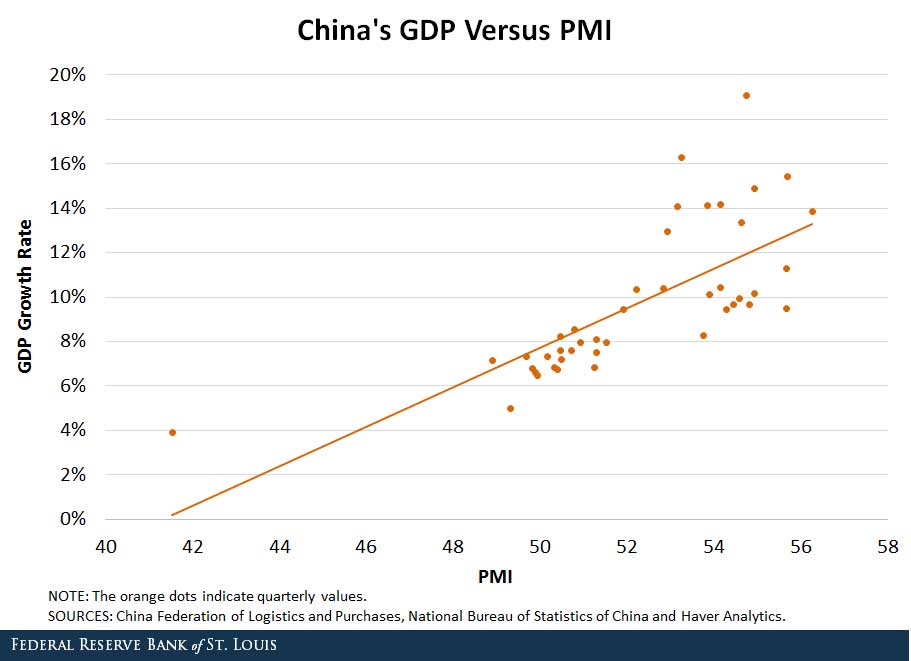

Chien and Morris noted that studying the relationship for China was particularly interesting because its recent economic slowdown incited concern over weak global growth. This caused turmoil in most major stock markets. The figure below plots the relationship between the PMI and GDP growth for China.

The variables had a correlation coefficient of 0.73, nearly identical to that of the U.S. Unlike the U.S., though, a PMI reading of 50 percent doesn’t indicate a near-zero growth rate for GDP. The authors noted: “In fact, China’s GDP still grows at around 5 percent annually even when its PMI is below 50 percent.”

Chien and Morris also wrote that China’s GDP growth rate is more sensitive to changes in the PMI than the U.S. GDP growth rate is. They noted: “For China, an increase in the PMI from 50 percent to 55 percent could increase the predicted GDP growth rate from 5 percent to more than 15 percent. For the United States, however, a similar increase in the PMI would not affect the GDP growth rate as strongly.”

Conclusion

They concluded: “The PMI seems to be a good, although not perfect, indicator of a country’s current economic condition.”

Additional Resources

- Economic Synopses: PMI and GDP: Do They Correlate for the United States? For China?

- On the Economy: Projecting Real GDP Growth for the Next Decade

- On the Economy: Better Measure of Output: GDP or GDI?

Citation

ldquoUsing PMI to Gauge the U.S.'s and China's Economies,rdquo St. Louis Fed On the Economy, April 11, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions