How the Construction Sector Has Factored into Slow Employment Recovery from the Recession

It is well known that employment growth has been particularly sluggish following the past three recessions relative to previous post-war recessions. Regarding the most recent recovery, the recession was preceded by a construction boom that resulted in excess supplies of real capital in the form of residential and commercial real estate. The excess supply has contributed to the slow recovery directly through its impact on the construction sectors and also indirectly because construction is so interconnected with a variety of other sectors such as wood, metals, concrete, furniture, and even services (such as legal and financial services).

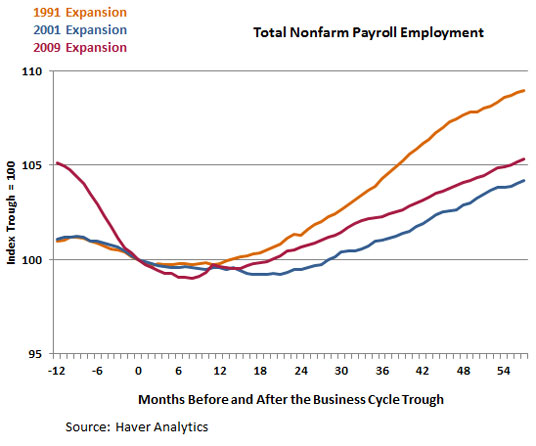

The effect of the excessive stock of residential and commercial real estate is reflected in the figures below. The first figure shows total nonfarm payroll employment from the cycle troughs of the past three recessions. Employment growth during these expansions was considerably slower than during the previous post-war expansions. Nevertheless, the figure shows that total employment increased at a slightly better pace during the most recent expansion than it did during the 2001 expansion, though somewhat worse than the 1991 expansion.

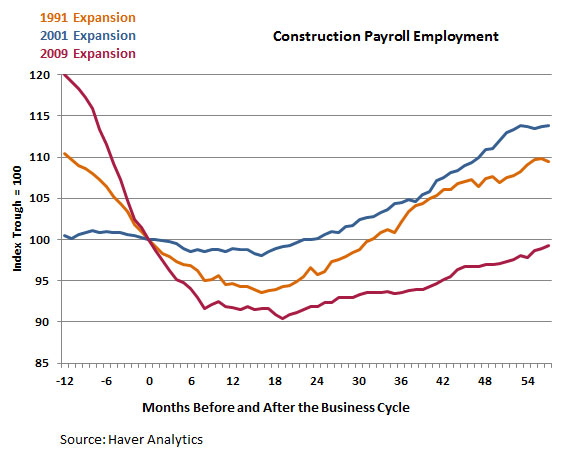

However, the excess stock of residential and commercial real estate helped cause employment in construction to decline considerably more after the beginning of this expansion than during either of the previous two expansions. Moreover, it has recovered much more slowly and even remains below the cyclical trough level. In contrast, construction employment had returned to the cyclical trough level within two years during the 2001 expansion and within three years during the 1991 expansion.

Construction of new homes and commercial real estate will be relatively modest until the excess is significantly reduced. Construction activity during the expansion will be further limited because a considerable amount of infrastructure (roads, sewers, electric, etc.) associated with residential construction is already in place, due to being completed prior to the start of the recession. Consequently, construction of infrastructure will be less important during the recovery.

Additional Resources

- Economic Synopses: What Is Output Growth So Slow?

- On the Economy: The Economic Recovery with Malfunctioning Sectors

- On the Economy: Eighth District Economic Conditions Are Mixed

Citation

Daniel L. Thornton, ldquoHow the Construction Sector Has Factored into Slow Employment Recovery from the Recession,rdquo St. Louis Fed On the Economy, May 8, 2014.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions