Education, Financial Decisions and Wealth

A family’s ability to make good everyday financial decisions is likely correlated to its ability to accumulate wealth over time. As part of their essay on the connection between education and wealth, researchers from the St. Louis Fed’s Center for Household Financial Stability examined the financial decision-making of families who have achieved various levels of education.

Senior Economic Adviser William Emmons and Lead Policy Analyst Bryan Noeth measured the quality of financial decisions of families via the center’s financial health scorecard, which looks at answers to five questions given as part of the Federal Reserve’s triennial Survey of Consumer Finances (SCF):1

- Did you save any money last year?

- Did you miss any payments on any obligations in the past year?

- Did you have a balance on your credit card after the last payment was due?

- Including all of your assets, was more than 10 percent of the value in liquid assets?

- Is your total debt service (principal and interest) less than 40 percent of your income?

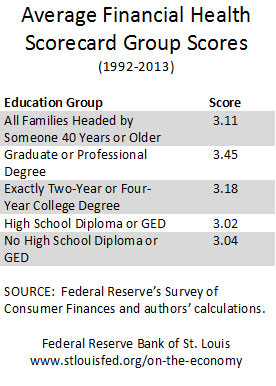

Answers were given a score of 0 or 1. The highest possible score, indicating strong financial health, was 5. Over the period 1992-2013, the average total score among SCF survey respondents was 3.01.

The authors broke respondents down into four groups, based on the educational attainment of the head of household:2

- Those with a graduate or professional degree

- Those with exactly a two-year or four-year college degree

- Those with a high school diploma or GED

- Those with no high school diploma or GED

The table below shows the average financial health scores for each education group.

In the essay, the authors noted that average financial health scores were strongly related to education. They concluded, “In general, the higher a group’s average financial health score, the higher its balance sheet liquidity, the greater its asset diversification and the lower its leverage—all elements of the conservative financial decision-making that is likely to lead to greater wealth accumulation.”

Notes and References

1 The specific questions asked in the survey and how they were scored are available in the In the Balance issue “Five Simple Questions That Reveal Your Financial Health and Wealth.”

2 The authors restricted the sample in the essay to families headed by someone 40 years old or older. This minimizes the possibility that a family will be placed in an education category lower than its ultimate degree attainment because a very small number of people over 40 receive a diploma.

Additional Resources

- Center for Household Financial Stability: The Demographics of Wealth: The Role of Education

- On the Economy: Five Simple Questions That Reveal Your Financial Health

- On the Economy: Other Sources of the Education/Wealth Correlation

Citation

ldquoEducation, Financial Decisions and Wealth,rdquo St. Louis Fed On the Economy, June 2, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions