Interest Rate Control Is More Complicated Than You Thought

Most people are aware that decisions by the Federal Reserve (Fed) affect market interest rates. These decisions have consequences for the interest rates that consumers pay on mortgage loans, credit cards and auto loans, and for the interest rates faced by businesses on bank loans, corporate bonds and commercial paper.

But there is more than one interest rate that the Fed sets, either as a target or by administrative fiat. Many people are aware of the target for the federal funds rate, or fed funds rate, that the Federal Open Market Committee (FOMC) of the Fed sets at its eight regular meetings a year. The fed funds rate is an interest rate on overnight credit arrangements among financial institutions—that is, a very short-term interest rate. The Fed also sets the discount rate, or the interest rate on primary credit, which is an interest rate at which the Fed lends to commercial banks in its role as a lender of last resort. Still another rate is that on interest paid by the Fed on reserves. Banks hold reserve accounts with the Fed; these accounts essentially play the role of checking accounts for financial institutions. (A reserve account is useful when a bank needs to make large payments to other financial institutions.) Thus, a reserve account is a loan to the Fed from a bank. Before late 2008, reserve accounts paid zero interest, as dictated by Congress in the Federal Reserve Act.

Prior to the financial crisis (late 2007 through 2008), the Fed conducted monetary policy within what economists call a channel system. The Fed targeted the overnight fed funds rate within a "channel," with the discount rate as the upper bound on the channel and the interest rate on reserves as the lower bound on the channel. For example, in January 2007, the discount rate was set at 6.25 percent, the fed funds rate was targeted at 5.25 percent and the interest rate on reserves was 0 percent. The fed funds rate could not, in principle, go above the discount rate because no bank would choose to borrow from another bank at an interest rate higher than the rate at which it could borrow from the Fed (the discount rate). Similarly, no bank would lend to another bank at an interest rate lower than the interest rate it could receive from the Fed (the interest rate on reserves). In 2007, the New York Fed would intervene every day in financial markets—through open market operations, which are the purchase and sale of assets by the Fed—to try to bring the fed funds rate as close as possible to the target set by the FOMC.

But between 2007 and now, the details of how the Fed conducts monetary policy have changed in important ways. First, since late 2008, the reserves held at the Fed by financial institutions have earned interest; such interest payments are allowed under an amendment to the Federal Reserve Act passed by Congress. Further, and more importantly, the interest rate on excess reserves, or IOER, is set by the Fed and can be changed over time.

Second, during the Great Recession (late 2007 to mid-2009) and its aftermath, the Fed engaged in some unconventional monetary policy actions. For our purposes, the most important of these was a program of large-scale asset purchases, sometimes known as quantitative easing. This program led to a large increase in the stock of reserves at the Fed—effectively, the Fed purchased a large quantity of assets (U.S. Treasury securities and agency mortgage-backed securities) by issuing more reserves.

For the Fed, the large stock of reserves outstanding implies that monetary policy works differently now—within a floor system rather than a channel system. In a floor system, the IOER plays a key role. In principle, what should happen in a floor system is that, with plenty of reserves in the system, the Fed can achieve its target for the fed funds rate by simply setting the IOER. Why? If the fed funds rate were lower than the IOER, then banks would be able to make a profit from borrowing on the fed funds market and lending to the Fed at the IOER, thus forcing up the fed funds rate. If the fed funds rate were higher than the IOER, then a bank wanting to lend would earn more interest on the fed funds market than by lending to the Fed at the IOER. The large demand for fed funds would then force the fed funds rate down.

According to this logic, controlling the fed funds rate should be easy for the Fed under a floor system. But theory and reality sometimes do not agree. From late 2008 to December 2015, the IOER was set at 0.25 percent. However, contrary to what many people might think, since early 2009 the fed funds rate has generally been 5 to 20 basis points (one basis point is equal to 0.01 percentage points) lower than the IOER. This difference between the IOER and the fed funds rate is typically ascribed to costs for commercial banks associated with borrowing on the fed funds market.1

The persistent difference between the IOER and the fed funds rate was a concern for the Fed as it anticipated the time when "liftoff" would occur, where liftoff refers to the date at which the Fed would depart from its long period (since late 2008) of zero interest rate policy, or ZIRP. Could the Fed expect that the fed funds rate would increase along with the IOER if the Fed attempted to control the fed funds rate only through increases in the IOER?

The solution adopted by the Fed is unique in central banking—a floor system with a subfloor. The New York Fed, in intervening in overnight financial markets, is now making use of an overnight reverse repurchase agreement (ON-RRP) facility. ON-RRPs are essentially reserves by another name. In ON-RRP transactions, financial institutions lend to the Fed, just as they do when they hold reserve accounts with the Fed. The difference between reserves and ON-RRPs is that, in an ON-RRP arrangement, the Fed posts securities in its portfolio as collateral, just as in any private repurchase agreement transaction. A repurchase agreement is simply a special kind of financial market loan that is secured by collateral just as, for example, your mortgage is secured by your house, which can be seized if you default on the mortgage.

Without getting into all the details,2 the idea behind the floor-with-subfloor system is that the Fed sets, along with the discount rate and IOER, an ON-RRP rate, which is the rate at which financial institutions can lend to the Fed in the market for repurchase agreements. The ON-RRP rate is set below the IOER, and then policy is announced as a target range for the fed funds rate, with the top of the range given by the IOER and the bottom of the range determined by the ON-RRP rate. Thus, the IOER sets the floor, and the ON-RRP rate sets the subfloor.

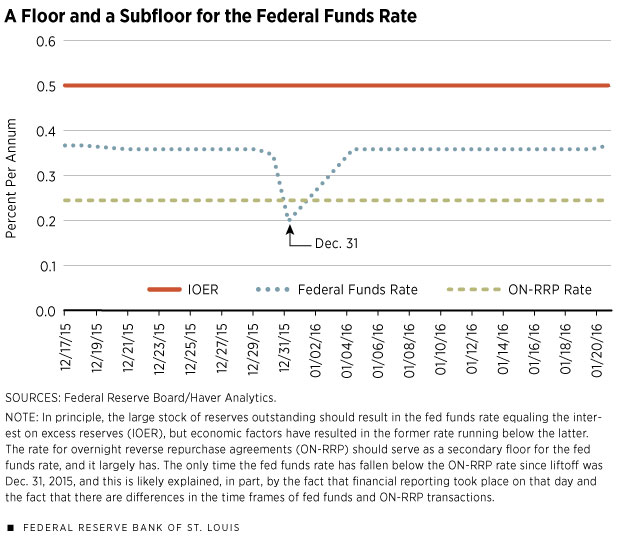

But could this system work? On Dec. 16, 2015, the FOMC decided to increase the target range for the federal funds rate from 0-0.25 percent to 0.25-0.50 percent,3 with the discount rate at 1.0 percent, the IOER at 0.50 percent and the ON-RRP rate set at 0.25 percent.

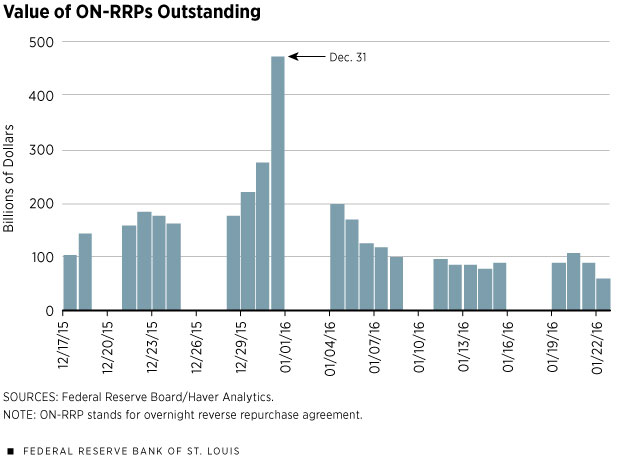

As shown in Figure 1, the value of ON-RRPs outstanding increased from $105 billion on Dec. 17, 2015, to $475 billion on Dec. 31, following which the quantity dropped back to the neighborhood of $100 billion. In the fed funds market, as shown in Figure 2, the average daily fed funds rate has typically been within a tight range of 0.35-0.37 percent, except on Dec. 31, 2015, when the average rate was 0.20 percent. Thus, in terms of results, the Fed has been successful in controlling the fed funds rate within the 0.25-0.50 percent range.

But why was the average fed funds rate so low and the ON-RRP quantity so high on Dec. 31, 2015? This date was both the quarter-end and year-end, which is important because at this time financial reporting takes place and financial institutions want to have their balance sheets appear as favorable as possible to their shareholders and regulators. Lending on the fed funds market can be a risky activity, as lending is unsecured, while lending to the Fed in the form of ON-RRPs is essentially riskless. Therefore, we might expect that, on Dec. 31, lenders in the overnight market would shift their activity from the fed funds market to the ON-RRP market, as this would reduce risk on their balance sheets. Sure enough, we saw a large increase in ON-RRP activity on Dec. 31.

Still, why were fed funds market lenders accepting an average interest rate of 0.20 percent on Dec. 31, 2015, which is lower than the ON-RRP rate on that date, and why were some participants accepting interest rates as low as 0.08 percent? A potential explanation for this is that fed funds market trades and ON-RRP trades are very different in terms of the time of the day lending occurs and when the loan is paid back the next day. In particular, ON-RRP borrowing by the Fed occurs between 12:45 and 1:15 p.m. ET, and loans are paid back the next day between 3:30 and 5:15 p.m. ET. However, a fed funds transaction can occur as late as 6:30 p.m., with funds potentially returned early the next day.4 So, while a fed funds market transaction may be riskier because lending is unsecured, it is also more liquid, as lending can occur later in the day and funds can be returned more quickly the next day. Thus, lenders may be willing to pay for liquidity with a lower overnight interest rate, and this would have a larger effect at the quarter-end, when trading on the fed funds market is thin.

Research assistance was provided by Jonas Crews, a research analyst at the Bank.

Endnotes

- See Williamson. [back to text]

- See Williamson for more information. [back to text]

- See Board of Governors. [back to text]

- See Bartolini, Hilton and McAndrews for more information on the timing of transactions. [back to text]

References

Bartolini, Leonardo; Hilton, Spence; and McAndrews, James. "Settlement Delays in the Money Market." New York Federal Reserve Bank Staff Reports, 2008, No. 319. See www.newyorkfed.org/medialibrary/media/research/staff_reports/sr319.pdf.

Board of Governors of the Federal Reserve System. Press Release, Dec. 16, 2015. See www.federalreserve.gov/newsevents/press/monetary/20151216a.htm.

Williamson, Stephen D. "Monetary Policy Normalization in the United States." Federal Reserve Bank of St. Louis Review, 2015, Vol. 97, No. 2, pp. 87-108. See https://research.stlouisfed.org/publications/review/2015/q2/Williamson.pdf.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us