Is Shadow Banking Really Banking?

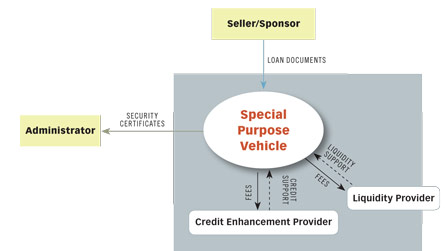

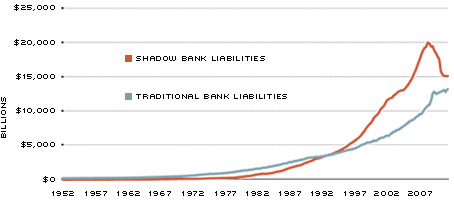

The term "shadow banking" has been attributed to 2007 remarks by economist and money manager Paul McCulley to describe a large segment of financial intermediation that is routed outside the balance sheets of regulated commercial banks and other depository institutions. Shadow banks are defined as financial intermediaries that conduct functions of banking "without access to central bank liquidity or public sector credit guarantees." 1 As shown in Figure 1, the size of the shadow banking sector was close to $20 trillion at its peak and shrank to about $15 trillion last year, making it at least as big as, if not bigger than, the traditional banking system.2 Given its size and role in the financial crisis, it would be useful to understand the mechanics of shadow banking. To do so, some basics of traditional banking need to be understood first.

Shadow Bank vs. Traditional Bank Liabilities

SOURCE: Federal Reserve Board/Haver Analytics and calculations from Adrian, Ashcraft, Boesky and Pozsar.

Simply put, banks are intermediaries that obtain funds from lenders in the form of deposits and provide funds to borrowers in the form of loans.3 The principal function of a bank is that of maturity transformation—coming from the fact that lenders prefer deposits to be of a shorter maturity than borrowers, who typically require loans for longer periods. It is important to point out that, because of sudden liquidity needs of individual agents or businesses, this function cannot be performed by individual agents or businesses alone—therein lies the rationale for a bank. Banks are able to achieve this transformation by exploiting the fact that only a small fraction of depositors have liquidity needs at a given time. Therefore, the bank can store a small fraction of its deposits in the form of liquid assets (readily convertible to cash) and lend out the rest in the form of term (illiquid) loans. This function is also known as qualitative asset transformation because, by changing the maturity of its assets, the bank also changes their liquidity.4

However, by performing this function, a bank is essentially rendered fragile. The fragility comes from the fact that even a healthy bank can be the victim of a bank run. If all depositors demand their deposits back, the bank would have to liquidate all its assets (even those that are not liquid) to fulfill depositors' demands. Since almost no bank can liquidate all its assets within a short period without suffering a loss in value, a problem of illiquidity can essentially turn into a problem of insolvency and the collapse of the bank. Accordingly, depositors are acting rationally when they withdraw their deposits even at the smallest hint of bad news.5 More often than not, such bank runs are hardly limited to just one bank, precipitating what is called a banking panic.

Given their inherent fragility, banks typically require credit enhancements in the form of insurance of deposits or emergency access to funds from the central bank.6 In most countries, public funds are the source of such provisions of emergency funding. Indeed, the financial history of the United States is replete with stories about bank runs and bank failures prior to 1934. In that year, the Federal Deposit Insurance Corp. was created, ending runs on commercial banks in the U.S.

However, the end of bank runs does not imply the end of bank failures. Indeed, the inclusion of such credit-enhancement measures, especially those funded by third parties, creates a significant moral hazard for banks.7 Banks investing in risky loans benefit from higher returns on the slim chance of success, whereas the taxpayer is left to bail out depositors in the likely event that the banks fail.8 Regulations seeking to prevent such moral hazard require banks to hold significantly higher capital for increased riskiness of loans (assets) on their balance sheet—known as a risk-weighted capital adequacy requirement. Banks view raising such capital as costly and often engage in practices that would help prevent them from having to do so.9 One such practice is the creation of off-balance-sheet entities to host some of the banks' assets and, thereby, reduce their regulatory capital requirements. This practice is often viewed as one of the major reasons behind the creation and growth of shadow banking.

Broadly speaking, credit intermediation through the shadow banking system is much like that through a traditional bank—it fulfills the principal function of qualitative asset transformation. However, unlike traditional banking, which involves a simple process of deposit-taking and originating loans that are held to maturity, shadow banking employs a much more complicated process to achieve maturity transformation. At the deposit end of the shadow banking system are wholesale investors (providers of funds) using the repo market and money market intermediaries such as money market mutual funds (MMMFs) to provide short-term loans that are essentially withdrawable on demand. At the loan origination end are finance companies and even traditional banks that engage in the activity of originating loans, much like the traditional banking system.

The shadow banking system intermediates between the ultimate consumer of funds (borrower) and the wholesale investor of funds, whose liquidity needs may preclude long-term investments. Shadow banking comprises a chain of intermediaries that are engaged in the transfer of funds channeled upstream in exchange for securities and loan documents that are moving downstream. Therefore, what was once accomplished under a single roof in the traditional banking system is now done over a sequence of steps in the shadow banking system, each performed by specialized entities that are not vertically integrated.

The Deposit End of the Shadow Banking System

Most advanced economies have solved the problem of bank runs by the creation of deposit insurance. In 1980, deposit insurance in the U.S. was capped at $100,000; after the crisis, this limit was raised to $250,000. This meant that the demand for safe, short-term investments from large, cash-rich financial and nonfinancial companies remained unfulfilled. The shadow banking system fulfilled this demand in two ways—both of which made extensive use of widely available financial securities.

The first of these arrangements uses repo, or repurchase, transactions, whereby firms with surplus cash buy securities for cash only and then resell them back after a short term. Effectively, this repo transaction is a short-term cash loan to the seller of the security, with the security acting as collateral on the loan. Repo transactions can be open-ended and rolled over on a daily basis, making them analogous to deposits at a traditional bank that are withdrawable on demand. However, unlike demand deposits, which derive their safety from deposit insurance, repo transactions derive their safety from the underlying security that is the collateral on the loan. In the event of default on the loan, the lender retains the right to sell the security in the open market and collect the proceeds.

To enhance the safety of the transactions, repos are overcollateralized—that is, the loan amount is typically less than the face value of the securities used as collateral. In this manner, overcollateralization imposes a "haircut" on the repo, a haircut that varies with the credit risk on the security put up for collateral. Naturally, haircuts on repo transactions using Treasury securities are lower than haircuts using comparable private-label securities.

The second alternative for cash-rich investors is to purchase shares in money market mutual funds. In MMMFs, investors pool funds to invest in high-quality short-term securities of the government and corporations. Notably, investments (shares) in MMMFs are withdrawable on demand.

The safety of investments in MMMFs comes from the fact that the securities they invest in are regulated to be of high quality and short maturity, such as Treasury bills and highest-grade commercial paper. While Treasury bills are regarded as securities with no credit risk, commercial paper is backed by assets that possess some credit risk. To alleviate concerns for investors, Rule 2a-7 of the Securities and Exchange Commission's Investment Company Act of 1940 restricts the quality, maturity and diversity of investments by MMMFs.

Cash-rich investors looking for safe investments that are withdrawable on demand can either purchase shares in MMMFs that are redeemable on demand or can purchase securities under a repo agreement, whereby the seller promises to purchase the securities back at a later date. The two avenues are somewhat different. Investments in MMMFs are in the form of a continuing contract with variable returns. On the other hand, a repo transaction is a one-time contract with fixed returns.

The Loan Origination End of the Shadow Banking System

This section refers to the processes by which the securities used in the deposit end of the system are created, either to be used as collateral in a repo transaction or as investments for MMMFs. The processes described below are a simple prototype of numerous schematics involved in the creation of such securities. In practice, the chains used in warehousing, securitization and servicing can be significantly more complicated than the illustrations given below.

Financial intermediation has moved from an originate-to-hold model of traditional banking to an originate-to-distribute model of modern securitized banking. Economist Gary Gorton argued in a book last year that deregulation and increased competition in banking rendered the traditional model of banking unprofitable. In modern banking, origination of loans is done mostly with a view to convert the loan into securities—a practice called securitization, whereby the transaction, processing and servicing fees are the intermediaries' principal source of revenue.

The Creation of Securities from Loans

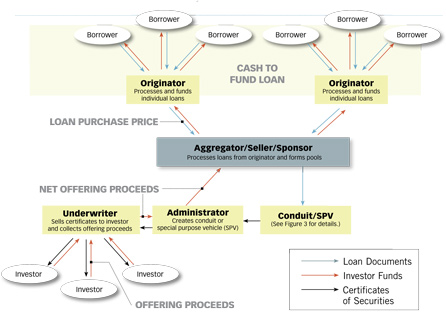

The diagram shows a simplified, five-step process for converting loan originations into final securities. First, auto loans, student loans, mortgages and other loans are originated by regulated commercial banks and unregulated financial firms. Second, a warehouse bank (aggregator) buys loans from one or more originators and pools the loans. Third, the pooled loans are sold to an administrator, usually a subsidiary of a large commercial or investment bank; the administrator creates a special purpose vehicle (SPV) to hold the loans; the SPV issues securities against loans held in its portfolio. Fourth, the securities created by the SPV are sold by an underwriter, typically an investment bank. Finally, the securities are bought by investors.

Figure 2 illustrates the process of converting loan originations into final securities. The starting point in this process is the origination of loans such as auto loans, mortgages and student loans by regulated commercial banks and unregulated finance companies. Under the traditional model of banking, this loan would reside on a bank's balance sheet, with the bank holding capital against the loan. Under the securitized model of banking, the bank arranges to sell the loan.

The second step of the process involves warehousing the loan. This includes a warehouse bank that purchases loans from one or more originators to form a pool of such loans. The warehouse bank is also known as the aggregator, seller or sponsor. In some cases, this entity can be the same as the originator. Typically, this financing occurs in the form of an extension of a line of credit from the warehouse bank to the originator of the loan (a finance company or a small community bank) that closes on the loan with such funds. The loan documents are then sent downstream to the warehouse bank to serve as collateral for the line of credit.

The third step in the process involves a sale of the pooled loans to an administrator, typically a subsidiary of a large commercial or investment bank. The role of the administrator is to purchase the loans from the aggregator and create the special purpose vehicle (SPV), which would finally hold the loans. Often, the administrator of the SPV receives a fee for services rendered. The SPV issues securities against loans held on its portfolio. (See sidebar.)

The fourth step involves the sale of the securities created by the SPV. Almost always, the securities are not sold directly by the administrator—the creator of the trust. Typically, the administrator sells the certificates of the trust to the underwriter. The underwriter, which is generally an investment bank, purchases all such securities from the administrator with the responsibility of offering them up for sale to the ultimate investors. Notably, the underwriter can even retain some of these securities in its own portfolio. Retaining the riskiest securities is often viewed as a mechanism to signal the quality of those on sale.

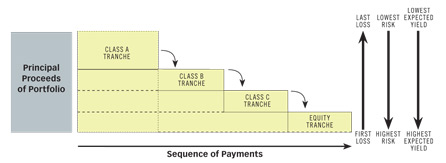

The fifth and final step of the process involves the purchase of securities by the investor. The investor is then entitled to receive monthly payments of principal and interest on the securities from the SPV in their order of priority. The order of priority on the payment of principal and interest is determined by payment rights accorded to investors, depending on the class or tranche of security certificates purchased. The order of payment is determined in advance and stated on the indenture (legal document) that circumscribes the deal of securities generated in the process. At this stage, the ultimate investors of such securities can hold them on their balance sheet, sell them or even use them as collateral in a repo arrangement.

Is Shadow Banking Really Banking?

The five steps above describe the simplest process of securitization by which securities are created from originated loans. In some cases, segments of the process are repeated to create more securities. Typically, the class of securities issued depends on the maturity and type of underlying collateral (loans originated upstream). For example, mortgage-backed securities that are backed by residential or commercial mortgages typically have longer maturities than does asset-backed commercial paper (ABCP) that is typically backed by loan receivables or credit card receivables.10

MMMFs are among the principal investors in short-term ABCP. As mentioned above, MMMFs finance such investments with shares that can be redeemed on demand. On the other hand, repo transactions employ securities of longer maturity as collateral for short-term borrowings of cash. In both cases, the liability formed is theoretically withdrawable on demand and of shorter maturity than the assets financed. In this way, the mechanics of the shadow banking system typically resemble the functions of a commercial bank.

In the creation of securities, the cash proceeds from the sale of securities are passed upstream to all participating entities—administrator, aggregator and finally to the originator of the loans. At each stage, therefore, each participating entity relies on the sale of the securities and loan documents for revenue. In addition, almost all of the participating entities require sources of short-term funding. This can arise for two reasons. First, as described earlier, the maturity on the securities can be of a shorter length than the maturity of the loans, requiring the entity to roll over the securities or use short-term funds to pay investors. Second, at each stage in the process of securitization, the need for short-term funding arises in the interval between the purchase of loans and their subsequent sale downstream.

It has also been observed that all of the entities typically use a whole host of short-term instruments, like financial commercial paper, ABCP and repo transactions, to fulfill their short-term funding requirements.11 To the extent that each entity uses short-term funding in the creation of assets (loans and securities) of longer maturity, these entities perform the functions of a bank. In this sense, individual entities of the credit intermediation process fulfill the functions of banking.

Moreover, the process as a whole transforms longer-term loans with significant credit risk (such as the origination of mortgages upstream) into instruments of shorter maturity and of considerably lower risk that are redeemable on demand (such as investment shares in MMMFs). In so doing, the credit intermediation process as a whole mimics the function of a bank.

Shadow Banking and the Financial Crisis of 2007-2008

Given the discussion at the beginning of this essay, an obvious corollary that follows is the fragility of the shadow banking system. In traditional banking, the fragility originates in a run by the bank's depositors. In securitized banking, the run comes from the deposit end—the providers of wholesale funding to the shadow banks. The two markets in which such runs are most likely are the repo market and the commercial paper market.

The evidence on runs in the markets for wholesale funding demonstrated the parallel between traditional bank runs by depositors in the banking panics prior to 1934 and the recent panic in credit markets that relied on wholesale funding. As wholesale funding dried up for troubled shadow banks, they were forced to sell off assets in order to meet liquidity demands of investors. Such a fire sale of assets lowered the prices of assets on similar collateral throughout the market, raising the cost of funding for healthy shadow banks precipitously.

This trend was first pointed out for the repo market in a series of papers that are summarized in work by Gorton. In the interdealer repo market, a run occurred primarily through increased haircuts on the securities posted as collateral.12In the case of some securities, especially those backed by troubled mortgage loans, the haircuts were close to 100 percent—implying that these assets were no longer eligible for repo transactions. An increase in the haircuts on the repo implies an increased demand for collateral on the same loan or, conversely, a reduction in the supply of funds for a given amount of collateral. Since the supply of collateral in the entire shadow banking system is fixed over the short run, this meant that there was a significant liquidity crunch (shortfall in the supply of funds) and a steep rise in the cost of funding through repo transactions.

In the case of funding through MMMFs, the panic was witnessed in two major shocks to the commercial paper market in 2007-2008. The first shock came around July-August 2007 with the collapse of certain financial entities that had invested heavily in subprime mortgages. This led investors to question the quality of even highly rated ABCP. As a result, the spread of ABCP over the federal funds rate increased from 10 basis points before the shock to 150 basis points in the days after the shock.

The second and more severe shock occurred with the collapse of Lehman Brothers in September 2008. This led to a direct default on commercial paper issued by Lehman Brothers, $785 million of which was held by the Reserve Primary Fund—one of the largest MMMFs, with more than $65 billion in assets. Needless to say, the news of exposure triggered a run on this fund and quickly spread to other MMMFs. To stem the run on MMMFs, the U.S. Treasury announced a temporary deposit insurance covering all money market instruments only three days after the collapse of Lehman.

Conclusion

The reader may question the rationale behind the development of the shadow banking system and all its components. While some analysts have asserted that the shadow banking system is redundant and inefficient, it is not difficult to see the benefits of securitized banking. Securitization allows for risk diversification across borrowers, products and geographic location. In addition, it exploits benefits of both scale and scope in segmenting the different activities of credit intermediation, thereby reducing costs. Moreover, by providing a variety of securities with varying risk and maturity, it provides financial institutions opportunities to better manage their portfolios than would be possible under traditional banking. Finally, and contrary to popular belief, this form of banking increases transparency and disclosure because banks now sell assets that would otherwise be hosted on their opaque balance sheets.

In summary, the shadow banking system can be viewed as a parallel system—one that is a complement to and not a substitute for traditional banking. The challenge going forward is to harness the benefits and mitigate the risks and redundancies of such a parallel banking system.

Endnotes

- See Adrian, Ashcraft, Boesky and Pozsar. [back to text]

- See Adrian, Ashcraft, Boesky and Pozsar. [back to text]

- Strictly speaking, this description fits commercial banks, which along with thrift institutions (savings and loans and credit unions) make up the set of depository institutions in the U.S. [back to text]

- In addition, credit intermediation involves "brokerage," whereby the bank also reduces pre- and post-contractual informational asymmetries between the borrower and the lender. Note that this brokerage function is not necessarily exclusive to credit intermediation because many other intermediaries, such as used-car dealers, perform a similar function. For more, see work by Greenbaum and Thakor. [back to text]

- This key insight developed by Bryant and formalized in Diamond and Dybvig is arguably the most celebrated work in banking theory. [back to text]

- See Diamond and Dybvig. [back to text]

- See Wheelock and Wilson. [back to text]

- See Morrison and White. [back to text]

- See Admati, DeMarzo, Hellwig and Pfleiderer. [back to text]

- See Anderson and Gascon for details on MMMFs and ABCPs. [back to text]

- See Adrian, Ashcraft, Boesky and Pozsar. [back to text]

- The evidence is somewhat different for the tri-party repo market. See Copeland, Martin and Walker for details. [back to text]

- See Gorton and Souleles. [back to text]

- See Adrian, Ashcraft, Boesky and Pozsar. [back to text]

References

Admati, Anat R.; DeMarzo, Peter M.; Hellwig, Martin F.; and Pfleiderer, Paul. "Fallacies, Irrelevant Facts, and Myths in the Discussion of Capital Regulation: Why Bank Equity Is Not Expensive." Research Papers 2065, Stanford University Graduate School of Business, 2010.

Adrian, Tobias; Ashcraft, Adam; Boesky, Hayley; and Pozsar, Zoltan. "Shadow Banking." Staff Reports 458, Federal Reserve Bank of New York, July 2010.

Anderson, Richard G.; and Gascon, Charles S. "The Commercial Paper Market, the Fed, and the 2007-2009 Financial Crisis." Federal Reserve Bank of St. Louis Review, Vol. 91, No. 6, November 2009, pp. 589-612.

Bryant, John. "A Model of Reserves, Bank Runs, and Deposit Insurance." Journal of Banking and Finance, Vol. 4, No. 4, 1980, pp. 335-44.

Copeland, Adam; Martin, Antoine; and Walker, Michael. "The Tri-Party Repo Market before the 2010 Reforms." Staff Reports 477, Federal Reserve Bank of New York, November 2010.

Diamond, Douglas W.; and Dybvig, Philip H. "Bank Runs, Deposit Insurance, and Liquidity." Journal of Political Economy, Vol. 91, No. 3, June 1983, pp. 401-19.

Gorton, Gary B. Slapped by the Invisible Hand: The Panic of 2007. Oxford University Press, 2010.

Gorton, Gary B.; and Souleles, Nicholas S. "Special Purpose Vehicles and Securitization." in Carey, Mark; and Stulz, René M. eds., The Risks of Financial Institutions. University of Chicago Press, 2007.

Greenbaum, Stuart; and Thakor, Anjan V. Contemporary Financial Intermediation: Second Edition. Elsevier, 2007.

McCulley, Paul. "Teton Reflections." PIMCO Global Central Bank Focus, 2007.

Morrison, Alan; and White, Lucy. "Crises and Capital Requirements in Banking." American Economic Review, Vol. 95, No. 5, December 2005, pp. 1548-72.

Wheelock, David C.; and Wilson, Paul W. "Explaining Bank Failures: Deposit Insurance, Regulation, and Efficiency." The Review of Economics and Statistics, Vol. 77, No. 4, November 1995, pp. 689-700.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us