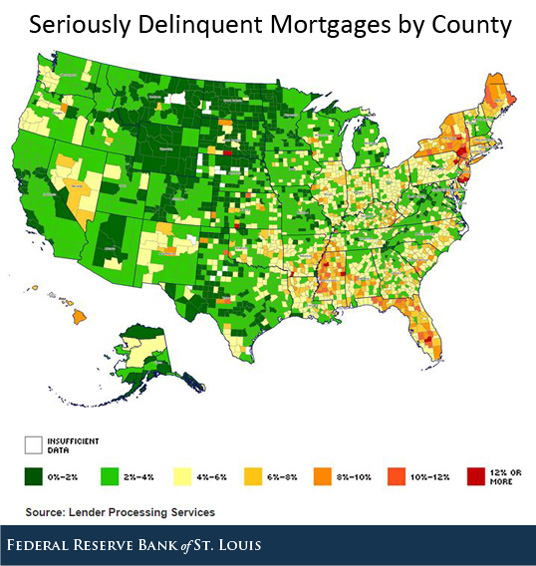

Serious Mortgage Delinquencies Fell during Third Quarter

The latest issue of Housing Market Conditions, produced by the Federal Reserve Bank of St. Louis, reported that 4.07 percent of mortgages in the United States were seriously delinquent in September. (These are mortgages delinquent 90 days or more or in foreclosure.) The figure below shows the percent of seriously delinquent mortgages by county for September.

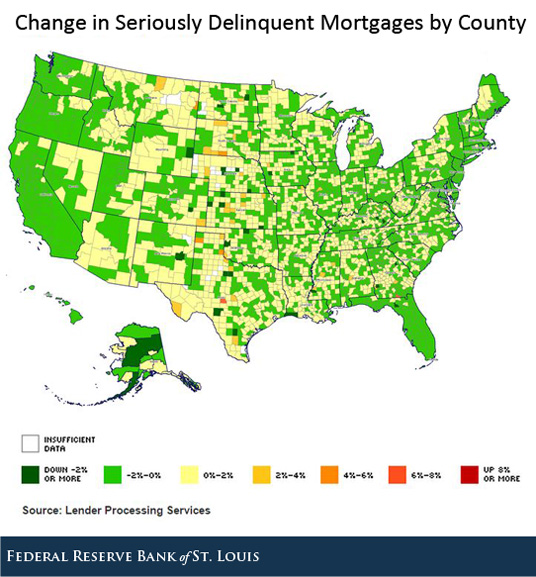

The share of seriously delinquent loans in the U.S. decreased 16 basis points (bps) between June and September. Loans that were delinquent 90 days or more decreased 4 bps, while foreclosures decreased 10 bps. The figure below shows the change in seriously delinquent mortgages by county over this period.

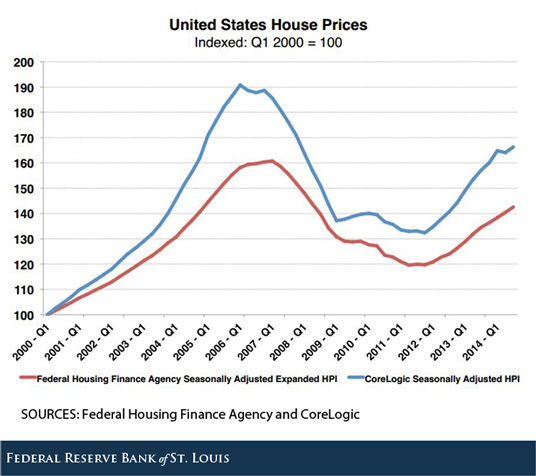

The next image shows changes in U.S. house prices since 2000 according to two indexes: the Federal Housing Finance Agency Seasonally Adjusted Expanded HPI (FHFA) and the CoreLogic Seasonally Adjusted HPI (CoreLogic). For the third quarter of 2014, house prices in the U.S. were 1.5 percent higher according to FHFA and 1.4 percent higher according to CoreLogic when compared with the second quarter of 2014.

Additional Resources

- On the Economy: Beige Book: Economic Activity Continued To Expand

- On the Economy: Fewer Younger, Richer Households Have Negative Home Equity

Related Topics

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions