Credit Card Delinquency Rates Falling Faster for Younger Households

In a previous blog post, we showed that the delinquency rate on credit card loans is at a record low level.1 Today, we’ll use data from the Federal Reserve Bank of New York’s Consumer Credit Panel to look at changes in credit card delinquency rates for different age groups. The delinquency rate considered here is the sum of debt 90 days delinquent, 120 days delinquent, in collection and severely derogatory as a percentage of the total amount of debt.

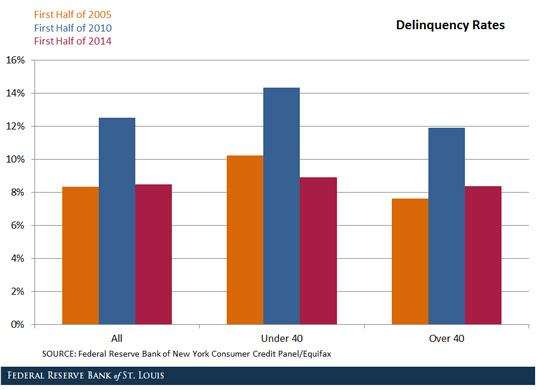

As the table above shows, this measure of delinquency peaked in the first semester (i.e. the first two quarters) of 2010 at 12.5 percent before falling back in the first semester of 2014 to a level very close to that in 2005 (8.5 percent versus 8.3 percent). More importantly, the declines in delinquency rates for younger and older households were quite different. While older households now have a delinquency rate that is still greater than that in 2005 (8.4 percent versus 7.6 percent), younger households now have a delinquency rate lower than that in 2005 (8.9 percent versus 10.2 percent) and substantially lower than the peak in the first semester of 2010 (14.3 percent).

Notes and References

1 For that post, the delinquency rate was computed as delinquent loans (those 30 days or more past due and still accruing interest, plus loans in nonaccrual status) as a percentage of end-of-period loans.

Additional Resources

- On the Economy: Delinquency Rate on Credit Card Loans at Historical Low

- On the Economy: Paying Down Credit Card Debt: A Breakdown by Income and Age

- On the Economy: The Great Recession Casts a Long Shadow on Family Finances

Citation

Juan M. Sánchez, ldquoCredit Card Delinquency Rates Falling Faster for Younger Households,rdquo St. Louis Fed On the Economy, Oct. 13, 2014.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions