Not All Bursting Market Bubbles Have the Same Recessionary Effect

In 2001, the U.S. experienced an eight-month long recession after the IT bubble burst. Six years later, a recession began after the housing bubble burst, but the economic contraction was much deeper and longer: The Great Recession lasted from December 2007 to June 2009. The figure below shows the impacts of these recessions on real gross domestic product (GDP).

Why did the real estate bust lead to a deep recession (with a 4% drop in GDP) when the dot-com bust did not? One potential factor may be contagion: the spread of market disturbances from one sector to another. If turmoil in the real estate sector were more contagious than a crisis in the IT sector, a crash in real estate would have a larger impact on the entire economy.

Real Estate Sector Correlations

Given that finance and financial investment are leading indicators for the real economy, we believe that contagion should manifest in the stock market in terms of comovements across industry sectors. We collected sectoral stock price data for 11 sectorsThe S&P GICS industry sectors are the sources of the sectoral stock price data, with the exception of the real estate sector. The FTSE NAREIT All Equity REITS Index is used for real estate as data for the S&P Real Estate Sector only started in late 2001. of the U.S. economy:

- Communication Services

- Consumer Discretionary

- Consumer Staples

- Energy

- Financials

- Health Care

- Industrials

- Information Technology

- Materials

- Real Estate

- Utilities

The data cover the period 2000 to 2012. Since we are interested in how each sectoral stock price correlates with the others over time (especially the IT and real estate sectors), we used a rolling window to measure the changing correlations over a period of 52 weeks.

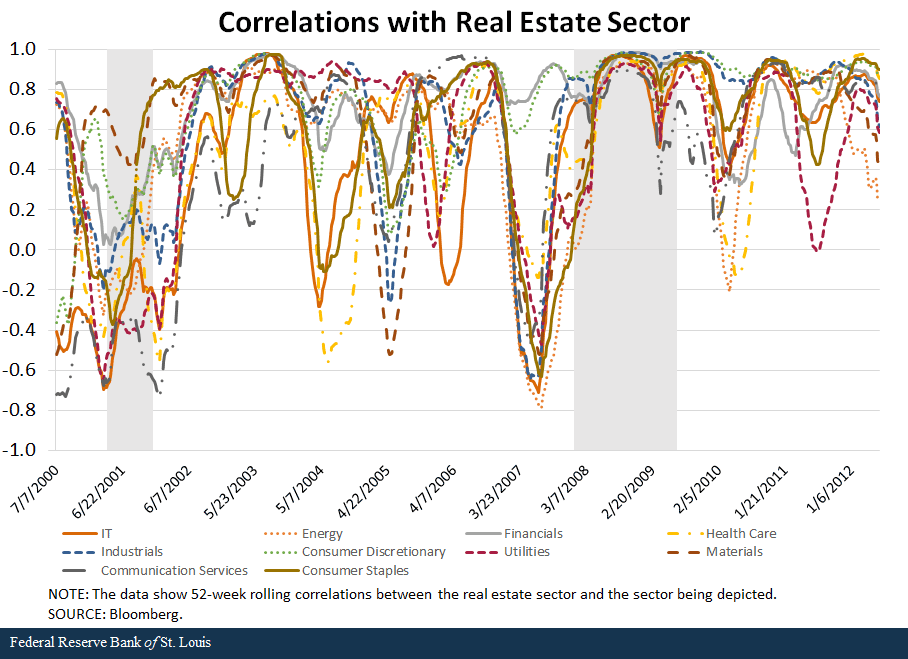

The average correlation between the IT sector and the other market sectors is roughly zero (indicating no correlation) during the 2001 recession, but above 0.9 for most of 2008 (indicating a very high positive correlation). Similarly, the average correlation between the real estate sector and other sectors is roughly zero during 2001 and about 0.9 during 2008. The figure below shows the correlations between the real estate sector and the other 10 sectors.

This suggests that the burst of the IT bubble did not cause contagion across sectoral stock values, but that the collapse of the real estate bubble generated a huge contagion effect across sectoral stocks. In 2008, increased volatility in the real estate sector led to increased volatility in other sectors, and stock prices generally all moved in the same direction. Thus, the correlation coefficients increased across virtually all sectors.

Conversely, in 2001 the average correlation coefficient was low because sectors moved in different directions instead of moving in step with the IT sector’s burst bubble. In other words, the volatility in the IT sector did not spread. This suggests that a crisis in the real estate sector is more contagious than one in the IT sector and thus gives a potential reason why the 2007-2009 recession was deeper than the 2001 recession.

Economics professors at Yale University and Tsinghua University and I (Yi) are designing a general equilibrium model of a multisector financial network with speculative financial bubbles to help explain this fact. Our preliminary finding is that that the bursting of a stock bubble in a critical sector in the production network has a strong contagion effect across sectoral stock prices that can cause a deep recession, while a bubble burst in a sector with shallow links to the real economy does not lead to a severe contraction in GDP.

Notes and References

- The S&P GICS industry sectors are the sources of the sectoral stock price data, with the exception of the real estate sector. The FTSE NAREIT All Equity REITS Index is used for real estate as data for the S&P Real Estate Sector only started in late 2001.

Additional Resources

- On the Economy: More Irrational Exuberance? A Look at Stock Prices

- On the Economy: V-Shaped Recovery Eludes G-7 Countries

- Regional Economist: Growth in Tech Sector Returns to Glory Days of the 1990s

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions