Another Way to Compare Banking Conditions in the US

Many researchers have long categorized commercial banks by the Federal Reserve district in which the banks are physically located. But there may be times when it makes more sense to categorize the banks according to the Fed district that actually supervises the bank holding company that is the parent of the commercial bank.

The banking data contained in the St. Louis Fed’s Federal Reserve Economic Database, commonly known as FRED,1 has long split various accounting measures of banks by Fed district. These pages are useful, for example, for someone at a rural bank in the Midwest to compare that bank’s performance with the performance of other banks in its own area.

There is more than one way, however, to assign a bank to a Federal Reserve district, whether the bank is directly regulated by the Fed or not. The standard method, and the one long used by FRED and favored by many economists, is to assign a bank to a particular district based on the physical address of the bank’s headquarters. This method, however, may overstate the size and influence of some Fed districts and understate the size and influence of others. A new method of classification is to assign all the commercial banks in a bank holding company to the district that has supervisory responsibility for that parent.

This article describes some of the findings derived from assigning banks to their “responsible” Reserve banks. It starts with an overview of the U.S. bank regulatory system and the importance of bank holding companies and the Federal Reserve to that system. It then shows how differently banks and banking assets would be distributed across the Federal Reserve System under the new methodology. This new method gives analysts both inside and outside the Federal Reserve System a better sense of the asset size of each district’s supervisory portfolio.

The Structure of Bank Supervision

Commercial banks are supervised by a variety of regulatory agencies. If a bank is chartered as a state bank, it is supervised by the state banking department in its home state. In addition to this state-level supervision, it also reports to a primary federal regulator. If the state bank chooses to be a member of the Federal Reserve System, that federal regulator is the Federal Reserve. If it does not choose Fed membership, it is regulated by the Federal Deposit Insurance Corp. (FDIC). A bank may also opt out of state-level oversight entirely and choose to charter as a national bank. In this case, it has no option but to be supervised by the Office of the Comptroller of the Currency (OCC).

A bank can change its charter type and, thus, move to a different regulator, but strict guidelines are in place to allow only banks that are in safe and sound condition to do so. As of June 30, 2017, there were 783 state banks that were members of the Fed (with $2.6 trillion in assets), 3,304 nonmember state banks (with $2.3 trillion in assets) and 896 national banks (with $10.8 trillion in assets).

Bank Holding Companies

Regardless of the charter type, most banks are organized as subsidiaries of a bank holding company (BHC). The simplest type of holding company is one that owns only one bank subsidiary and no nonbank subsidiaries. This type of BHC is referred to as a “shell” holding company. Other holding companies can get quite complex, consisting of multiple bank subsidiaries and many nonbank subsidiaries, such as mortgage companies, insurance companies and brokerages.

It is important to note that the Federal Reserve directly regulates all bank holding companies, regardless of the charter types of the underlying subsidiary banks. If a holding company is a shell company, then Federal Reserve supervisors have the power to inspect it in detail; however, if the bank is in generally sound condition, they rely heavily on the bank-level exam reports created by the various regulatory entities.

Complex holding companies, in contrast, require a much greater devotion of time and resources. For these organizations, the Fed is responsible for ensuring safety and soundness on an enterprise-wide basis to ensure that the entire BHC does not suffer because of risky practices in one or more subsidiaries, whether they are banks or nonbanks.

When Is a Responsible District Different from a Physical District?

When the Federal Reserve System was created in 1913, it was divided into 12 districts. The designers of the system intended to diffuse power along regional lines so that policy would not be completely dominated by politicians in Washington, D.C., or by large banking interests on Wall Street.

In most cases, the headquarters of a BHC is in the same Fed district as its biggest subsidiary bank, also called the lead bank. In fact, for most shell holding companies, the two headquarters are in the same building.

For the more complex BHCs, however, that condition does not always hold. For example, a BHC may have its headquarters in New York City to give it better access to global financial markets and other major financial institutions, but it may also have a subsidiary in another state to take advantage of lower corporate taxes and a subsidiary in a third state to take advantage of relatively permissive usury laws.

In those cases, it is rare but not unheard of for the Fed to shift responsibility for the supervision of a bank from the Federal Reserve district where the bank is physically located to the district where the top-level BHC resides. For example, a commercial bank may be headquartered in South Dakota, putting it physically in the Minneapolis Fed District, but its top holding company is in New York, putting it in the New York Fed District. In that case, the supervisors at the New York Fed would be responsible for monitoring the condition of the South Dakota subsidiary, even though it does not physically reside in the New York Fed District.

How Does It Affect the Distributions of Banks and Assets?

The table below shows the effect of these different methodologies on the distribution of commercial banks by district. If each commercial bank is assigned to the district where its own headquarters is located, then the column labeled “Physical” shows the number of banks assigned to that district. If each bank is assigned to the district of its top bank holding company, then the column labeled “Responsible” indicates the number of banks in each district. If a bank is not a holding company subsidiary, then its responsible Fed is based on its own headquarters address, as before. The resulting changes in the number of banks in each district are fairly small, especially in percentage terms.

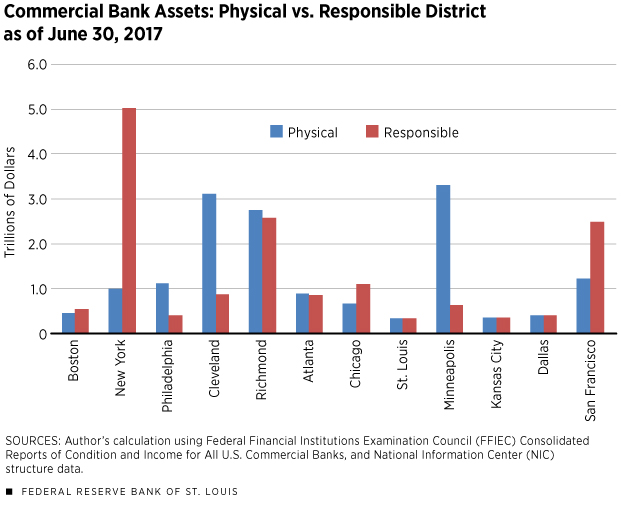

The changes are more dramatic in terms of the total amount of assets supervised, however. In the table and in the figure, we see that the biggest gain is in the New York Fed District. The largest contributors to this increase are JPMorgan Chase Bank (from the Cleveland Fed District) and Citibank (from the Minneapolis Fed District). The second-biggest increase is in the San Francisco Fed District, which gains Wells Fargo Bank from the Minneapolis Fed District. (As it turns out, San Francisco has a net loss of 21 banks, but the combined assets of the lost banks are nowhere near the assets of Wells Fargo.) The above movements also explain why the biggest decreases in supervised assets appear in the Cleveland and Minneapolis Fed districts.

Distribution of Commercial Banks and Their Assets as of June 30, 2017

| Fed | Panel A – # of Banks | Panel B – Total Assets (Billions of dollars) | |||

|---|---|---|---|---|---|

| District | District Name | Physical | Responsible | Physical | Responsible |

| 1 | Boston | 49 | 52 | 459 | 547 |

| 2 | New York | 141 | 163 | 1,012 | 5,086 |

| 3 | Philadelphia | 120 | 112 | 1,107 | 410 |

| 4 | Cleveland | 200 | 196 | 3,154 | 880 |

| 5 | Richmond | 245 | 248 | 2,747 | 2,578 |

| 6 | Atlanta | 624 | 620 | 899 | 878 |

| 7 | Chicago | 874 | 886 | 690 | 1,106 |

| 8 | St. Louis | 557 | 555 | 344 | 346 |

| 9 | Minneapolis | 551 | 549 | 3,326 | 653 |

| 10 | Kansas City | 840 | 838 | 362 | 356 |

| 11 | Dallas | 485 | 488 | 401 | 410 |

| 12 | San Francisco | 296 | 275 | 1,236 | 2,485 |

SOURCES: Author’s calculation using Federal Financial Institutions Examination Council (FFIEC) Consolidated Reports of Condition and Income for All U.S. Commercial Banks, and National Information Center (NIC) structure data.

NOTE: The “physical” method assigns a bank to a particular Federal Reserve district based on the physical address of the bank’s headquarters. The “responsible” method assigns all the commercial banks in a bank holding company to the district that has supervisory responsibility for that parent.

Which Method to Use?

For most purposes, the standard definition of physical Federal Reserve district is perfectly appropriate. In fact, none of the pages in the FRED database that split data by district will be changed. For any research project that looks at how banking assets are distributed across U.S. geographic regions or the differences in bank performance across these regions, these definitions will still fit the bill.

Two new FRED pages now contain time series of the number of banks2 and the total assets3 by the responsible district, not the physical one.4 For research questions that explicitly examine decision-making at a bank holding company level, the responsible-district approach provides a more relevant perspective.

Andrew P. Meyer is a senior economist in the Banking Supervision and Regulation Division at the Federal Reserve Bank of St. Louis.

Endnotes

- See https://fred.stlouisfed.org/. [back to text]

- See https://fred.stlouisfed.org/release/tables?rid=55&eid=188972. [back to text]

- See https://fred.stlouisfed.org/release/tables?rid=55&eid=188947. [back to text]

- For the time series of the number of banks and the total assets by physical location, see https://fred.stlouisfed.org/release/tables?rid=55&eid=188985 and https://fred.stlouisfed.org/release/tables?rid=55&eid=188998, respectively. [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us