Unemployment and Monetary Policy

Mary Suiter: OK, good afternoon and welcome to this session of Feducation. Thank you all for joining us and sharing your lunch with us.

My name is Mary Suiter, and I’m the assistant vice president responsible for economic education for the Federal Reserve Bank of St. Louis. Feducation was developed to provide economic content and to equip people with a better understanding of the Federal Reserve and it’s policy actions.

The topic for this episode is Monetary Policy and Unemployment, and we started by conducting a simulation with the goal of helping attendees understand how unemployment is measured. This began when we distributed yellow, pink or green slips of paper to each audience member.

I’d like those of you who have yellow slips of paper if you’ll raise your hand. I’d like you to move over to this section. You can leave your lunch, you’re gonna come back—just go over there for a moment.

And there should be a few people who have pink slips of paper. I’d like you to go here in these two rows near the cameras for just a minute. And the rest of you should have green slips of paper, right? Everyone has a green slip of paper? I want you to come over here. I have chairs over here and I have candy bars at these chairs … and I want each of you with green slips to have a seat and a candy bar.

Just as we planned, there were more people with green slips than there were seats with candy bars, so not everyone with a green slip was able to have a seat and a candy bar.

OK, now, I want to talk a little about this demonstration in terms of unemployment. Alright, so those people back here who had the yellow slips of paper, those people are under 16 years of age and, as a result, they are not part of the labor force in this room. They are not counted as part of the labor force.

Those of you over here who had my pink slips, you are people who are retired, or you’re choosing to stay at home with your young children, or perhaps you were looking for a job but you’ve stopped and you’re no longer looking. So, as a result, you also are not part of the labor force.

The rest of you—those folks with green slips of paper—you are all part of the labor force. Some of you have jobs as evidenced by your payment, here, others of you don’t have jobs but you’re looking for jobs. You’re actively seeking work, you’re older than 16 years of age and you’re actively seeking work—so you are unemployed. All right, so based on this little activity, we can calculate an unemployment rate for our economy in here.

The unemployment rate is the percentage of the labor force that is 16 years or older, willing and able to work, does not currently have a job, and is actively looking for work. The Bureau of Labor Statistics determines the unemployment rate on a monthly basis. They do this by collecting survey data from households—sixty-thousand households—and based on the responses regarding the people in the household who are 16 years of age or older. They categorize them as employed, unemployed or not in the labor force.

Something to keep in mind is that labor markets are dynamic. There are many moving parts … and the notion there is that you transition from one of these areas to another so, Adriane comes out of college and she is looking for a job so she is unemployed. She finds a job at the Federal Reserve Bank and she works here for a while, and perhaps then she has a family, and decides to take off five years and stay at home with her children, so now she’s no longer part of the labor force, but after that period of time, she enters back into the labor force and seeks another job. So the unemployment statistics—or the employment statistics—those are little slots in time, little snapshots in time, but people are moving within these areas during their lives.

Economists categorize unemployment into three types: frictional, cyclical and structural. Frictional unemployment refers to people who are newly entering the job market. This includes recent college, high school or trade school graduates, or those transitioning from one job to another. Cyclical unemployment is typically associated with recessions or temporary fluctuations in the business cycle. And structural unemployment is caused by a mismatch in the skills held by those looking for work and the skills demanded by those seeking workers. A structurally unemployed worker might lack the skills needed to continue working, or might not work in a part of the country where jobs are available, and may need to be retrained, relocate or both—in order to return to work.

The Federal Reserve has two objectives: to maintain maximum employment and price stability. In the past, the main focus has really been on price stability. The thinking was that if we achieve price stability—if we have a healthy economy—maximum employment will follow. In December of 2008, the Federal Open Market Committee, or FOMC, noted that the objectives of the Fed were maximum employment and price stability, and that language has appeared in every FOMC statement since September of 2010.

Then, in December of 2012, the FOMC went a step further and said that they decided to keep the Federal Funds Rate at zero to one-quarter percent, and that they anticipate keeping that exceptionally low rate as long as the unemployment rate remains above six and a half percent. So now they’re actually making ties to what they’re going to do with the Federal Funds Rate based on some level of unemployment. This is an important change, and one that will continue to shape policy for the foreseeable future.

For more information and other educational resources, visit us online at stlouisfed.org.

This video provides an overview of unemployment – how it’s defined and measured. It also explains the role of the Federal Open Market Committee (FOMC) in using monetary policy to pursue maximum employment and price stability, known as the Fed’s “dual mandate.”

More Feducation Videos

Discover the functions of money, the relationship between the supply of money and inflation, and how changes in the money supply affect the economy.

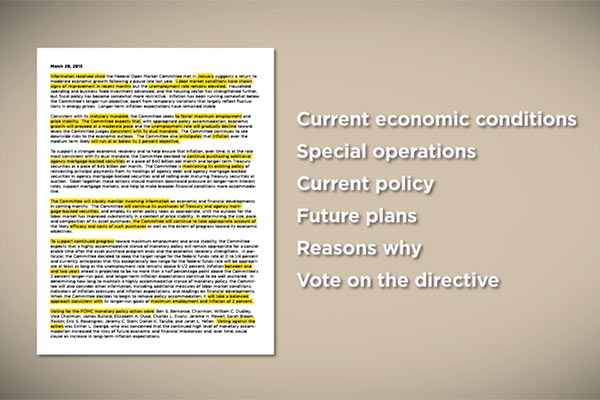

Understanding an FOMC Statement

Learn how to read and understand an FOMC statement and what the statements mean. This video overviews Fed communication strategies for transparency and clarity.

---

If you have difficulty accessing this content due to a disability, please contact us at economiceducation@stls.frb.org or call the St. Louis Fed at 314-444-8444 and ask for Economic Education.