How Does the Fed Use Its Monetary Policy Tools to Influence the Economy?

—Jerome Powell, Chair of the Federal ReservePowell, Jerome. "Data-Dependent Monetary Policy in an Evolving Economy." Board of Governors of the Federal Reserve System, October 8, 2019.

The Federal Reserve (the Fed) is the central bank of the United States. As the central bank, it serves several key functions within the economy. One of the most important functions of the Fed is to promote economic stability using monetary policy. The Fed's goals for monetary policy, as defined by Congress, are to promote maximum employment and price stability.

The Federal Open Market Committee (FOMC) is the monetary policymaking arm of the Federal Reserve. The FOMC usually meets eight times per year in Washington, D.C. These two-day meetings include a review of economic data and financial conditions, briefings by economists, policy discussions, and a vote on the setting of monetary policy—including a decision about whether the FOMC will adjust its target range for the federal funds rate. The federal funds rate is the interest rate banks charge each other for overnight loans. The Fed sets a target range for where it wants the interest rates charged to fall within, and it is the setting of this range that the Fed uses to communicate its monetary policy position.

Figure 1: The Federal Funds Rate Target Range

SOURCE: Board of Governors of the Federal Reserve System via FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/graph/?g=COX8, accessed April 4, 2022.

The FOMC conducts monetary policy by setting the target range for the federal funds rate. This graph shows the target range, determined by the upper and lower limits, and the effective federal funds rate within the range.

Over time, as shown in Figure 1,The effective federal funds rate is the rate used in the figures in this article. On any given day, there are many transactions that settle at slightly different federal funds rates. The effective federal funds rate is the volume-weighted median rate of these transactions. the FOMC has moved the target range up and down as it steers the economy toward maximum employment and price stability. For example, once the economy recovered from the global financial crisis, the FOMC moved the target range from near zero at the end of 2015 up to 2¼ -2½ percent by early 2019. Then when the COVID-19 pandemic hit, the FOMC quickly moved the target range back to near zero.

What Is the Federal Funds Rate and Why Is It So Important?

The federal funds rate is a very specific short-term interest rate. It involves the transfer of funds between banks that maintain accounts (deposits) with their Federal Reserve Bank; the accounts are called reserve balance accounts. The federal funds market is where banks that may need money in their reserve accounts for cashflow reasons go to borrow from banks that have excess funds in their reserve accounts. Banks who lend funds act as suppliers of reserves in the federal funds market; banks who borrow funds act as demanders of reserves in the federal funds market. The federal funds rate is not "set" by the Fed, but rather determined by the borrowers and lenders in the federal funds market.

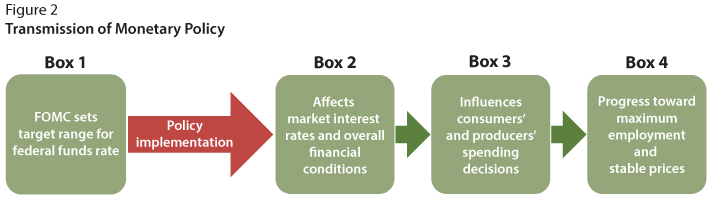

Figure 2: Transmission of Monetary Policy

Monetary policy is transmitted through market interest rates to affect consumers' and producers' spending decisions, which ultimately moves the economy toward the Fed's objectives—maximum employment and stable prices. This monetary policy implementation framework ensures that when the FOMC changes its policy stance (raises or lowers the target range for the federal funds rate), market interest rates and financial conditions move in the desired direction.

The FOMC conducts monetary policy by setting the target range for the federal funds rate (Figure 2, Box 1). Then the Fed implements policy by using its monetary policy tools to ensure the federal funds rate stays within the target range (red arrow).

The federal funds rate is important because when the FOMC sets its target range, it influences many other interest rates in the economy (Figure 2, Box 2). In fact, by adjusting the target for this rate, the Fed can influence the spending choices of consumers and producers (Figure 2, Box 3) and ultimately move the economy toward maximum employment and price stability (Figure 2, Box 4).

The Fed's Monetary Policy Implementation Toolbox

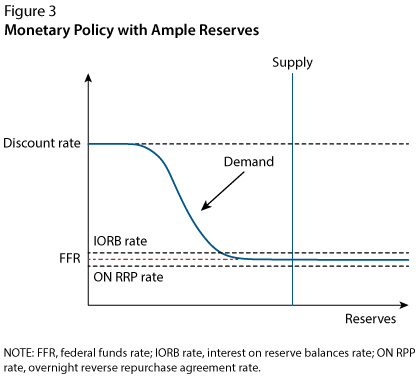

The Fed uses its monetary policy tools in the implementation phase. In all, the Fed uses four key tools to help ensure the federal funds rate stays within the target range set by the FOMC.The Fed recently introduced two repurchase agreement (repo) backstop tools, the standing overnight repo facility and the foreign and international monetary authorities repo facility. These are used by specific counterparties to help set a ceiling on repo rates. We do not discuss them here because this article is targeted toward a principles of economics audience. We'll use a simple supply and demand model (Figure 3) to describe how the tools work together. Overall, these are the critical tools the Fed uses because reserves in the banking system are ample. That is, the supply of reserves, set by the Fed, is large enough that it intersects the demand curve where it is nearly flat (see Figure 3).

Figure 3: Monetary Policy with Ample Reserves

In the ample-reserves framework, the Federal Reserve raises (lowers) its administered rates to move the federal funds rate higher (lower). Small shifts of the supply curve have little or no effect on the federal funds rate.

The Fed's Primary Tool: Interest on Reserve Balances

Today, the Fed's primary tool for adjusting the federal funds rate is interest on reserve balances. The interest on reserve balances rate (labeled "IORB rate" in Figure 3) is the interest rate paid on funds that banks hold in their reserve balance account at a Federal Reserve Bank. For banks, this interest rate represents a risk-free investment option. Importantly, the interest on reserve balances rate is an "administered rate," which means it is set by the Fed and not determined in a market (like the federal funds rate is). In fact, there are two key concepts that ensure interest on reserves is an effective tool.

The first concept is the reservation rate, which is the lowest rate that banks are willing to accept for lending out their funds. Banks can deposit their funds at the Federal Reserve and earn the interest on reserve balances rate. Because depositing funds at the Fed is a risk-free option, banks will likely not be willing to lend their funds in the federal funds market for a lower interest rate than they can earn from depositing their funds at the Fed. So, the interest on reserve balances rate serves as a reservation rate for banks.

The second concept is arbitrage, which is the simultaneous purchase and sale of funds (or goods) in order to profit from a difference in price. For example, let's assume reserves are trading in the federal funds market at 2 percent (i.e., the federal funds rate is 2 percent) and that reserves (deposits) at the Fed earn 2.5 percent (i.e., the interest on reserve balances rate is 2.5 percent). Banks will quickly see that they can borrow funds in the federal funds market at 2 percent and deposit those funds at the Fed and earn the interest on reserve balances rate of 2.5 percent, which means that they can earn a profit of 0.5 percent (the difference between the rates).The increase in demand for funds in the federal funds market will put upward pressure on the federal funds rate, and the federal funds rate will rise toward the interest on reserve balances rate. This upward pressure on the federal funds rate will continue until the federal funds rate has risen to the level that banks no longer see the opportunity to profit.

So, arbitrage ensures that the federal funds rate does not fall far below the interest on reserve balances rate. Arbitrage is the reason why these short-term rates remain closely linked. In fact, arbitrage is what makes interest on reserve balances an effective tool for guiding the federal funds rate. Because the Fed sets the interest on reserve balances rate directly, the Fed can steer the federal funds rate down or up by lowering or raising the level of the interest on reserve balances rate. As a result, interest on reserve balances is the Fed's primary tool for adjusting the federal funds rate, but the Fed has other tools that play supporting roles.

Setting a Floor for the Federal Funds Rate: The Overnight Reverse Repurchase Agreement Facility

Interest on reserve balances is available only to banks and a few other institutions. The Fed has an overnight reverse repurchase facility that is open to a broader set of financial institutions. This facility allows these financial institutions to deposit their funds at a Federal Reserve Bank and earn the overnight reverse repurchase agreement rate offered by the Fed. The overnight reverse repurchase agreement rate (labeled "ON RRP rate" on Figure 3) works for these institutions similar to the way the interest on reserve balances rate works for banks. So, this rate acts like a reservation rate for these financial institutions, and the overnight reverse repurchase agreement rate interacts with other short-term market rates through arbitrage. The overnight reverse repurchase agreement facility is a supplementary tool because the rate the Fed sets for it helps set a floor for the federal funds rate (Figure 4).

Figure 4: Steering the Federal Funds Rate

SOURCE: Federal Reserve Bank of New York and Board of Governors of the Federal Reserve System via FRED®, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/graph/?g=LP47, accessed April 4, 2022.

The Fed implements monetary policy by using its monetary policy tools, such as the interest of reserve balances rate (red) and overnight reverse repurchase agreement rate (blue), to ensure interest rates are consistent with the federal funds rate target.

Setting a Ceiling for the Federal Funds Rate: The Discount Window

The discount rate is the rate charged by the Fed for loans obtained through the Fed's discount window. Because banks will not likely borrow at a higher rate than they can borrow from the Fed, the discount rate acts as a ceiling for the federal funds rate: It is set higher than the interest on reserve balances rate and the overnight reverse repurchase agreement rate (Figure 5).

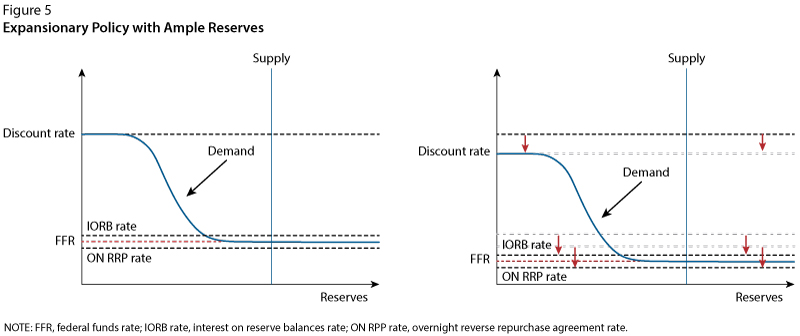

Figure 5: Expansionary Policy with Ample Reserves

When the Federal Reserve lowers its administered rates, the end points of the demand curve shift down. The vertical supply curve is unchanged. The demand curve intersects the supply curve at a lower federal funds rate. In general, the Fed tends to lower all the administered rates by the same amount, keeping the spread between the rates constant.

The Final Tool: Open Market Operations

As noted above, the Fed's current method for implementing monetary policy relies on banks' reserves remaining "ample." So, if the Fed needs to add reserves to ensure they remain ample, it does so by buying U.S. government securities in the open market. This action is known as open market operations. When the Fed buys securities, it pays for them by depositing funds into the appropriate banks' reserve balance accounts, adding to the overall level of reserves in the banking system. As Figure 3 shows, open market operations can be used to shift the supply curve left or right. Prior to 2008, open market operations were the Fed's primary monetary policy tool, which it used daily to make sure the federal funds rate hit the FOMC's target. Today this tool is mainly used to ensure that reserves remain ample.

Now that you understand the Fed's implementation tools, let's see how the Fed uses them to achieve its two goals: maximum employment and price stability.

Expansionary Monetary Policy Using the Fed's Tools

Suppose the following: The economy weakens, with employment falling short of maximum employment, and the inflation rate has been steady at around 2 percent but is showing signs of decreasing. The FOMC might decide to conduct monetary policy by lowering its target range for the federal funds rate. To implement that monetary policy, it would decrease its administered rates—the interest on reserve balances rate, overnight reverse repurchase agreement rate, and discount rate—to ensure the market-determined federal funds rate stays within the target range (see Figure 5). These actions would transmit to other interest rates and broader financial conditions:

- Lower interest rates decrease the cost of borrowing money, which encourages consumers to increase spending on goods and services and businesses to invest in new equipment.

- The increase in consumption spending increases the overall demand for goods and services in the economy, which creates an incentive for businesses to increase production, hire more workers, and spend more on other resources.

- As these increases in spending ripple through the economy, likely moving the unemployment rate down toward its full employment level, inflation could possibly move up.

So, the Fed's monetary policy implementation tools can be effective for moving the economy back toward maximum employment and price stability when the economy is stalling.

Contractionary Monetary Policy Using the Fed's Tools

Suppose the following: The economy is showing signs of overheating, with the unemployment rate very low and businesses finding it hard to fill jobs, and the inflation rate has been above the Fed's 2 percent target for quite some time and is rising. In this case, the FOMC might decide to conduct monetary policy by raising its target range for the federal funds rate. To implement that monetary policy, it would increase its administered rates—the interest on reserve balances rate, overnight reverse repurchase agreement rate, and discount rate—to ensure the federal funds rate stays within the target range. These actions would transmit to other interest rates and broader financial conditions:

- Higher interest rates increase the cost of borrowing money and raise the incentive to save, which dampens consumer spending on some goods and services and slows businesses' investment in new equipment.

- The decrease in consumption spending decreases the overall demand for goods and services in the economy, which will likely lead to a decrease in production levels, fewer employees hired, and less spending on other resources.

- As these decreases in spending ripple through the economy, demand for workers could lessen, inflationary pressures would diminish, and the inflation rate would fall back toward 2 percent.

So, higher interest rates can be used to move the economy back to maximum employment and price stability when the economy is overheating.

Conclusion

The Fed has a congressional mandate of maximum employment and price stability. The FOMC conducts monetary policy by setting the target range for the federal funds rate. Then the Fed uses its monetary policy tools to implement the policy, which guides market interest rates toward the Fed's desired setting of policy. The Fed ensures there are ample reserves in the banking system and uses its administered rates to steer the federal funds rate into the FOMC's target range: Interest on reserve balances is the Fed's primary tool for adjusting the federal funds rate; the overnight reverse repurchase agreement facility is a supplementary tool that sets a floor for the federal funds rate; and the discount rate serves as a ceiling for the federal funds rate. Changes in the federal funds rate are transmitted to other interest rates through arbitrage and affect the decisions of consumers and businesses. Their decisions ultimately move the economy toward maximum employment and price stability.

Arbitrage: The simultaneous purchase and sale of funds (or goods) in order to profit from a difference in price.

Discount rate: The interest rate charged by the Federal Reserve to banks for loans obtained through the Fed's discount window.

Facility: A standing program targeted at a set of counterparties for depositing or lending. The Fed has permanent facilities (like the discount window and the overnight reverse repurchase agreement facility) as well as temporary facilities (like those implemented during the Financial Crisis of 2007-09 and the COVID-19 pandemic).

Federal Open Market Committee (FOMC): A Committee created by law that consists of the seven members of the Board of Governors; the president of the Federal Reserve Bank of New York; and, on a rotating basis, the presidents of four other Reserve Banks. Nonvoting Reserve Bank presidents also participate in Committee deliberations and discussion.

Maximum employment: The highest level of employment that an economy can sustain while maintaining a stable inflation rate.

Open market operations: The buying and selling of government securities through primary dealers by the Federal Reserve. When the securities are bought or sold, reserves in the banking system are increased or decreased, respectively.

Price stability: A low and stable rate of inflation maintained over an extended period of time.

Reservation rate: The lowest rate of return that banks are willing to accept for lending out funds.

Reserve balances (reserves): The deposits a bank maintains in its account with a Federal Reserve Bank.

- Powell, Jerome. "Data-Dependent Monetary Policy in an Evolving Economy." Board of Governors of the Federal Reserve System, October 8, 2019.

- The effective federal funds rate is the rate used in the figures in this article. On any given day, there are many transactions that settle at slightly different federal funds rates. The effective federal funds rate is the volume-weighted median rate of these transactions.

- The Fed recently introduced two repurchase agreement (repo) backstop tools, the standing overnight repo facility and the foreign and international monetary authorities repo facility. These are used by specific counterparties to help set a ceiling on repo rates. We do not discuss them here because this article is targeted toward a principles of economics audience.

Citation

Jane E. Ihrig and Scott A. Wolla, ldquoHow Does the Fed Use Its Monetary Policy Tools to Influence the Economy?,rdquo Federal Reserve Bank of St. Louis Page One Economics, May 2, 2022.

These essays from our education specialists cover economic and personal finance basics. Special versions are available for classroom use. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us