Making the Dean’s “Other” List: Reflections of a First-Generation College Grad

Unlike J.D. Vance, author of Hillbilly Elegy, or Tara Westover, who wrote the memoir Educated, I haven’t (yet) written a book about my experience as a first-generation college graduate to become a New York Times best-selling author. But, hey, you never know, perhaps this blog post is a start.

So here goes. …

As an unimpressive teenager—far more focused on cars, rock bands, football and getting dates than on my classes—and growing up with parents without college degrees, college didn’t appear likely for me.

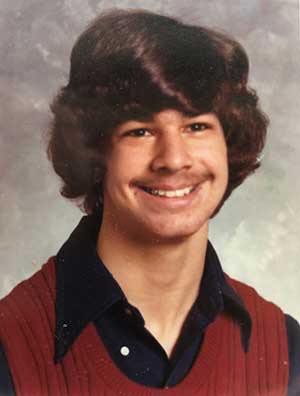

College did not appear likely for this “unruly-haired kid,” circa 1979. The author admits he bombed the ACT, not knowing it was a test you could prep for.

I was regularly grounded by my dad for getting D’s and F’s. Not surprisingly, I bombed the ACT, not knowing one could actually prepare for it.

There were no books in the house, nor was college in the cards for any of my 13 siblings and first cousins (though one cousin eventually graduated from college).

But my best friends were going away to college, and I was quite eager to get out of the house, get out of the family business and get out of Akron, Ohio, so I ended up applying to Ohio State University in May (May!) of my senior year, 1979.

I couldn’t believe it, but I was admitted—a feat unlikely at Ohio State today.

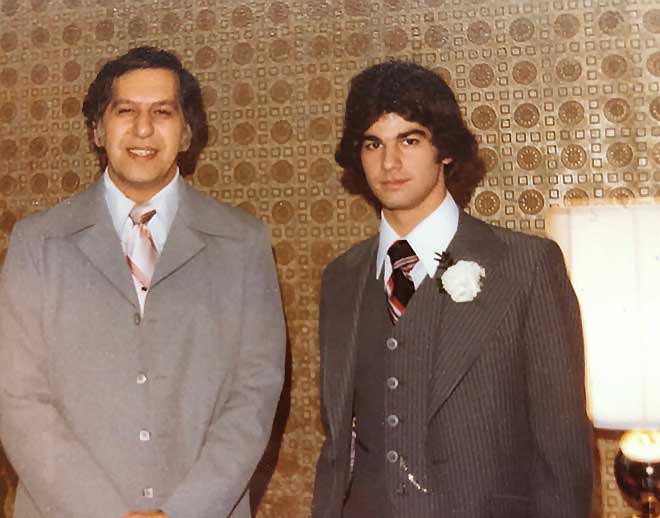

I had a blast my first term at OSU, but landed on the Dean’s “other” (i.e., bad) list, prompting a threat from my dad to cut off funding if that continued.

That definitely motivated me to get my act together. To my surprise, I made the Dean’s proper list nearly all of my remaining terms, graduated cum laude with a degree in accounting, passed the CPA exam, and landed a coveted job at Ernst & Whinney (now EY).

I somehow made it to and through college, but far too many first-gen kids do not.

In fact, we’re going in reverse.

America’s Unrealized Potential

Recent research from my colleagues Ana H. Kent, William R. Emmons and Lowell R. Ricketts, from the St. Louis Fed’s Center of Household Financial Stability, found that:

The share of college graduates who are first-generation has declined.

Between 2015 and 2018, the share of grads who are first-generation grads declined by about 7 percentage points. It now stands at about 4 in 10.

In fact, the share of first-generation grads has declined steadily across each successive generation, starting with adults born in the 1940s. Rates are even lower among blacks and Hispanics.

Nearly 2 in 3 adults have “first-generation potential.”

The overall number of college graduates has been rising, but that’s due almost entirely to the growing number of “continuing-gen” grads, or those who have at least one college-educated parent.

This is especially surprising given that nearly 2 out of 3 adults age 25-64 have “first-generation potential” (meaning that their parents are not college-educated).

I can’t really explain all these trends, but I can offer a few observations based on my own experience.

First, don’t underestimate how much a kid without college-educated parents does not know. It wasn’t just the ACT that was foreign to me; it was how to apply, how to write an essay, and which school was “right” for me.

That feeling of not knowing, or even not belonging, can continue once on campus, too.

Second, family pressures play a much bigger role for first-generation college kids—whether helping out financially, taking care of siblings, or (for me) pitching in with the family restaurant business.

For many, college isn’t really about enriching yourself or finding your true passion; it’s about coming back home and helping your family, now or down the road.

And third, it’s hard to stay in and succeed in college when you’re not surrounded by a college-going culture. I went to college because my friends were going, not because I cared at all about education. I stayed in college in no small part because my friends were staying.

Boshara had a blast his first term at Ohio State University, but his dad (left) threatened to cut off funding if his son’s poor academic performance persisted. The author points out that even today, “It’s hard to stay in and succeed in college when you’re not surrounded by a college-going culture.”

Does a College Degree Matter?

It’s really too bad that more kids with first-generation potential are not college-bound, given what our Center has learned about the remarkable economic returns.

At age 50, we predict that:

- The annual income of a typical first-generation college grad family is $59,000 higher (109% higher) than a typical non-college grad family headed by someone whose parents were also nongrads.

- The wealth of a typical first-generation college grad family is $320,000 higher (349% higher) than a typical nongrad family headed by someone whose parents were also nongrads.

To be sure, the expected income and wealth of children whose parents were also college graduates are significantly higher—the first-generation college boost doesn’t make up for having college graduate parents.

Still, it’s hard to argue with triple-digit income and wealth returns for first-gen college grads, so it behooves us to help more of those millions of kids with first-generation potential to get to and make it through college.Although there probably is a limit to how many people will benefit financially from a college degree, we don’t seem to have reached that limit yet. My Center for Household Financial Stability colleagues found evidence that the income premium (as distinct from the wealth premium) associated with college degrees has held up, even as the share of college graduates continues to rise. See William R. Emmons, Ana H. Kent and Lowell R. Ricketts, “Is College Still Worth It? The New Calculus of Falling Returns,” Federal Reserve Bank of St. Louis Review, Fourth Quarter 2019 (forthcoming).

The “making it through” part is especially important for lower-wealth families.

Fabian Pfeffer of the University of Michigan found that, among those whose families are in the bottom 40% of U.S. wealth distribution, college attendance has actually risen significantly for kids born in the 1970s and 1980s. However, college completion—which is what generates those impressive boosts—has flat-lined. We must close that gap.

But it’s just as important to stress that these compelling returns pegged to a college degree for first-generation and continuing-grad parents does not mean that college is for everyone.

College wasn’t the best route for nearly all of my siblings and cousins. College may not necessarily be the best route for many other Americans.

Therefore, it’s critical we develop more skills and career options for them, too.

That’s a tricky business, of course, figuring out who should and should not be college bound—what other countries call “tracking”—and then getting them on the best path. (Indeed, I’m fairly certain my high school counselors would have dismissed me, as well as J.D. Vance and Tara Westover, as not college material.)

So, yes, let’s do a better job aligning capabilities and interests with college and career paths—but, in doing so, make sure that we don’t close off the college path too soon for that seemingly unpromising, unruly-haired, souped-up-car-driving, KISS-obsessed kid who just hasn’t yet found his way.

Special Event: Sept. 24

Society believes that those who "pull themselves up by their bootstraps," like first-generation college graduates, should be rewarded through upward economic mobility. But are they? Hear more from St. Louis Fed experts at “Grading On a Curve: Do First-Gen Grads Fall Flat?” This free event is part of our Dialogue with the Fed series.

Bookmark this page to watch the livestream.

Notes and References

1 Although there probably is a limit to how many people will benefit financially from a college degree, we don’t seem to have reached that limit yet. My Center for Household Financial Stability colleagues found evidence that the income premium (as distinct from the wealth premium) associated with college degrees has held up, even as the share of college graduates continues to rise. See William R. Emmons, Ana H. Kent and Lowell R. Ricketts, “Is College Still Worth It? The New Calculus of Falling Returns,” Federal Reserve Bank of St. Louis Review, Fourth Quarter 2019 (forthcoming).

Additional Resources

See the August 2019 In the Balance essay, "First-Generation College Graduates Get a Financial Boost, but Don’t Catch Up," by Emmons, Kent and Ricketts.

See the Center for Household Financial Stability’s May 24, 2018, symposium, "Is College Still Worth It: Looking Back and Looking Ahead." In particular, check out Fabian Pfeffer’s presentation, ""Wealth Gaps in Education" (PDF).

This blog explains everyday economics, consumer topics and the Fed. It also spotlights the people and programs that make the St. Louis Fed central to America’s economy. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us