The Economics of Natural Disasters

"What has so often excited wonder [is] the great rapidity with which countries recover from a state of devastation; the disappearance, in a short time, of all traces of the mischiefs done by earthquakes, floods, hurricanes, and the ravages of war."

—John Stuart Mill

Few regions of the country have escaped the wrath of Mother Nature recently. While every year has its share of calamities, the past few years have seen an extraordinary spate of natural disasters and atypical weather. The economic losses from these events have been considerable: Since 1989, insurance companies have paid out more than $44 billion in damage claims stemming from blizzards, hurricanes, earthquakes, tornadoes, floods, droughts, mudslides, wildfires and other assorted maladies. Altogether, these calamities have cost the economy dearly in terms of lost wages and output, utility disruptions, destruction of public and private property, additional commuter time and transportation costs and hundreds of lives.

The nature of these destructive events—as well as their effect on the economy—varies considerably. Some natural disasters, like tornadoes, hurricanes and earthquakes, tend to be short-lived events, lasting several seconds to a few hours, but causing substantial destruction in a concentrated area. Others, like droughts or major floods, tend to be of a longer duration, spreading their damaging effects over a relatively larger expanse for days or weeks. Any type of disaster, however, can leave an economic imprint that lingers for years.

Estimating Disaster Losses: An Imprecise Science

Natural disasters typically set in motion a complex chain of events that can disrupt both the local economy and, in severe cases, the national economy. Calculating the damages of such an event can be an onerous task because the cost of a natural disaster is ultimately wedded to several factors, and—more importantly—varies by type of disaster. Among the key influences are the magnitude and duration of the event, the structure of the local economy, the geographical area affected, the population base and the time of day it occurred. Naturally, disasters that affect densely populated areas have the greatest potential for inflicting the most damage. Not only are large numbers of people endangered, but the potential loss to homes, businesses, highways, roads, bridges and utilities is also magnified. It is not surprising then that Hurricane Andrew, which affected a populous area of southern Florida, still registers as the most costly natural disaster of all time, even though the 1993 floods affected nine Midwestern states and lasted for a much longer period.

One characteristic common to all natural disasters is that damage estimates calculated shortly afterward tend to be significantly overstated, hardly more than back-of-the-envelope calculations. Some estimates in the immediate aftermath of Hurricane Andrew put the damages as high as $60 billion, two to three times its projected final total. Similarly, initial damage estimates of the Great Flood reached as high as $30 billion, perhaps more than double its projected final tally. A similar pattern occurred recently after the Northridge (Los Angeles) earthquake.

The factors that contribute to the over-estimation of losses vary considerably. In some cases, buildings, infrastructure and crops that appear totally destroyed may in fact be only partially damaged. To some extent, this phenomenon may be driven by the media, who are merely striving to add a monetary flavor to the disaster. Other factors also come into play. According to some economists who have studied natural disasters, there is an incentive for states to overestimate their losses in order to maximize their political leverage over federal disaster assistance dollars.1

The Principles of Loss Assessment

Up to now, we have discussed the cost of a natural disaster and the losses that stem from a natural disaster as if they are one and the same; economically they are two separate terms.2 Losses occur principally through destruction of an economy's wealth—the physical assets that help generate income (see table). These assets include levees, roads, bridges, utilities, factories, homes, buildings, farmland, forests or other natural resources. To correctly measure these losses, one must attempt to calculate either the lost income that these physical assets help generate, or the decline in the assets' values. To count both is to double count. By contrast, costs are incurred when an economy undertakes to replace, repair or reinforce those tangible assets (capital) that are destroyed; this includes the buttressing of structures beforehand (for example, the construction of levees or seawalls, or the reinforcement of bridges or buildings in earthquake prone areas).

Calculating the Economic Effects of Natural Disasters: Some Definitions and Concepts

| Term | Definition | Example |

|---|---|---|

| Losses | Change in wealth caused by damage to structures or other physical assets | Houses, buildings and structures are damaged, crops and forests destroyed, landslide damages |

| Direct vs. Indirect Losses | Direct losses are those resulting from building, lifeline, and infrastructure damages. Indirect losses are those that follow from the physical damages. | Direct losses: building damages, bridge collapse, loss of lives. Indirect losses: commuter disruptions, loss of local tax revenues, reduced tourism |

| Market vs. Non-market Effects | Market effects are those that are reflected in national income accounts data; Non-market effects do not appear in the national income accounts data | Market effect: loss of income due to disaster-caused destruction. Nonmarket effects: loss of leisure time due to longer commute as a result of the disaster. |

| Costs | Highest-valued of foregone alternative use of a resource | Mitigation expenditures undertaken before the disaster occurs, (for example, construction of levees or seawalls or reinforcement of buildings) and reconstruction of buildings, etc. during recovery period |

| Redistribution | Transfer of wealth between individuals or governments | Federal disaster relief, but also includes transfers that occur because resources or production are moved to a new region |

| Wealth | Present value of the income stream from the productive assets of society | The value of a forest or farmland is the sum of the flow of monetary benefits (income from sales of timber or crops) and non-monetary benefits (vistas and recreational benefits of a forest) |

SOURCE: Adapted from Brookshire and McKee (FEMA, July 1992), p. 282.

Disaster losses manifest themselves in numerous ways and, unfortunately, can never be estimated with absolute certainty. When correctly calculating losses, an analyst must account for several factors that are often overlooked, intertwined or extremely difficult to measure (see table). For example, how do you determine the true value of a levee, a public bridge or a sewage treatment plant? Economists believe that the true value of a physical asset is its present discounted value, but calculating this value involves a degree of subjective judgment.3 A structure's market value is probably the next best alternative, but this measure also presents problems because some physical assets are not traded in the marketplace; thus, determining their true market value is next to impossible. Therefore, for lack of reliable information, analysts often use the asset's replacement cost. Endless other issues also arise. How do you measure the decline in property values that sometimes occurs in the vicinity of the disaster area? What prices and production should you attach to crops that were washed away before harvest, or livestock that were unable to gain weight during severe weather? Finally, how do you calculate the expected lifetime earnings of individuals who perished?

Despite these limitations, economists attempt to measure the total loss of a disaster by estimating two separate types of losses: direct and indirect. Direct losses are easier to estimate. For example, in an earthquake or hurricane, they would consist of the buildings or structures that are destroyed or damaged as a result of the actual force; in the case of a flood, they would consist of water damage to levees, crops or buildings. Indirect, or secondary, losses occur as a result of destruction to buildings, structures or bridges. These include lost output, retail sales, wages and work time, additional time commuting to work (reduced leisure), additional costs to business from rerouting goods and services around the affected area, utility disruptions, reduced taxable receipts, lost tourism or increased financial market volatility. Obviously, calculating indirect losses is the more difficult of the two.

The Recovery Period: A Fiscal Expansion?

One can picture a natural disaster as a time line consisting of three distinct periods. In period 1, losses to buildings, highways and other infrastructure (direct losses) occur; in period 2, indirect losses such as lost output and reductions in employment, leisure time and taxable receipts occur. Finally, in period 3, a recovery ensues: Rebuilding and cleanup efforts generate temporary increases in retail sales of such items as construction materials and nonperishable items like batteries, charcoal and canned foodstuffs. Damaged or destroyed goods like clothing, furniture and other household items are replaced, and roads, bridges or other structures are repaired or rebuilt.

This rebuilding activity usually generates both increased sales tax receipts and additional employment. Thus, one ironic feature of a disaster is that it spurs the pace of economic activity in the affected region. An additional positive effect occurs as the economy's destroyed physical assets are replaced with assets that incorporate more advanced technology. By enhancing the productivity of a community's physical assets, incomes will typically be enhanced as well.

In general, though, the net economic effect of the recovery period depends on several factors.4 First is the stage of the business cycle that the local or regional economy was in. Was it, for example, experiencing strong growth prior to the disaster, or was the economy in a recession? A second factor influencing the recovery period is the timing and extent of disaster assistance monies from federal and state and local governments. Although emergency funds for food and shelter are usually disbursed immediately by Presidential directive, monies for longer-term rebuilding efforts are often appropriated by Congress with a substantial lag. For example, the bill that appropriated funds for the Northridge earthquake in February 1994 also included funds for the 1993 Midwest flood and the 1989 Loma Prieta (San Francisco) earthquake.

Third, in many cases, the jobs and incomes generated in the recovery period do not stay in the local economy; rather, outside contractors that specialize in the cleanup, rebuilding and renovation activities are often brought in. For instance, a study conducted in the aftermath of Hurricane Frederic in 1979 suggests that the net economic effect of the disaster was negative because of this leakage.5

Finally, the percentage of total losses that are insured also affects the recovery. The lower the percentage of insured losses, the greater the dependency the local economy affected becomes on private and government monies. Not surprisingly, insured losses vary substantially by disaster. For example, estimates of insured losses from Hurricane Andrew at last count were approximately $15.5 billion (total losses are estimated between $25 billion to $30 billion), while insured losses from the 1989 San Francisco earthquake were only $960 million (total loss estimate is placed at $7.6 billion to $12.6 billion).6

Monies from private organizations, such as the Red Cross, are also disbursed. Total Red Cross disbursements to Midwest flood victims last year totaled $44.6 million; while significant, private funds tend to be small in relation to total losses.

Case Study: The Great Flood of 1993

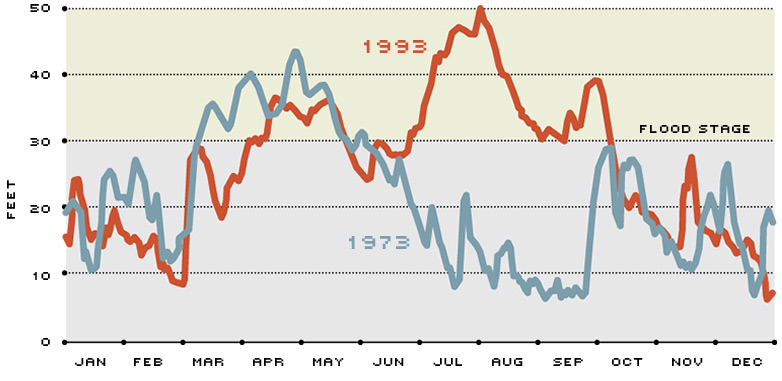

The disaster of record last year was the so-called Great Flood of 1993. Occurring primarily along states that border the upper and middle Mississippi River Basin or tributaries that feed into the Mississippi, the damage was so widespread that more than 500 counties in nine states—including the entire state of Iowa—were designated natural disaster areas. In the St. Louis area, it eclipsed the previous record flood in 1973.

A major flood has the capacity to affect numerous sectors of the economy—everything from agriculture to manufacturing to transportation. As a result, estimating flood losses is a time-consuming process, fraught with uncertainty. Besides the obvious damage to public and private structures, other damages occur that are often hidden, appearing only after the fact. Examples include reduced fertility of farmland, weakened structural foundations of buildings, or waterlogged roads and bridges whose deterioration is exposed only during the winter months. Other factors, such as transportation delays and increased volatility of crop and livestock markets, also must be accounted for, however imprecisely.

Not surprisingly, estimates abound as to the economic impact of the Great Flood. Most rank this flood second in terms of the costliest natural disasters of all time, just behind Hurricane Andrew in 1992. Unfortunately, detailed loss estimates by the Army Corps of Engineers and the National Weather Service will not be released until later this year; the few estimates that do exist—hardly more than rough guesses—often fail to distinguish between direct and indirect losses. Nevertheless, most accounts estimate the flood losses in the $10 billion to $20 billion range, with a large percentage of those losses uninsured. According to the Insurance Information Institute, insured nonagricultural losses were about $755 million; insured crop losses are put at an additional $250 million. Typically, insured flood losses are a smaller percentage of total losses than those associated with a hurricane or earthquake. For this flood they are estimated to be approximately 5 percent to 10 percent of total losses. By this rule of thumb, one could plausibly estimate the total losses from the Great Flood to be between $10.5 billion and $20.1 billion.

Sectors Affected

Although the flood affected several important sectors of the economy, the disruptions to transportation were arguably the greatest. According to Association of American Railroads (AAR), the flood caused numerous disruptions and forced many railroads to lay emergency tracks to prevent manufacturers—especially automotive plants—from closing because they employ the just-in-time inventory system. The AAR calculates that railroads incurred direct losses of $131 million—primarily physical destruction of rail lines, bridges and signaling equipment. Another $51 million in indirect losses were incurred in the rerouting of trains. The AAR believes that other indirect losses (for example, business interruptions and lost revenue) could reach as high as $100 million.7

Trucklines and bargelines were also affected. The Upper Mississippi River Basin is an important transportation lifeline, moving a significant percentage of the nation's grain, coal, chemicals, fertilizers and other goods. The Maritime Administration estimates that indirect flood losses totaled nearly $284.5 million, more than three-quarters of which affected operators in Illinois and Missouri.8

Agriculture also incurred significant losses. The United States Department of Agriculture (USDA) has disbursed $531.6 million in disaster assistance to nearly 150,000 producers and another $513.2 million in crop insurance losses. Of this nearly $1.1 billion, farmers in Iowa and Minnesota received almost half the total. In the Eighth Federal Reserve District, farmers in Illinois received $44.6 million, while those in Missouri received $98.4 million.

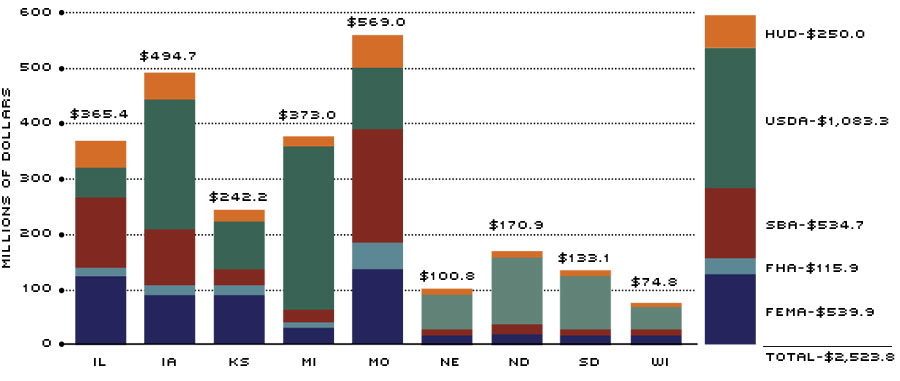

Disbursements from the USDA were but one form of federal assistance. As Chart 2 shows, other federal agencies have also distributed monies. In sum, the federal government has disbursed just over $2.5 billion in funds. This number will rise steadily over time, however, as state and local governments negotiate with the federal government about the eventual repair costs for community structures, such as bridges, utilities and buildings. This injection of federal monies is what leads many economists to refer to the recovery as expansionary fiscal policy.

Disbursement To Date of Federal Funds to Flood-Affected States

Several agencies can be called upon to provide disaster assistance. Typically, applications are first made to the Federal Emergency Management Agency (FEMA). FEMA determines eligibility and directs applicants to the appropriate federal agency. If applicants fall below certain income requirements, they can apply for assistance through FEMA's housing and family grant program; otherwise, they are directed to the Small Business Administration (SBA), which makes low-interest loans to homeowners. The SBA also extends such loans to small businesses for repair of physical damages and for operating capital. State and local governments receive aid from FEMA's public assistance program. This aid is intended for many purposes, including repair and replacement of damaged public property and public schools, as well as disaster clean-up. FEMA grants usually require governments to bear at least 25 percent of the cost; this burden was lowered to 10 percent for the Midwest floods. Aid to state and local governments is also available from the Department of Housing and Urban Development's (HUD) community development block grant program. Monies for infrastructure repair are also available from the Federal Highway Administration (FHA). The FHA allocates money for federal highway and bridge repair; most state roads and bridges also fall under this program. Finally, assistance to farmers comes from the U.S. Department of Agriculture (USDA), which provides crop disaster payments and, for those who purchase it, crop insurance payments. Most farmers are eligible for disaster aid; those enrolled in USDA set-aside programs, however, are eligible for a higher level of aid.

NOTE: Figures may not add because of rounding

SOURCE: Individual federal and state government agencies.

How Natural Disasters Can Change Economic Perceptions at the National Level

Typically, the largest effects on output, employment, wages and the capital stock occur at the local or regional level. But a natural disaster can sometimes skew the numbers at the national level if economic activity is sufficiently impeded across regions of the country, or if it affects a large enough percentage of the population or an important industry. In the first quarter of this year, for example, the economy was buffeted by the Northridge earthquake and winter storms in the South, Midwest and East. Altogether, these events affected about one-half of the U.S. population, disrupted construction in the housing industry and caused significant reductions in the output of automotives, steel and appliances (although the harsh weather actually boosted output at the nation's utilities and mines).9 The effect on total output from these temporary disruptions will probably be minor; nevertheless, some economists have revised downward their estimates for economic growth in the first quarter.

What is interesting about this scenario is that a similar scenario occurred in the first quarter of 1993, when the East Coast suffered through what the National Weather Service dubbed the "storm of the century." At the beginning of 1993, most economists were expecting the economy to grow at about a 3 percent rate. When the first quarter 1993 GDP growth rate came in substantially below expectations at 0.8 percent, many economists attributed it to the adverse weather, because important measures such as retail sales and construction activity fell sharply. Although many series rebounded in April, as expected, the second quarter real GDP growth rate was also below expectations, making it apparent that the first quarter's weakness was not entirely weather-related. Thus, in determining the economic effects of a disaster on the national economy, one must first attempt to ferret out the normal ebbs and flows of the business cycle. While such a task is difficult, to do otherwise may give a misleading picture of the economy's overall strength. For instance, weather-related phenomena perceived as temporary may cause firms to overproduce, not realizing that aggregate demand may be weakening for unrelated reasons.

Conclusion

Most of the United States is susceptible to some kind of natural disaster. As a result, natural disasters will exact their toll on local or regional economies on a continuing basis. Because the avenues of influence traverse through many economic sectors and affect many individuals and, moreover, are intertwined in innumerable and unseen ways, calculating the true economic effect of a natural disaster is an arduous task. In the final analysis, though, as John Stuart Mill pointed out more than 100 years ago, the economy ultimately recovers and prospers once again.

Endnotes

- See Dacy and Kunreuther (1969, pp. 9-10). [back to text]

- This section draws heavily from FEMA (1992). [back to text]

- The present value of an asset is determined by the amount of income it can generate now and in the future; a good example is an acre of farmland. This income will vary depending on the expected interest rate (termed the discount rate) used for converting the value of future income flows to the present. In all likelihood, the expected income and the discount rate will change over time because of changing market conditions. [back to text]

- Although the recovery period tends to temporarily bolster economic activity (a plus), the disaster itself, by destroying some of the economy's physical and human capital stock, acts to depress the level of economic activity. The net long-run effect is thought to be positive in most instances, however. [back to text]

- See Chang (1984). [back to text]

- Insured loss estimates were kindly provided by Jeanne Salvatore of the Insurance Information Institute (New York). [back to text]

- See Association of American Railroads (1993). [back to text]

- See U.S. Department of Transportation (1993). [back to text]

- Just as with the Great Flood, these storms exposed one shortcoming of the just-in-time inventory system that many manufacturers currently employ to reduce costs. When transportation disruptions occur—for example, rail or highway closures—plants that carry only one or two days inventory of parts are at the mercy of the weather. [back to text]

References

Association of American Railroads. Testimony of Edwin L. Harper, President and Chief Executive Officer, Before the Subcommittee on Transportation and Hazardous Materials Committee on Energy and Commerce, United States House of Representatives, September 23, 1993.

Chang, Semoon. "Do Disaster Areas Benefit from Disasters," Growth and Change (October 1984), pp. 24-31

Dacy, Douglas C, and Howard Kunreuther. The Economics of Natural Disasters: Implications for Federal Policy (The Free Press, 1969).

Federal Emergency Management Agency. Indirect Economic Consequences of a Catastrophic Earthquake, Jerome W. Milliman and Jorge A. Sanguinetty, eds., National Earthquake Hazards Reduction Program (July 1992).

Mill, John Stuart. Principles of Political Economy, Reprints of Economic Classics (August M. Kelly, 1961).

United States Department of Transportation. "Inland River Port Industry: Economic Impact and Flood Losses," Press Release, Office of the Assistant Secretary for Public Affairs, August 17, 1993.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us