Retirement Savings: The SECURE Act Helps; Can More Be Done?

When U.S. policymakers united on December 19, 2019, to enact the SECURE Act, they could not have known that a novel coronavirus circulating in a seafood market in China around that time would later erupt into a global pandemic—making the SECURE ACT even more timely and necessary for millions of Americans.

While the SECURE Act does not address public health security, it is poised to improve retirement security—something policymakers were concerned about before COVID-19 ground the U.S. economy to a halt and threatened the financial and retirement security of millions of Americans.

So, were policymakers right to be concerned about Americans’ retirement security even before the SECURE Act and COVID-19? Yes. One Federal Reserve survey, the “SHED,” found that in 2018:

- About 36% of non-retired adults believed their retirement savings were on track.

- 44% said their retirement savings were not on track.

- The rest weren’t sure.

One-third prepared, two-thirds not prepared or not sure—that was, and is, cause for concern.

These Americans are struggling to build wealth for retirement.

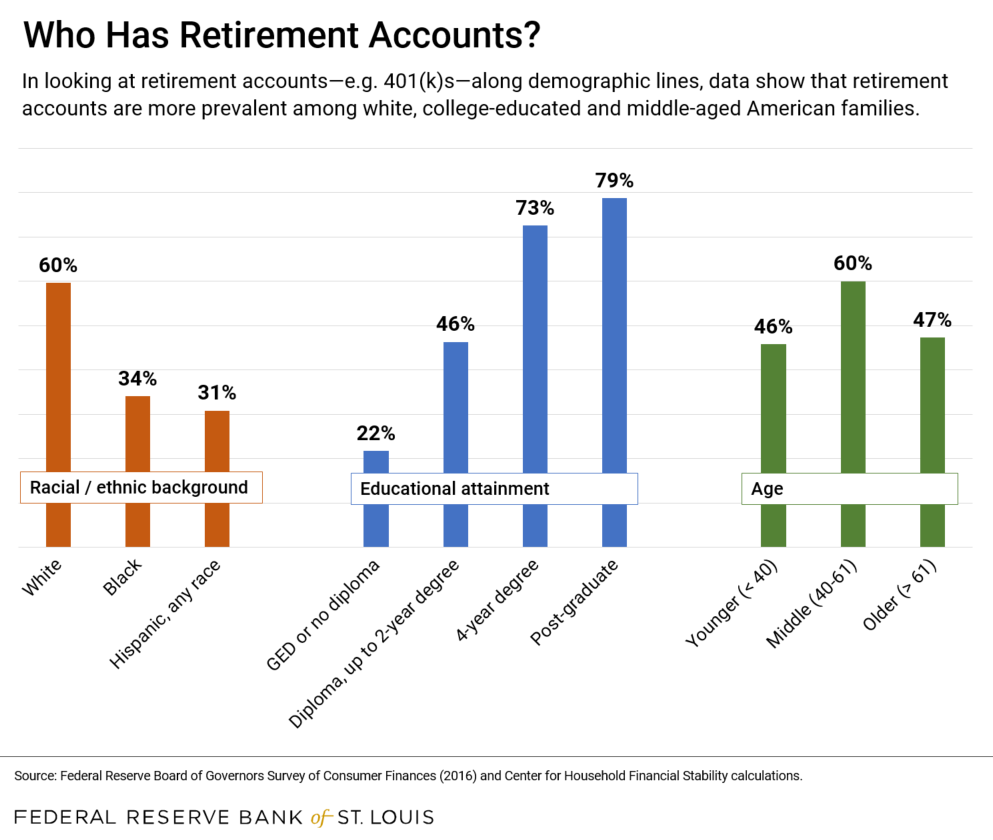

As we’ve consistently found in our Demographics of Wealth series, it is younger, non-white and less educated Americans who are struggling to build wealth—and the data show up in retirement savings balances along these demographic lines.

Breaking it down: Younger Americans have less wealth than their parents did at a similar age.

Let’s start with age and the generation into which you were born.

The SHED (Survey of Household Economics and Decisionmaking) survey mentioned above also shows that younger and middle-aged Americans were more likely than older Americans to say their retirement savings were not on track, and to report that they had no retirement savings whatsoever.

It’s not just that younger families are, well, younger and have had less time to save, it’s that younger Americans today have less wealth than their parents did at a similar age. This is largely, we think, due to the timing or “luck” of when they were born.

So this concerns us … although having more time to save offers some comfort, as does economist Ellen Zentner’s recent analysisSee “Millennials Aren’t Spending All Their Money on Avocado Toast, Actually,” by Morgan Stanley Chief U.S. Economist Ellen Zentner, Jan. 31, 2020, New York Times. Zentner has been a guest on the St. Louis Fed’s Women in Economics podcast; she looked at the Fed’s Distributional Financial Accounts. of Federal Reserve data showing greater average amounts of retirement savings among millennials than of Gen X-ers at a similar age.

Racial gaps: Only 1 in 3 non-white families nearing retirement had a defined-contribution plan.

But time may not overcome more troubling racial gaps. A more detailed Fed survey, the 2016 Survey of Consumer Finances, showed that 2 in 3 white families nearing retirement (ages 55-64) owned a 401(k) or similar “defined contribution” retirement savings plan, with a median balance of about $152,000. Meanwhile, just over 1 in 3 non-white families approaching retirement had any such retirement account, with a median balance of just $57,000.Calculations by Lowell Ricketts of the Federal Reserve Board’s Survey of Consumer Finances. Note that defined benefit retirement accounts, commonly known as pensions, are omitted here. Therefore, retirement funds are under measured to a certain degree for both white and non-white families.

Education matters: Just 22% of families headed by someone with a GED or lower had a retirement account.

And, finally, education is sorting those who are more prepared for retirement from those who are less prepared.

About 22% of families headed by someone with a GED or no high school diploma had a retirement account, with a median balance of just around $35,000, while 79% of those with a graduate or professional degree had a 401(k) or similar account, with a median balance of $173,000.

And for older Americans, the “three-legged stool” is mighty wobbly.

So, just as Americans are living longer, just as Social Security payments are growing faster than revenues, and just as fewer and fewer Americans participate in defined-benefit pension plans, personal retirement savings fall woefully short for many.

Stated simply, the “three-legged stool” for retirement known by older generations—Social Security, company pensions, and personal retirement savings—appears to have three wobbly, insecure legs. While a January 2020 analysis by the National Institute on Retirement Security (PDF) notes that 22% of U.S. workers participated in a pension plan in 2017, only about 7% of older Americans actually have all three legs and actually receive some income from all three sources.

Perhaps it’s time to reimagine that visual of retirement security?

Here’s what the SECURE Act does.

These are among the reasons policymakers came together to pass the SECURE Act. Among other things, the act:

- Repeals the maximum age (now 70½) for traditional (pre-tax) IRA contributions.

- Allows “longer-term” part-time workers to participate in 401(k)s—generally, those who’ve worked at least 500 hours a year for three years in a row.

- Encourages small business owners to band together to offer a retirement savings plan.

- Offers up to $5,000 to small business owners to begin offering a retirement plan.

- Makes it simpler for 401(k) plan sponsors to offer annuities and other lifetime income streams.

Keep in mind these enhancements are on top of the gradual expansionFor more on savings programs at a state level, see the Aspen Institute Financial Security Program’s report: “The Time Is Now: Next Steps Toward a More Secure Retirement for All Americans” (PDF). of state-based “Secure Choice” retirement savings plans, which aim to help workers without access to a retirement plan to make automatic payroll deductions into a state-run savings plan.

While the federal SECURE Act and state-based Secure Choice plans set out to make more Americans more secure in retirement, here are four ideas—widely supported among retirement security experts—that could make them even more secure, especially in light of the financial devastation caused by COVID-19.

Four ideas to further enhance retirement security:

1. Increase basic financial security and, especially, access to emergency savings.

How can families save for retirement when, as SHED data show, nearly 4 in 10 Americans would cover an unexpected $400 expense by selling something or borrowing? The Earned Income Tax Credit, mobile apps and quality short-term loans can all play a role in building emergency savings.

Also, employer-based “side car” savings, which enable employees to save for emergencies, can really help, given that between 30 and 40 cents “leak” out of 401(k)s and similar retirement accounts for every $1 saved.

2. Ease educational costs to make retirement savings more likely.

Education pays, on average, and leads to more retirement savings. But student loan payments displace retirement savings. This is especially so for non-white families who, according to data from the New York Fed, are more likely than white families to borrow—and to borrow more—for their education.

3. Shore up Social Security finances.

A remarkable 40% of older Americans in 2013 received just Social Security income; it remains the most common source of retirement income for older Americans. For many, it’s also critical for their financial well-being: Close to 18 million seniors were kept out of poverty by Social Security income in 2018, according to the Census Bureau’s Supplemental Poverty Measure (PDF).

4. Establish a retirement savings account at birth for all kids.

Several states have already established a funded 529 college savings account at birth for all kids. Why not for retirement? Starting in the 1990s, many bipartisan proposals have proposed doing just that for all newborns nationwide.

A 2011 report that one of us co-authored, “The Roth at Birth” (PDF), showed that if retirement savings started accumulating at a child’s birth (through a custodial account) instead of waiting until that child grew up and entered the workforce around age 25, he or she could have $96,000 in additional retirement savings by age 65.

While the ideas offered above do not explicitly target younger, less-educated and non-white families, they would disproportionately benefit these families, given their relatively low levels of savings and assets.

We can be grateful for policymaker progress on retirement security before COVID-19 unexpectedly threw into question the financial security of millions of Americans—and, ideally, look forward to even more progress in the years to come.

Notes and References

- See “Millennials Aren’t Spending All Their Money on Avocado Toast, Actually,” by Morgan Stanley Chief U.S. Economist Ellen Zentner, Jan. 31, 2020, New York Times. Zentner has been a guest on the St. Louis Fed’s Women in Economics podcast; she looked at the Fed’s Distributional Financial Accounts.

- Calculations by Lowell Ricketts of the Federal Reserve Board’s Survey of Consumer Finances. Note that defined benefit retirement accounts, commonly known as pensions, are omitted here. Therefore, retirement funds are under measured to a certain degree for both white and non-white families.

- For more on savings programs at a state level, see the Aspen Institute Financial Security Program’s report: “The Time Is Now: Next Steps Toward a More Secure Retirement for All Americans” (PDF).

Related Topics

This blog explains everyday economics, consumer topics and the Fed. It also spotlights the people and programs that make the St. Louis Fed central to America’s economy. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us