Don't Expect Consumer Spending To Be the Engine of Economic Growth It Once Was

Can American consumers continue to serve as the engine of U.S. and global economic growth as they did during recent decades? Several powerful trends suggest not, at least for a while. Instead, new sources of demand, both domestic and foreign, are needed if we are to maintain healthy rates of growth. Unfortunately, this won't be easy because consumer spending constitutes the largest part of our economy, and replacements for it—more investment, more government spending or more exports—either can't be increased rapidly or might create unwanted consequences of their own.

How We Got Here: The Consumer-Driven U.S. Economy

It is no exaggeration to say that consumer spending was the dominant source of economic growth in the United States during recent decades. For example:

- During the 10 years ending in the last prerecession quarter (third quarter of 2007), inflation-adjusted personal consumption expenditures (PCE) grew at a continuously compounded annual rate of 3.47 percent, while overall inflation-adjusted annual growth of gross domestic product (GDP) averaged only 2.91 percent.

- During that period, the remainder of the economy—consisting of investment (I), government purchases of goods and services (G), and net exports (NX)—grew at only a 1.70 percent inflation-adjusted annual rate.

- Expressed in terms of its contribution to average quarterly real GDP growth during the decade ending in the third quarter of 2007, PCE accounted for 81.3 percent, while the other components (I, G and NX) contributed only 18.7 percent.

- Over the quarter-century ending in the third quarter of 2007, consumer expenditures grew, on average, at a 3.50 continuously compounded annual rate, while the rest of the economy (I, G and NX) grew at a 2.79 percent annual rate.

- PCE accounted for 70.8 percent of average real GDP growth during those 25 years (1982: Q3 through 2007: Q3), while all other components (I, G and NX) contributed

29.2 percent.

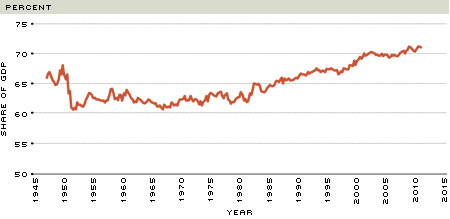

Consumer spending accounts for a majority of spending in all advanced nations. What makes the U.S. experience of recent decades unusual is that the share of consumer spending in GDP was relatively high already before it began to increase substantially further during the 1980s, 1990s and 2000s. In dollar terms, PCE's share of GDP in the third quarters of 1977, 1987, 1997 and 2007 were 62.5, 65.9, 66.7 and 69.5 percent, respectively. (See Figure 1.) Thus, consumer spending was a large and increasingly important part of the American economy during the decades preceding the recession and remains so today.

Personal Consumption Expenditures (PCE)

as Share of Gross Domestic Product (GDP)

SOURCE: Bureau of Economic Analysis; quarterly data through 2011:Q3.

International dimensions of U.S. consumer spending. As consumer spending grew rapidly in the U.S., we imported consumer-oriented goods and services even more rapidly. Imports of all goods and services increased at an annual, inflation-adjusted rate of 6.5 percent during the decade ending in the third quarter of 2007. But imports of consumer goods—44 percent of all imports—increased at an annual average rate of 7.5 percent. U.S. imports contributed importantly to growth in many exporting countries around the world. U.S. consumers, therefore, served as the locomotive not only for the U.S. economy but for the global economy. Because we incurred large trade deficits, we required a corresponding inflow of foreign capital to finance them.

These three facets of U.S. and global economic growth—high-spending and low-saving American consumers, large U.S. trade deficits, and substantial inflows of foreign capital—are important contributors to the so-called "global imbalances" long noted by international economists and policymakers. These imbalances may have contributed to the U.S. housing bubble, the global financial crisis and the ensuing Great Recession.1

A neighborly comparison: the U.S. and Canada. To illustrate how striking the growth of consumer spending in the U.S. has been, Table 1 shows decade averages of the four major sectoral expenditure categories for the U.S. and Canada since 1961.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us