Earnings Inequality and Social Security Disability Payments

In recent years, Social Security disability insurance (SSDI) payment rolls have increased. A 2003 research paper showed a gradual increase in SSDI payments’ average replacement rate, or the benefit as a fraction of pre-disability labor income, over the period 1984-2001.1 However, this is mostly not resulting from policy changes, but rather from changes in the earnings structure. It turns out that the trend towards greater earnings inequality has increased the average replacement rate of disability insurance.

“Earnings inequality” really has two components, both of which are contributing to the rise in the replacement rate:

- Fluctuations in income, including increases as workers age

- Some people simply having higher incomes than others

First, if there are larger fluctuations in earnings across years, even if the average is the same, then the maximum over any group of years will be larger. For example, consider two workers with 40 years of earnings, with one earnings $40,000 every year and another with earnings alternating between $10,000 and $70,000 per year. When considering the top 35 years of earnings, the second worker will have higher average earnings. The Social Security Administration considers the maximum of 35 years of earnings out of a beneficiary's entire working life.

More importantly, as inequality in lifetime earnings has increased, the mean of earnings has risen faster than the median of earnings. This is important for disability benefits because they are computed as a replacement on earnings inflated by the average wage, rather than the median. Most people had slower wage growth than the rate at which past wages are inflated, so benefits for the average recipient are becoming relatively more generous simply by inflating past wages more quickly at a rate pulled up by strong growth at the top of the earnings distribution.

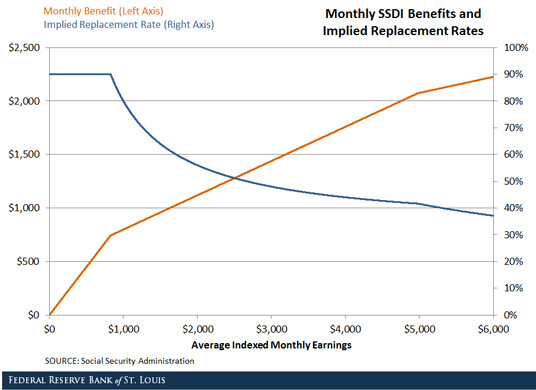

The way benefits are calculated as a recipient’s earnings increases is one more reason that earnings inequality increases the average benefit. There are certain “bend points” at which the replacement rate changes. Earnings below a certain point (for example, $180 in 1989 and $826 in 2015) are replaced at 90 percent. As earnings increase, the replacement rate on earnings beyond that point is only 32 percent. Eventually, earnings are replaced at 15 percent past another point (for example, $1,085 in 1979 and $4,980 in 2015). The result is a benefit structure and implied replacement rate seen in the figure below.

The inflation rate of these bend points, however, is based on the growth of average wages. Again, the growth in average wages is faster than the growth of wages at the low end of the distribution, and so the first two bend points are getting to be relatively higher in the wage distribution. This means that more people enjoy higher replacement rate brackets.

Notes and References

1 Autor, David; and Duggan, Mark. “The Rise in the Disability Rolls and the Decline in Unemployment.” Quarterly Journal of Economics, Vol. 118, No. 1, February 2003, pp. 157-206.

Additional Resources

- Working Paper: Occupational Hazards and Social Disability Insurance

- On the Economy: Why Are There So Many Price Indexes?

- On the Economy: Will Household Deleveraging End Anytime Soon?

Citation

David G Wiczer, ldquoEarnings Inequality and Social Security Disability Payments,rdquo St. Louis Fed On the Economy, Jan. 5, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions