St. Louis Fed Launches Bank On National Data Hub and Affordable Banking Analysis

ST. LOUIS — A new report from the Federal Reserve Bank of St. Louis examines the affordable banking movement known as Bank On.

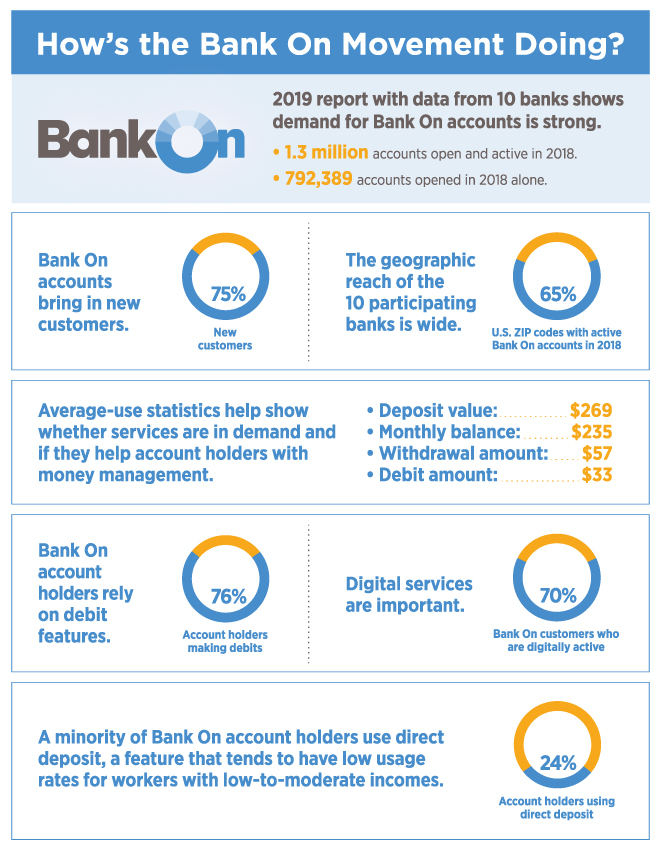

Bank On National Data Hub: Findings from the First Year (PDF) analyzes high-quality data (2018) from 10 financial institutions showing the take-up and usage of Bank On certified accounts across the U.S.

Findings include:

- The demand and use of Bank On accounts continues to grow. More than 3.4 million Bank On certified accounts have been opened. Over 1.3 million accounts were open and active in 2018, representing about 65% of U.S. ZIP codes.

- In 2018, 75% of accounts were opened by customers new to the banks. Accounts at large banks appealed more to new customers; accounts at community financial institutions were more likely to be opened by existing customers.

- About 70% of Bank On account holders are considered digitally active.

The report is a companion to the St. Louis Fed’s new Bank On National Data Hub, allowing financial institutions offering certified accounts to submit their data annually to a federal regulator—ensuring a consistent, accurate reporting process. The Bank On National Data Hub also features an interactive tool to help anyone learn about the affordable banking landscape. For example, if compared with unbanked/underbanked rates, the data can show supply and demand for Bank On accounts by state, ZIP code or metropolitan statistical area.

About a quarter of American households are unbanked or underbanked, conducting some or all of their financial transactions outside of the mainstream banking system, according to FDIC data.

“A banking relationship can both promote savings and create a pipeline to more mature products and services. While the factors that influence a household’s decision to remain unbanked or underbanked are complex, what is clear is a demonstrated need for safe, affordable and accessible financial products and services for American households,” said Carl White, senior vice president for Banking Supervision, Credit, Community Development and Learning Innovation at the St. Louis Fed.

Financial institutions offering Bank On accounts must meet National Account Standards developed by the Cities for Financial Empowerment Fund; these standards include low monthly maintenance fees and no overdraft fees. In addition, products certified as meeting the standards support Community Reinvestment Act (CRA) service test examinations.

Contact Us

-

Laura Girresch

314-444-6166

-

Anthony Kiekow

314-949-9739

-

Shera Dalin

314-444-3911

-

Tim Lloyd

314-444-6829