The Economic Recovery with Malfunctioning Sectors

In recent speeches, Federal Reserve Chair Janet Yellen has expressed the commitment to continue the stimulus for quite some time. This is partially driven by mixed signals from labor market indicators. For example, the economy added about 175,000 jobs in February following two weak months, but the unemployment rate increased from 6.6 to 6.7 percent. This evidence has been used to support the idea that considerable slack remains in the economy and the labor market.

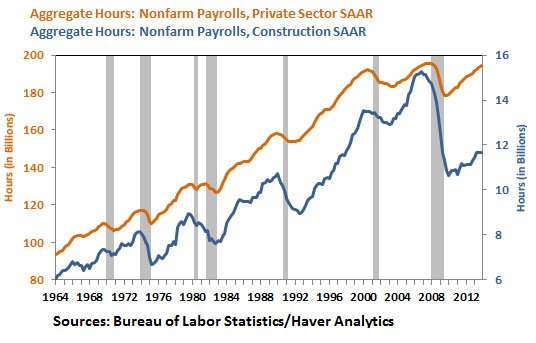

Identifying the magnitude of the slack in the economy can be a challenge if looking only at job creation or the employment data. Examining the evolution of aggregate hours of nonfarm payroll as reported by the Bureau of Labor Statistics is more informative, because it measures, using comparable units, the number of hours employed in different sectors in the economy.

Looking at the dynamics of hours worked in the different sectors in the economy allows for identifying underperforming sectors and how these underperformances differ from those experienced in previous recessions. One notorious case of malfunctioning is the construction sector, which has had a very different pattern of recovery compared with other sectors in the economy and relative to past recessions.

Historically, the total number of hours worked in the construction sector recovered at a much faster rate than in the private sector as a whole. However, the experience of the Great Recession has been very different. At the peak of the housing boom, the sector accounted for nearly 15.3 billion hours worked. (It also employed around 10 million workers and generated 5 percent of all the “value added/GDP” in the economy.) The Great Recession was dramatic for this sector with a decline in total hours to 10.6 billion and nearly 2.5 million workers losing their employment. Eight years later, total hours have only recovered 21 percent relative to the boom level in 2006 or 35 percent relative to the pre-boom level in 2000. At this rate, it will take quite a few years to recover even to the pre-boom levels.

Comparing it with the 1990-91 recession (also very severe for the construction sector) provides additional perspective. In this recession, the total hours employed by the construction sector had a large decline, but the recovery to prerecession levels only took six years.

The impact of a malfunctioning construction sector, which is largely interconnected with other sectors, has important implications for aggregate economic activity. This is because the production of residential and nonresidential real estate requires not only physical goods, but also financial intermediation and services. As a result, shocks to the construction sector of the magnitude observed during the Great Recession (in terms of size and duration) are likely to generate a large slack in the economy. Once this is taken into consideration, the recovery of total hours has been remarkable.

Additional Resources

- Economic Synopsis: Measuring the Contribution of Construction to the Slow Recovery

- Working Paper: Reconstructing the Great Recession

- On the Economy: Discouraged Workers: What Do We Know?

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions