The Recent COVID-19 Spike and the U.S. Employment Slowdown

The coronavirus pandemic continues to affect employment across the United States. In a previous blog post, we explored the idea of forecasting weekly changes in employment using data from Homebase, a data set that reports changes in employment daily. In this article, we discuss our updated forecasts for employment using this technique and investigate whether the recent changes in the labor market are related to the spike in COVID-19 cases across the country since June.

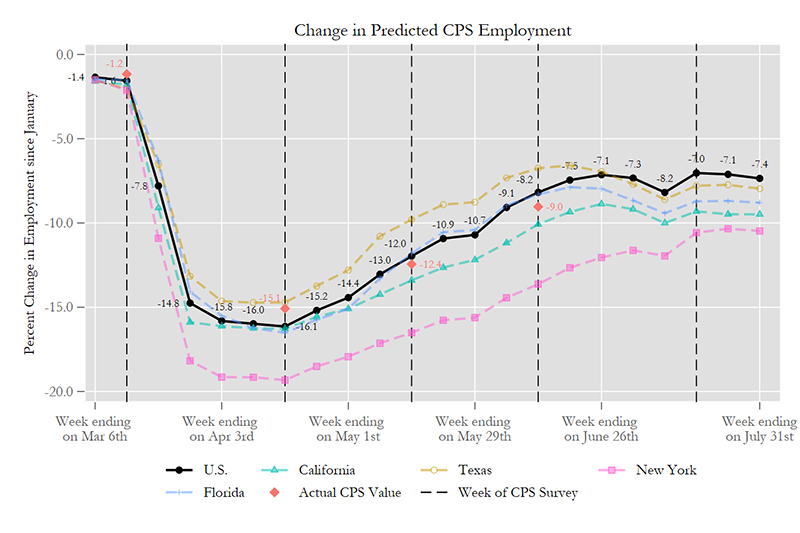

The correlation between the Homebase data and the monthly Current Population Survey (CPS) continues to be very high. The figure below shows the evolution of the change in CPS employment, relative to January 2020, as predicted by our coincident employment index. (For more on the index, see our earlier blog post.)

SOURCES: Current Population Survey/IPUMS, Homebase and authors' calculations.

The figure’s solid black line represents the change in employment for the U.S. predicted by the index and the red points represent actual changes in employment from the CPS. Our indicator performed well in May and June, slightly over-predicting the recovery in employment relative to the CPS. Moreover, the figure shows the predicted changes in employment for the four largest U.S. states, which experienced trends similar to that of the nation.

The figure also shows that since the week of June 12, the recovery in employment has slowed down and slightly reverted. Can we link this recent deterioration in labor market conditions to the recent increase in COVID-19 cases since June?

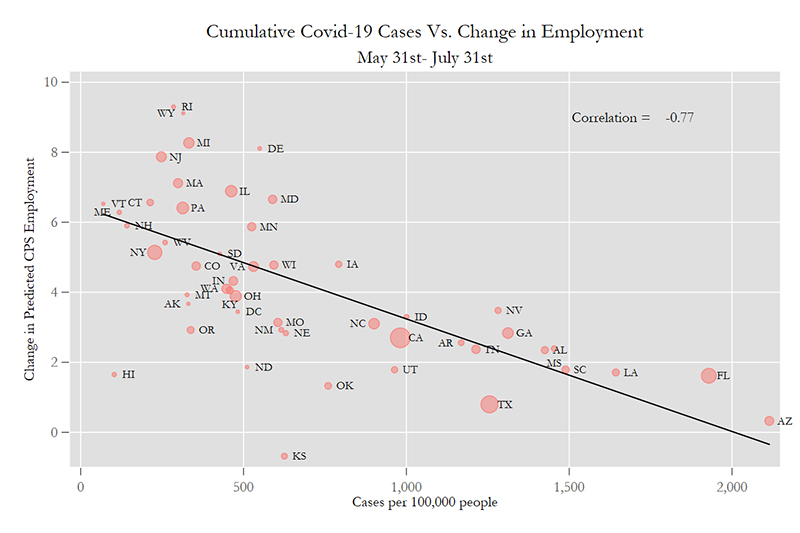

To answer this question, we computed the cumulative number of COVID-19 cases between May 31 and July 24, 2020; to get a measure that is comparable across states, we divided this by the state’s population. We also computed the change in our coincident employment index for each state between May 31 and July 24.

The figure below shows a scatterplot between these two measures, revealing a very strong negative correlation. In other words, the figure shows that states with a larger number of cases since June are states where employment recovered the least between early June and late July. The most notable cases are those of Arizona, Florida and Texas, which experienced both a large number of cases and a very mild employment recovery since early June.

NOTES: The change in predicted CPS employment is the absolute change in the coincident employment index. This means, for example, that New Jersey’s change in employment (with a value of around 8) was twice as large as the change in Kentucky’s employment (with a value of around 4) during the two-month period. The size of the circle represents the relative size of state employment in January 2020.

SOURCES: Current Population Survey/IPUMS, Homebase, USA Facts and authors' calculations.

The coronavirus pandemic has caused great harm to the economy and the labor market. The recent evolution in our coincident employment index suggests that the recent recovery in employment has halted and that the increase in Covid-19 may be the main cause for this. Thus, a strong economic recovery may need a healthy recovery from the pandemic.

Additional Resources

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions