What Price Convenience? The ATM Surcharge Debate

Most people balk at the idea of paying for something they're used to getting for free. So it's no surprise that the decision by the nation's two major automated teller machine (ATM) networks to let ATM owners charge non-customers a surcharge for using their machines is causing a stir. Although bank customers are used to paying a fee to their bank when they withdraw cash from an ATM that isn't owned by their bank, surcharges represent an additional fee—one that can more than double the cost of an ATM transaction.

A number of consumer groups and federal and state legislators have railed against these surcharges, proposing remedies ranging from increased disclosure to outright bans. Surcharge proponents say the fees represent the price of convenience. Foes say the fees are not only anticonsumer but anticompetitive, potentially hurting the nation's smallest financial institutions. The key question in the surcharge debate is this: Is government interference necessary or desirable, or should the marketplace decide?

The ABCs of ATMs

The nation's first ATMs were installed in the late 1960s. These machines were rather primitive by today's standards, typically dispensing only cash. Modern ATMs, in contrast, offer a full range of functions, including deposit-taking and funds transfers, as well as check cashing and bill paying. Many also enable users to buy such disparate products as stamps, travelers checks, mutual funds and movie tickets. Despite the increasing availability of these new features, however, the bulk of ATM transactions continue to be cash withdrawals. A 1991 study of ATM use indicated that 86 percent of ATM transactions were cash withdrawals, with cash or check deposits comprising 10 percent of transactions and account transfers and bill payment making up the rest.1

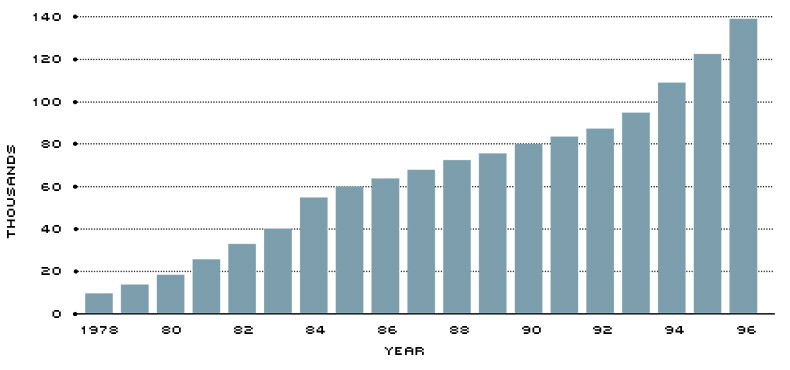

ATMs have changed the way Americans bank.2 Unlike bank branches, ATMs are open 24 hours a day and are increasingly located in nontraditional locations like supermarkets, airports, casinos and shopping malls, as well as their traditional locations on bank premises. The number of ATMs installed in the United States has risen substantially since the late 1970s. Between 1978 and 1996, the number of U.S. ATMs rose at a compound annual rate of 15.9 percent, with much of the growth occurring between 1978 and 1987 (see Chart 1). The approximately 140,000 ATMs installed in the U.S. currently handle an average of 6,400 transactions per month.

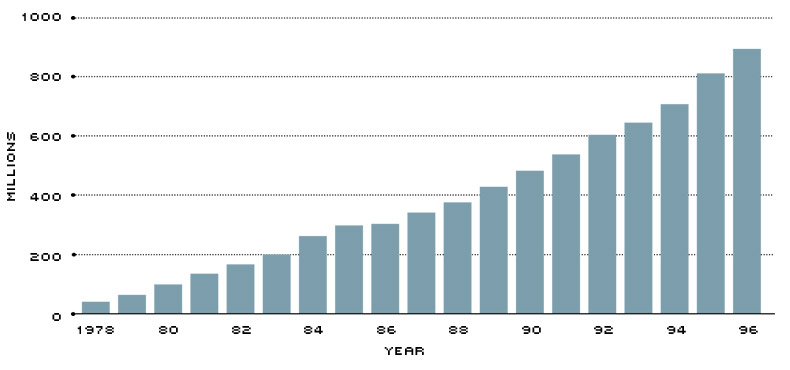

ATM use has also increased dramatically over the last two decades, with monthly transactions rising at an 18.6 percent annual rate since the late 1970s (see Chart 2). Although ATM use has been spurred by a variety of factors, the increasing availability of ATM networks is largely responsible for the uptick. The vast majority of today's ATMs are connected to regional (MAC, Most and BankMate, for example) or national (PLUS and Cirrus) networks, allowing customers to access their accounts from virtually anywhere in the nation and many parts of the world.

ATM networks reduce duplication and overcapacity, simultaneously lowering the cost of offering ATM services, while increasing availability for all ATM cardholders. Since 1982, the proportion of ATMs that are "shared," that is, used by customers of more than one bank, has increased from about a third to just under 100 percent. Moreover, the existence of shared networks has enabled very small depository institutions to offer ATM services to their customers, without significant capital outlays.3

Cost Saver or Money Maker?

Although banks tout ATMs as a means of increasing customer convenience, an arguably more important motivation is the chance to cut costs. The drive to install new ATMs and expand ATM accessibility by joining networks is part of a larger effort by banks to reduce operating expenses through technology. Since most traditional banking activities can be handled by ATMs, many banks view their installation as a way to cut current costs at the same time they're expanding services and possibly market share at a lower cost than building more bricks and mortar.

The difference in fixed costs between an ATM and a branch is substantial: An average full-service ATM costs about $30,000 to purchase and install versus the $1 million or so needed to build a full-service branch.4 ATMs have lower variable costs, too. Although, admittedly, they need to be serviced and maintained, these costs are generally much less than that of branch-related expenses, such as employees, utility bills and upkeep. Consequently, ATM transactions like cash withdrawals and deposits are much cheaper than comparable teller transactions. Although estimates of the difference vary, 36 cents for an ATM transaction versus $1.06 for a comparable teller transaction is typical.5

For a variety of reasons, most banks do not charge their customers fees to conduct ATM transactions at machines they own. In fact, a growing number of banks are encouraging their customers to switch from tellers to ATMs. Some are using carrots—reduced fees on bank accounts or lower minimum balances, for example—while a brave few (or foolish, depending on your view) have tried sticks—like First Chicago's April 1995 decision to begin charging holders of some account types $3 for teller transactions that can be handled by ATMs.6

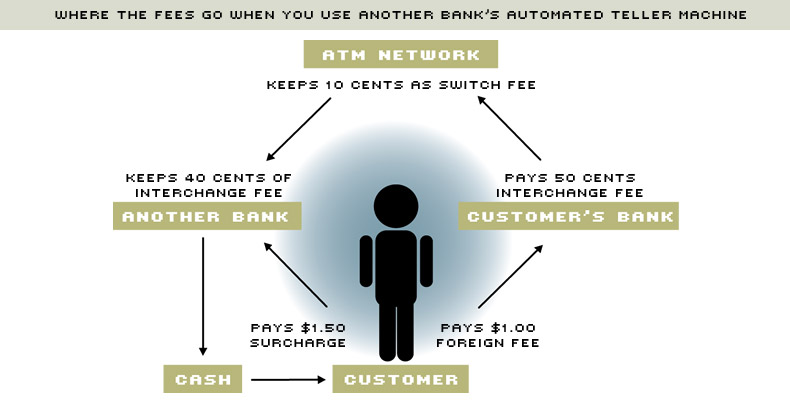

Most ATM users do end up paying fees, however, since banks usually charge a fee—frequently called a foreign fee—for using ATMs they do not own. Banks tend to pass on to their customers some, all, or all plus a premium, of the fees they pay to ATM networks and owners—which can be other banks or nonbanks—to cover the cost of foreign transactions. In a typical sharing arrangement, all banks in a network pay fees to the network owners to cover the costs of operations. The card-issuing bank pays an "interchange fee" to the ATM owner. The network keeps part of the interchange fee as a "switch fee" to cover its costs. Interchange fees, which typically range from 50 cents to $2, are usually passed on to customers as foreign fees. Automated teller machine users can avoid these foreign fees by using either ATMs owned by their banks or bank tellers.

Whether ATMs are money makers, or even cost savers, for banks is debatable. Although it's pretty clear that on a per-transaction basis, ATMs are cheaper than tellers, a number of studies have indicated that on an aggregate basis, ATMs can be more expensive since users of them tend to make more frequent, smaller-denomination transactions. A customer who has to wait in line for a teller may withdraw $100 for a week, while another customer might make five trips to the ATM that same week, withdrawing $20 each time.7 There's also evidence that ATMs are not being fully utilized. A large proportion of ATM users, for example, will not use the machines to make deposits, requiring the continued use of more costly tellers to handle these routine transactions.

Surcharge Skirmish

The war over ATM fees has heated up significantly with the introduction of surcharges. On April 1, 1996, the two largest national ATM networks—Cirrus, which is owned by MasterCard, and PLUS, which is owned by Visa—announced they were dropping their long-time ban on ATM surcharges by network members. The companies said their decision was due to competitive pressures from several regional networks that had already dropped surcharge bans. The outcry against surcharges was loud and immediate, with opponents accusing banks of "double dipping" and price gouging. Although 15 states already had laws or regulations overriding the bans, they were mostly small states. Thus, the elimination of the bans affected a significant number of ATM users in populous states like California, Illinois and New York.8 A number of regional networks have since followed the lead of Cirrus and PLUS, allowing their members to levy surcharges for non-customer transactions.

As illustrated in Figure 1, the widespread introduction of surcharges means that customers who use ATMs that are not owned by their banks will generally pay two fees to withdraw cash—the foreign fee and the surcharge. Combined, these fees generally range from $1.25 to $2.50 or more. Surcharge opponents believe customers are being charged twice for the same transaction, since card issuers typically already pass on to consumers the interchange fee paid to ATM owners. Some opponents also charge that the fees are anticompetitive, since they put smaller banks with few proprietary ATMs at a disadvantage relative to larger banks. This gives small-bank customers who are heavy ATM users a real financial incentive to move their accounts to larger banks that own a lot of ATMs. Surcharge proponents counter that ATM owners are not adequately compensated for the use of the machines by non-customers. Moreover, they say that profits generated from surcharges can be used to finance installation of ATMs in more remote locations, like vacation spots and ballparks.

Consumer groups, such as the U.S. Public Interest Research Group (USPIRG) and the Center for the Study of Responsive Law, have led the charge against surcharges, conducting studies that show, among other things, how much ATM fees have risen since the end of the surcharge ban and the proportion of ATMs that are not adequately disclosing the surcharge.9 Some consumer watchdogs have also expressed concern that surcharges will disproportionately affect low-income customers, since they're more likely to live in areas with high ratios of ATMs to traditional branches.

The U.S. Congress and several state legislatures have also addressed the surcharge issue. Rep. Marge Roukema (R-NJ), chairwoman of the House Subcommittee on Financial Institutions and Consumer Credit, and Sen. Alfonse D'Amato (R-NY), chairman of the Senate Committee on Banking, Housing and Urban Affairs, have been particularly vocal on the issue, each holding hearings and sponsoring legislation that would affect ATM surcharges. Roukema's bill would require ATM owners to disclose the amount of any surcharge on the ATM screen, as well as on the machine itself, and give consumers the opportunity to cancel the transaction without penalty. The bill also asks the General Accounting Office (GAO) to study the feasibility of having ATMs disclose all fees—including any fees the customer's bank would levy—before initiating a transaction.

Sen. D'Amato's bill goes much further, requesting an outright ban on surcharges. This bill was prompted in part by a recent GAO survey—commissioned by D'Amato—that shows that the number of commercial banks and thrifts that surcharge rose more than 300 percent from December 1995 to early 1997.10 Bernard Sanders (I-VT) has introduced a similar bill in the House. At the state level, bills to cap or ban surcharges have been introduced in California, Missouri and New York, among other states, although, so far, none has passed. Connecticut and Iowa already ban surcharges at ATMs in their states, and Arkansas, Mississippi and Wyoming have put caps on surcharge amounts.

Surcharge proponents argue that this legislation is unnecessary—and potentially harmful—to consumers and banks. They point to the vast majority of ATMs that already disclose surcharges and allow customers to cancel transactions if they don't want to pay fees. A federal disclosure law would be duplicative, they argue, because network operating rules, state laws and the Electronic Fund Transfer Act of 1978 already mandate disclosure of ATM surcharges.

As for a ban on fees, surcharge proponents say the market should decide. After all, customers can choose to use machines that do not surcharge or get cash from other fee-free sources, like point-of-sale terminals at grocery stores and other retail establishments. Proponents maintain that income from surcharges will make it economically viable to install ATMs in more remote locations, which do not tend to generate as many transactions as centrally located ATMs, but provide valuable cash outlets. ATM analysts estimate that an off-premise ATM that does not surcharge needs to handle 3,000 transactions a month just to break even. With surcharging, the break-even point drops to 500 transactions.11

A Consumer Backlash

Industry experts are divided about how consumers will ultimately respond to surcharges. Consumer anger about surcharges, and bank fees in general, can be traced in part to Regulation Q, which set ceilings on the interest rates banks could pay depositors. Because banks were restrained from offering customers competitive interest rates on deposits relative to money market mutual funds and other products, they frequently compensated by throwing in free services. However, when Regulation Q was eliminated in the early 1980s, the market for deposits became more competitive, leading banks to charge customers fees and require minimum balances. ATM fees hit a raw nerve with many customers because the machines have traditionally been marketed as a way for banks, and hence consumers, to cut banking costs. The average ATM user already pays about $72 a year in foreign fees (72 visits a year at an average of $1 per visit) on top of other fees that can total several hundred dollars.12 Surcharges are expected to double the annual cost of using ATMs.

Although the reaction of consumers to surcharges was initially very negative, it may not lead to large-scale behavior changes. A 1990 American Banker survey of more than 1,000 bank customers found that 38 percent of cardholders cut back on ATM use when foreign fees were introduced, while almost half of those polled did not reduce use at all. In a survey on ATM use from two years earlier, however, 44 percent said they would reduce ATM transactions, while 30 percent said they would not use their cards at all if they had to pay for transactions that used to be free.13

In Texas, which has permitted surcharging since 1987, all 10 of the state's largest banks levy a surcharge for foreign transactions.14 Figures from Pulse, the regional ATM network that serves the state, show that 80 percent of all cash withdrawals from its ATMs are levied a surcharge, which averages 86 cents. The proportion of ATM users who are paying those surcharges is much smaller, though. A 1995 survey conducted by the network indicated that 77 percent of its customers avoid ATMs that surcharge; the survey showed that 20 percent of all surcharge revenue comes from the 3 percent of ATM users who are surcharged frequently.15

A Competitive Challenge

Of course, the ultimate effect on consumers from surcharges depends in large part on how ATM owners respond to the ability to surcharge. While a number of ATM owners, especially large banks and nonbanks, wasted little time levying surcharges after the ban was lifted, others have not yet decided what to do. In California, banks and thrifts that own more than 2,000 ATMs have formed a no-surcharge alliance to counteract a $1.50 surcharge being imposed by Bank of America, Wells Fargo and Home Savings Bank, which together control more than half of the state's ATMs.16 Similar groups have popped up in other areas. Other markets, like New York City, have yet to see pervasive surcharging because the large ATM owners have not instituted it—yet.

Some bank ATM owners have rejected surcharging out of fear that it will turn consumers off not only on ATMs, but on other forms of electronic banking, too. Another concern is that the market for ATMs is already saturated—installations were growing at double-digit rates long before surcharging became widespread. Some believe that expansion from surcharging will reduce average transaction volumes at all machines, raising per-unit transaction costs.

A major public policy concern related to ATM surcharging is its effect on bank competition. Smaller banks and credit unions are not only less likely than large banks to own ATM machines but are also more likely to offer free or low-priced ATM services to their customers. With surcharging, the card-issuing bank loses control over its customers' ATM fees: The bank can still eat the foreign use charge, but is unable to waive the surcharge. Customers of these smaller banks—especially those who are heavy ATM users—are likely to migrate to banks that own a lot of ATMs to avoid the surcharges. To avoid this loss of business, smaller banks will have an incentive to withdraw from ATM networks—which also hurts bank customers and could possibly destabilize the networks—and install their own ATMs, further saturating an already crowded market.

A Market Solution

Surcharges are clearly not popular with consumers. Bank customers have been encouraged over the years to rely more and more on ATMs, and now they're being charged for something that used to be free. But ATMs are also becoming more convenient, and consumers have access to cash virtually anywhere they go. Still, at this point, no one is forced to pay a surcharge. It seems clear that the market has segmented by willingness to pay: Customers who wish to avoid surcharges are able to do so and customers who are willing to pay them—because of increased convenience or an unwillingness to shop around—do pay them. As long as surcharges are adequately disclosed and consumers have non-surcharge alternatives, like their own banks' ATMs, there is no reason to ban them on consumer protection grounds.

In an era of dwindling bank competition from hundreds of mergers, however, policymakers and regulators are likely to cast a dim view on ATM surcharging if it inhibits competition. Some analysts have suggested that ATM owners and networks will be vulnerable to antitrust charges if they collect both interchange fees and surcharges. But caps or an out right ban on surcharges at the federal level is highly unlikely, since Congress is generally resistant to calls for price controls, although surcharge opponents may be able to push through surcharge bans or caps in some additional states. Ultimately, though, market forces will determine whether surcharging is a profitable strategy for ATM owners. Cash-hungry consumers will vote with their ATM cards.

Endnotes

- See Humphrey (1994). [back to text]

- Unless otherwise indicated, all derivations of the word "bank" in this article refer to any or all U.S. depository institutions, including commercial banks, savings and loans, savings banks and credit unions. [back to text]

- For more information on ATM networks, see Laderman (1990) and Trautman (1989). [back to text]

- See Rose (1996), p. 693. [back to text]

- See Rose (1996), p. 694. [back to text]

- See Meier (1995). [back to text]

- See Humphrey (1994) and Horvitz (1996) for more information on ATM costs and profitability. [back to text]

- See Bureau of National Affairs (1996), p. 726. [back to text]

- See U.S. Public Interest Research Group (1997). [back to text]

- See GAO (1997). [back to text]

- See Morrow (1997). [back to text]

- See Morrow (1997). [back to text]

- See Homa (1990). [back to text]

- See Olaya (1996). [back to text]

- See Horvitz (1996), p. 59. [back to text]

- See Gilroy (1997). [back to text]

References

Bureau of National Affairs. "Further Legislation on ATM Fees Is Unnecessary, Industry Tells Subcommittee," BNA's Banking Report, Vol. 66, No. 17 (April 28, 1996), pp. 726-27.

Gilroy, Tom. "Several California Banks Form Alliance to Fight ATM Surcharges," BNA’s Banking Report, Vol. 68, No. 9 (March 3, 1997), p. 411.

Homa, Lynn. "ATM Fees Are Gaining Acceptance; Few Consumers Curtail Usage," American Banker (October 24, 1990), p. 6.

Horvitz, Paul M. "ATM Surcharges: Their Effect on Competition and Efficiency," Journal of Retail Banking Services (Autumn 1996), pp. 57-62.

Humphrey, David B. "Delivering Deposit Services: ATMs Versus Branches," Economic Quarterly, Federal Reserve Bank of Richmond (Spring 1994), pp. 59-81.

Laderman, Elizabeth S. "Shared ATM Networks: An Uneasy Alliance?" Weekly Letter, Federal Reserve Bank of San Francisco (February 23, 1990).

Meier, Barry. "Need A Teller? A Big Bank Plans $3 Fee," New York Times (April 27, 1995).

Morrow, David J. "Has Your ATM Eaten Your Wallet?" New York Times (May 4, 1997).

Olaya, Phil. "Consumers Union: ATM Fees Will Sweep the Nation," American Banker (June 25, 1996).

Rose, Peter S. Commercial Bank Management, 3rd edition (Chicago: Richard D. Irwin, 1996), pp. 693-95.

Trautman, William B. "Regulating Communication Technology: The Case of Automated Teller Machine Networks," A Rand Note. The RAND Corporation (October 1989).

U.S. General Accounting Office. Automated Teller Machines: Banks Reported That Use of Surcharge Fees Has Increased. GAO/GGD-97-90 (May 1997).

U.S. Public Interest Research Group. Twice as Many Charge Consumers Twice (April 1, 1997).

Related Topics

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us