Teach One, Reach Many

"As we prepare teachers to enter the world of teaching, it’s important that they understand how economics relates to all parts of their lives and how to incorporate economics into all curricula areas."

—Betty Porter Walls | assistant professor in the College of Education at Harris- Stowe State University in St. Louis.

Although the nine members of the economic education team at the St. Louis Fed have a combined 100-plus years of experience in the field of economic education, we could barely make a dent by ourselves in teaching economic and personal finance literacy to all those who need it. That's why we focus our efforts primarily on teaching the teachers, from those in pre-K to those in the college classroom.

Some may think that the best path to economic literacy is to work directly with students. But let's look at the math behind that. A new wave of students enters school and graduates every year. Direct contact and intervention with students would require using scarce resources to visit the same classroom repeatedly, teaching new students each time.

Instead, with our "teach one, reach many" model, teachers receive high-quality resources and training, both online and in person. These new skills and tools stay with the teachers to be used year after year, with wave after wave of students.

On average, a teacher who attends our programs reaches 75 students in a year.1 If the teacher continues to teach for 10 years, that's 750 students. How does this multiplier effect add up? In 2016, we reached nearly 6,500 teachers, who in turn taught nearly a half-million students.

How We Help

What do teachers need from us and get from us?

In general, most teachers, even high school social studies teachers, have little to no economics background.2 Generally, they aren't required to take any economics courses. There is an adage in education that you can't teach what you don't know.

In our free professional development programs for educators, we teach economics and personal finance content, and we demonstrate methods educators can use to teach economics and personal finance in the classroom successfully. We also provide, through our teacher portal, online professional development for educators. These programs, too, focus on content and pedagogy.

Focusing on both the "what" (content) and "how" (pedagogy) is equally important. Research abounds showing the positive relationship between teacher content knowledge in economics and student achievement in economics.3 For example, one group of researchers found that students whose teachers participate in economic education professional development programs and who use high-quality materials perform better on tests of economic knowledge—and the more professional development the teacher has, the better the students perform.4 Another study showed that training teachers in the use of a high-quality curriculum resulted in significant improvement in the average personal finance knowledge of students across a broad spectrum of personal finance content.5

A team of evaluators who reviewed the St. Louis Fed's economic education programs found that teachers who attended professional development programs learned the content and used the curriculum materials received.6 And another group of researchers found that "a rigorous state mandate for financial education, if carefully implemented, can improve the credit scores and lower the probability of delinquency for young adults."7 These researchers identified professional development in personal finance for educators as part of what makes a rigorous mandate.

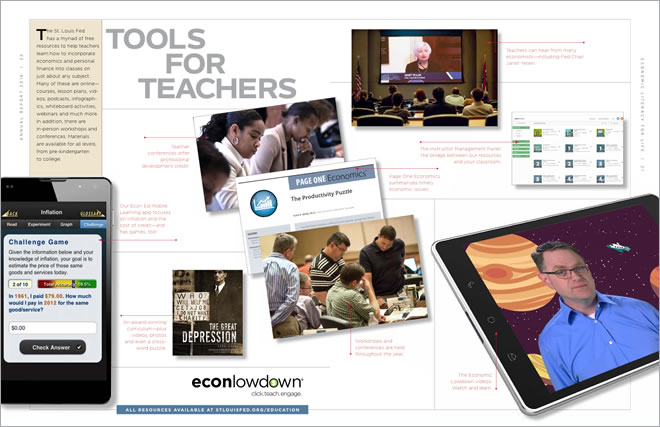

The St. Louis Fed has a myriad of free resources to help teachers learn how to incorporate economics and personal finance into classes on just about any subject. Many of these are online– courses, lesson plans, videos, podcasts, infographics, whiteboard activities, webinars and much more. In addition, there are in-person workshops and conferences. Materials are available for all levels, from pre-kindergarten to college.

What Teachers Say

And what do the teachers themselves think about the St. Louis Fed's efforts to get them to weave economics and personal finance into their classes?

Vicki Fuhrhop, a high school business teacher on one of our educator advisory boards, framed her answer around the needs of students. "We don't want them to learn by trial and error. That's too grave of an impact on them. We need to educate them so they don't make mistakes—so they make really good decisions."

Watch as teachers from one of our educator advisory boards talk about their favorite resources from the St. Louis Fed's economic education department.

As for the resources themselves, Fuhrhop said she appreciated the variety of content and modes of accessing them ("I really like the Econ Ed Mobile app"), as well as the fact that the resources are always being updated—and are free.

Another board member is Patrice Bain. "Being a middle school teacher, if I should Google 'economics', chances are there's not going to be too much for middle school. And, so, to have a site (www.stlouisfed.org/education) where you can just put in 'middle school' and all of these wonderful resources pop up, I'm saving a lot of time."

Bain added, "Something else that I think is so vital to what's being offered is that many of them are research-based. They just align with the latest research and how people learn."

Watch as one high school teacher tells how he turned his students on to using FRED (Federal Reserve Economic Data), the St. Louis Fed's signature economic database.

A few resources for teachers:

- The Econlowdown Teacher Portal at www.econlowdown.org, used by thousands of teachers around the country to enhance instruction by providing online courses, videos, and podcasts for their students.

- In-person and over-the-web professional development so that teachers can learn about economic and personal finance content themselves. In most instances, teachers qualify for continuing education credits.

- Print lessons, curricula, readings, PowerPoints, and SMART and Promethean Board materials for pre-K through college classrooms that can be downloaded at www.stlouisfed.org/education.

About the Author

Erin Yetter joined the Federal Reserve Bank of St. Louis in 2012. Earlier, she taught economics at the University of South Florida, the University of Delaware and Hillsborough Community College, in Tampa, Fla. She has written numerous lessons and published research articles on economic and personal finance education. [ back to text ]

Our Recent Awards

| Year | Award |

|---|---|

| 2017 | Excellence in Financial Literacy Education (EIFLE) Award for Children's Education Program |

| 2016 | National Association of Economic Educators (NAEE) Gold Curriculum Award of Excellence |

| 2015 | Abbejean Kehler Technology Award EIFLE Award for Econ Lowdown and the Inside the Economy® Museum |

| 2014 | PR Daily's Corporate Social Responsibility Award |

Economics and Personal Finance Classes Aren't Universally Required

A Look at the U.S. and States in the St. Louis Fed's District

| US | Ark. | Ill. | Ind. | Ky. | Miss. | Mo. | Tenn. | |

|---|---|---|---|---|---|---|---|---|

| States that include economics in their K-12 standards (+District of Columbia) | 51 | Y | Y | Y | Y | Y | Y | Y |

| States that require standards to be implemented (+DC) | 45 | Y | Y | Y | Y | Y | Y | Y |

| States that require a high school course in economics be offered (+DC) | 23 | Y | N | Y | N | Y | N | Y |

| States that require a high school course be taken (+DC) | 20 | Y | N | Y | N | Y | N | Y |

| States with standardized testing of economics (+DC) | 16 | N | N | Y | Y | Y | N | N |

| States that include personal finance in their K-12 standards (+DC) | 45 | Y | Y | Y | Y | Y | Y | Y |

| States that require personal finance standards to be implemented (+DC) | 37 | Y | Y | Y | Y | Y | Y | Y |

| States that require a high school course in personal finance be offered (+DC) | 22 | Y | N | N | N | Y | Y | Y |

| States that require a high school personal finance course be taken (+DC) | 17 | Y | N | N | N | N | Y | Y |

| States with standardized testing of personal finance (+DC) | 7 | N | N | N | N | N | Y | N |

SOURCE: Council for Economic Education, Survey of the States, 2016.

NOTES: The St. Louis Fed is the home of the Eighth Federal Reserve District. The District covers all of Arkansas and parts of Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee. Y=Yes. N=No.

Endnotes

- See Bosshardt and Grimes 2010. [ back to text ]

- See Loibl, as well as Way and Holden. [back to text]

- See Bosshardt and Watts; Becker, Greene and Rosen; Marlin; Wetzel, and O’Toole, and Millner, 1991; Allgood and Walstad, 1999; Valletta, Hoff, and Lopus, 2013; and Butters, Asarta, and Thompson, 2013. [ back to text ]

- See Swinton 2010. [ back to text ]

- See Asarta et al. [ back to text ]

- See Bosshardt and Grimes 2011. [ back to text ]

- See Urban et al. [ back to text ]

References

- Allgood, S.; and Walstad, W. B. The Longitudinal Effects of Economic Education on Teachers and Their Students. Journal of Economic Education, 1999, Vol. 30, No. 2, pp. 99-111.

- Asarta, C.; Hill, A.; and Meszaros, B. The Features and Effectiveness of the Keys to Financial Success Curriculum. International Review of Economics Education, 2014, Vol. 16 pp. 39-50.

- Becker, W. E.; Greene, W.; and Rosen, S. Research on High School Economic Education. Journal of Economic Education, 1990, Vol. 21, No. 3, pp. 231-45.

- Bosshardt, W.; and Watts, M. Instructor Effects and Their Determinants in Precollege Economic Education. Journal of Economic Education, 1990, Vol. 21, No. 3, pp. 265-76.

- Bosshardt, W.; and Grimes, P. Assessment Initiative: Final Report. Submitted to the Federal Reserve banks of Atlanta and St. Louis. 2010.

- Bosshardt, W.; Grimes, P.; and Suiter, M. Teacher Workshops Chip Away at Economic Illiteracy. Federal Reserve Bank of St. Louis’ The Regional Economist, January 2011

- Butters, R.; Asarta, C.; and Thompson, E. The Production of Economic Knowledge in Urban and Rural Areas: The Role of Student, Teacher, and School Characteristics. Journal of Agricultural and Applied Economics, 2013. Vol. 45, No. 1, pp. 1-15.

- Hanushek, E. A. Valuing Teachers: How Much is a Good Teacher Worth? Education Next. 2011. Vol. 11, No. 3, pp. 40-55

- Loibl, C. Survey of Financial Education in Ohio’s Schools: Assessment of Teachers, Programs, and Legislative Efforts. Ohio State University P-12 Project. Retrieved from http://www.budgetchallenge.com/Portals/0/Documents/Loibl.PersonalFinanceEducation.pdf.

- Marlin, J. R. State-Mandated Economic Education, Teacher Attitudes, and Student Learning. Journal of Economic Education, 1991, Vol. 22, No. 1, pp. 5-14.

- Swinton, J. R.; De Berry, T.; Scafidi, B.; and Woodard, H. C. The Impact of Financial Education Workshops for Teachers on Students’ Economics Achievement. Journal of Consumer Education, 2007, Vol. 24, pp. 63–77.

- Swinton, J. R.; De Berry, T.; Scafidi, B.; and Woodard, H. C. Does In-Service Professional Learning for High School Economics Teachers Improve Student Achievement? Education Economics, 2010, Vol. 18, No. 4, pp. 395-405.

- Urban, C.; Schmeiser, M.; Collins, J.M.; and Brown, A. State Financial Education Mandates: It’s All in the Implementation. FINRA Investor Education Foundation, Insights: Financial Capabilities January 2015. See https://www.finra.org/sites/default/files/investoreducationfoundation.pdf.

- Valletta, R. B.; Hoff, J. K.; and Lopus, J. S. Lost in Translation? Teacher Training and Outcomes in High School Economics Classes. Federal Reserve Bank of San Francisco, Working Paper Series 2012-03. 2013. See http://www.frbsf.org/economic-research/files/wp12-03bk.pdf.

- Way, W.; and Holden, K. Teachers’ Background and Capacity to Teach Personal Finance. National Endowment for Financial Education. See http://www.nefe.org/Portals/0/WhatWeProvide/PrimaryResearch/PDF/TNTSalon_ExecutiveSummary.pdf.

- Weaver, A. A.; Deaton, W. L.; and Reach, S. A. The Effects of Economics Education Summer Institutes for Teachers on the Achievement of Their Students. Journal of Educational Research, 1987, Vol. 80, No. 5, pp. 296-300.

- Wetzel, J. N.; O’Toole, D. M.; and Millner, E. L. A Qualitative Response Model of Student Performance on a Standardized Test. Atlantic Economic Journal, 1991, Vol. 19, No. 3, pp. 18-25.