Identifying the Most Financially Vulnerable Families

The following post is the first in a two-part series about which families are most vulnerable to an income shock like COVID-19.

In late March, Congress authorized more than $2 trillion in relief for U.S. households and others affected by the COVID-19 pandemic. While the cash infusion helped millions of individuals, people with limited savings or wealth were more likely to suffer anyway, according to an In the Balance article.

Lowell Ricketts, lead analyst for the St Louis Fed’s Center for Household Financial Stability, and Ray Boshara, the Center’s senior adviser and director, focused on reports of serious delinquency to pinpoint the families most (and least) at risk. (Serious delinquency refers to being at least two months behind on a loan obligation.)

Who Is More Likely to Fall Behind?

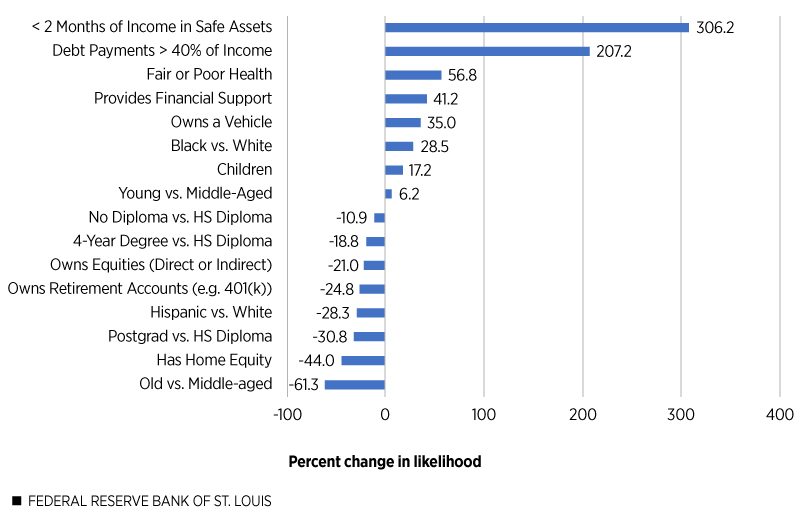

The figure below examines which families are more likely than others to experience serious delinquency on a loan obligation, holding all other factors constant. Ricketts and Boshara found the most important predictor of serious delinquency is whether a family has at least two months’ worth of income in the form of liquid assets, such as cash and checking and savings accounts. If they don’t, they’re about 300% more likely to become seriously delinquent than those who have at least that much.

Liquid Assets and Debt Burden Have Biggest Effect on Likelihood of Serious Delinquency

SOURCES: Federal Reserve Board’s Survey of Consumer Finances and Center for Household Financial Stability calculations.

NOTES: The bar chart shows the percent change in the likelihood of serious delinquency. Each bar compares two groups. For example, in the sixth bar from top, we see that, on average, Black families were 28.5% more likely to be seriously delinquent than white families, after controlling for the other variables shown here.

For those who are more likely to have a serious delinquency, the authors also found:

- These families have too much debt relative to income. Another important factor associated with serious delinquency is whether a family’s debts exceeded 40% of their income. In the period covered in the article, if their debts were over that threshold, they were about 200% more likely than others to be seriously delinquent.

- They aren’t healthy. Families reporting “fair” or “poor” health were nearly 60% more likely than those describing “good” or “excellent” health to report a serious delinquency, the authors found. This highlights how health problems such as COVID-19 can lead to financial instability.

- They’re supporting family or friends. Families providing financial support to relatives or friends were 41% more likely to fall at least two months behind on payments. Plus, each child in the family increased the likelihood of a serious delinquency by 17%.

- They own vehicles. Those who own vehicles were 35% more likely to report serious delinquency, possibly because of the vehicle loans.

Who Is Less Likely to Fall Behind?

With all other factors being held constant, the authors also examined families who might be less likely to become seriously delinquent on a loan obligation—and, by extension, less vulnerable to a shock such as the pandemic:

- They have other sources of wealth. Families with home equity, retirement accounts and equities such as stocks were 44%, 25% and 21% less likely, respectively, to report a serious delinquency, the authors found. This suggests that people with these assets could convert them to something more liquid if needed.

- They are more educated. In general, the more educated families are, the less likely they are to become seriously delinquent. People with a postgraduate degree were 31% less likely and those with a four-year college degree were nearly 19% less likely to report a serious delinquency than those with high school diplomas, Ricketts and Boshara found.

- They’re older. Americans 62 and older were 61% less likely than middle-aged Americans to experience serious delinquency. Younger Americans had roughly the same rates of serious delinquency as those who are middle aged. The authors posited, based on their earlier research, that middle-aged and younger Americans typically have more financial obligations and less wealth built up than older Americans.

Overall, people with longer-term assets such as home equity and retirement accounts—as well as greater liquidity—were less likely to report a serious delinquency, the authors concluded. That also suggests they are better equipped to deal with an income shock such as COVID-19.

So, are there other factors when it comes to predicting serious delinquency? The second post in this series will examine the role of race and ethnicity.

Additional Resources

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions