History’s Lasting Imprint on the Racial Wealth Gap

A version of this opinion piece first appeared in the St. Louis Post-Dispatch on Feb. 21, 2022.

History, more than current choices, best explains the racial wealth gap today.

Take the case of J.B. Stradford, a Black entrepreneur, who—unlike others—survived the Tulsa race massacre of 1921, when white mobs razed one of the wealthiest Black communities in the U.S. But his hotel and other properties did not survive. His great-grandson, John W. Rogers Jr. of Ariel Investments, calculates that Stradford’s investments, then valued at $125,000, would be worth over $100 million today.

Stradford and his descendants did not choose to have their wealth obliterated, of course. Yet a harmful assumption persists today that the Black-white wealth gap largely reflects choices, not history.

The narrative goes something like this: Legal discrimination no longer exists, educational opportunities have expanded significantly, and we’ve elected a Black president and vice president—so, absent any barriers, our economic success largely depends on how hard we work and the financial, educational and other choices we make. In this post-racial America, good choices lead to more wealth and success, while bad choices lead to less.

Professors Darrick Hamilton and William A. Darity Jr. forcefully challenged this assumption a few years ago: “The problem with this language,” they observed, “is the implicit notion that the racial wealth gap is a matter of financial literacy, choice, and agency, as opposed to inheritance and structure.” Darity further warned that, “The ultimate implication of this kind of argument is that there’s something inferior about the group that has worse outcomes.”

Historically Shared Experience Constrains Choices

While individual agency and choices always matter, Darity and Hamilton got us wondering: How much of the racial wealth gap is explained by our choices and how much by inheritance, history and structure?

As expected, our St. Louis Fed colleague and economist William R. Emmons and Lowell R. Ricketts, one of this blog post’s co-authors, found that families who, regardless of race, chose to save for retirement, diversify their investments and own a home, for example, have more wealth than those who did not make those choices. However, they also observed that this ignores the fact that the choices themselves were shaped by factors beyond anyone’s control—that each group’s common or historically shared experience overwhelmingly explains the choices they were afforded to make.

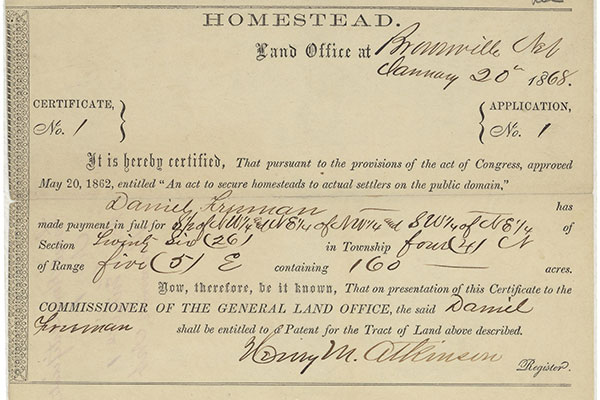

For white Americans, those common experiences were widely shared inclusion in major wealth-building policies such as the 1862 Homestead Act (which granted 160 acres of land, mostly west of the Mississippi River, to families willing to work it); the GI Bill of 1944 (which helped returning soldiers go to college, start a business or buy a home); and robust 20th-century policies to promote homeownership. Black Americans, though, were largely excluded from those policies.

Black wealth further suffered from the overturned 1865 promise to some 4 million freed slaves of “40 acres and a mule,” the white trustees’ neglect and mismanagement and the ultimate demise of the Freedman’s Bank in 1874, and the destruction of Black-owned property in race massacres in cities like Tulsa, Wilmington, Dela., and Rosewood, Fla., to name a few.

Click/tap to view larger image

In January 1863, Daniel Freeman became the first American to file a claim for land under the Homestead Act of 1862. Five years later, he received this ownership certificate, now in the National Archives.

The Wealth Gap Persists Despite Progress in Other Areas

Today’s Black-white wealth gap—Black families have about 12 cents of wealth for every dollar held by white families—largely reflects, then, the culmination of all those shared historical experiences of exclusion and destruction. And this gap hasn’t changed much in the last generation, despite educational and other progress. Many have argued that, without meaningful economic redress, these embedded and enduring features of the racial wealth gap cannot be overcome.

But the racial wealth gap also reflects the constrained choices many Black Americans and others still face today compared with those of white Americans: having, as research shows, to borrow more for college and graduate school; diminished opportunities to pursue more lucrative STEM degrees; and fewer options to lean on parents in a financial pinch or to inherit their wealth. In this context, the racial wealth gap has been less about making different choices and more about having different choices to make.

Ways to Narrow the Racial Wealth Gap

If the racial wealth gap, then, has been defined by exclusion, closing it should be defined by inclusion.

Experts have mapped many routes to inclusion, starting with closing racial wage and employment gaps, which is foundational for building wealth. Or through a more inclusive federal tax system that currently encourages homeownership and retirement savings for wealthier families, the majority of whom are white. Inclusive financial wellness efforts in workplaces nationwide command broad support, too, as do expanded opportunities to promote Black-owned enterprises. And calls for automatic inclusion in “baby bonds” and state-based 529 college savings and retirement security plans are growing nationwide as well.

Moreover, these policies would grow the U.S. economy, as the San Francisco Fed and others have found. Economic equity and inclusion really can move all of us forward.

The views of the blog post’s authors are their own, and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Related Topics

This blog explains everyday economics, consumer topics and the Fed. It also spotlights the people and programs that make the St. Louis Fed central to America’s economy. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us