Is College Still Worth It? It’s Complicated

Getty/iStock/Milkos

Getty/iStock/Milkos

Is college still worth it? That was precisely the question posed at the Center for Household Financial Stability’s biennial research symposium held in May of last year. To help answer that question, the Center commissioned original research from leading scholars in the fields of economics, sociology, education and public policy. As one might expect, the findings were rich and varied.

The Conventional Wisdom about the Benefits of College

We corroborated the conventional wisdom that, on average, a college degree is associated with higher family income and wealth over one’s lifespan. Emmons, William R.; Kent, Ana H.; and Ricketts, Lowell R. “Is College Still Worth It? The New Calculus of Falling Returns.” Working Paper, Jan. 7, 2019.

However, the extent of the returns depended on several demographic characteristics—most notably, when people were born and their races or ethnicities. In particular, the financial benefits one can expect from a college degree appear to be lower among people born in the 1980s, and they remain unequal across racial and ethnic groups.

Separately, we also found that the likely payoff to a college degree depends on whether you have a college-educated parent. First-generation college graduates typically receive an income and wealth boost, but they fall short of college grads whose parents also have college degrees.

A Declining Boost from College Degrees, Especially for Wealth Accumulation

We examined the income and wealth of college graduates and postgraduate degree holders born between 1930 and 1989 and found two consistent trends.

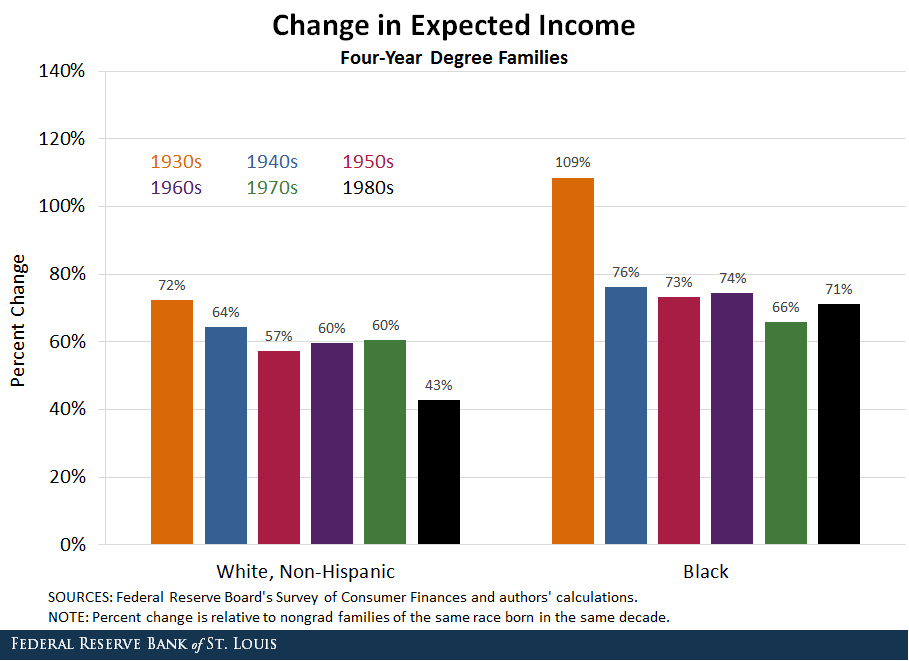

First, the average college and postgrad income premiums (the amount a family headed by a four-year or postgrad degree holder earns in excess of an otherwise similar family) have declined somewhat across successive birth-decade cohorts (born in the 1930s, in the 1940s, etc.) but remained substantial.

In terms of earnings, college is clearly still worth it. This was true for all races and ethnicities, including non-Hispanic white, black, Hispanic of any race and all other families. (The latter two, and results for postgraduate degree holders, are shown in our paper.)

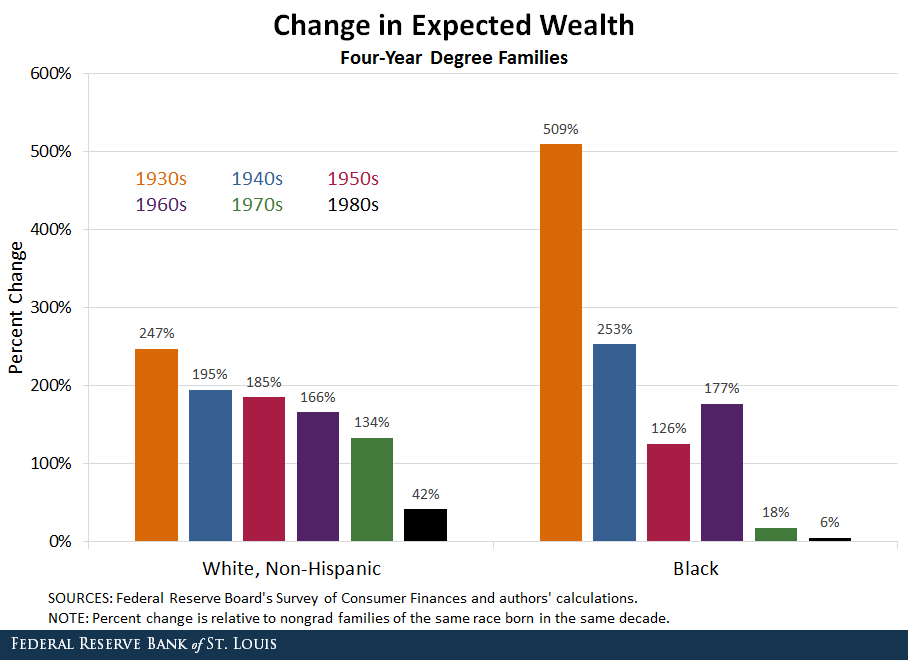

At the same time, the college wealth premium has declined more noticeably over successive generations of college grads and precipitously for people born in the 1980s.

Disturbingly, the wealth benefits of college and postgraduate degrees were much lower among non-white family heads born in the 1970s and 1980s. (The results for white and black families with exactly a four-year degree are shown below.)

In terms of wealth accumulation, college is not paying off for recent college graduates on average—at least, not yet.

We explored several potential explanations for the striking deterioration of the wealth-accumulation benefits from college even while the income benefits remained significant. We suggested three reasons:

- The rising cost of higher education

- The greater availability (and risks) of consumer debt

- The luck of when someone was born since investment opportunities vary over time

We also ruled out explanations such as expanded college enrollments over time reducing the selectivity represented by a college degree. (This would have also resulted in sharply declining income premiums, which we did not observe.)

The Roles of Asset Choice and Early Financial Experiences

Our findings were broadly consistent with other research presented at the conference. Alina Bartscher, Moritz Kuhn and Moritz Schularick showed that college-educated families’ wealth outpaced that of nongrad families due to greater exposure to the stock market and higher rates of small business ownership. Bartscher, Alina K.; Kuhn, Moritz; and Schularick, Moritz. “The College Wealth Divide: Education and Inequality in America, 1956-2016.” Working Paper, Dec. 13, 2018.

Center Visiting Scholar Bradley Hardy and Dave Marcotte found that exposure to poverty and income volatility negatively affects high school graduation, college matriculation and persistence. Poverty occurring close to the end of high school was the most detrimental. Hardy, Bradley L. and Marcotte, Dave E. “Ties that Bind? Family Income Dynamics and Children’s Post-Secondary Enrollment and Persistence.” Working Paper, November 2018.

The Rising Stakes of Achieving a College Education

In his symposium remarks, Fabian Pfeffer described how family wealth itself increasingly predicts both college attendance and persistence among children.

Separately, Pfeffer and co-authors Matthew Gross and Robert Schoeni found in their symposium paper that a large part of growing wealth inequality can be traced to the increasing challenges noncollege graduate households have accumulating wealth over time.Pfeffer, Fabian T.; Gross, Matthew; and Schoeni, Robert F. “The Demography of Rising Wealth Inequality.” Working Paper, November 2018.

Likewise, keynote speaker Susan Dynarski stressed deteriorating financial outcomes among noncollege graduates. Echoing our discussion, Dynarski also emphasized rising college costs due to consistent cuts to public funding for college in slowing college grads’ wealth accumulation.

Finally, Kevin Carey called for greater consumer protection within higher education during his remarks. In particular, Carey suggested that colleges should be required to provide a standardized and transparent estimate of the costs and financial aid being offered.

So, Is College Still Worth It?

On average—that is, across all birth years, races and ethnicities—college is still worth it in terms of earnings. We found that college and postgrad degree holders generally earn significantly higher incomes than nongrads.

However, for recent generations and for non-white students, the payoffs are somewhat lower than average. This is especially true for wealth accumulation. Considering all of the evidence, we conclude that the conventional wisdom about college is not as true as it used to be.

Notes and References

1 Emmons, William R.; Kent, Ana H.; and Ricketts, Lowell R. “Is College Still Worth It? The New Calculus of Falling Returns.” Working Paper, Jan. 7, 2019.

2 Bartscher, Alina K.; Kuhn, Moritz; and Schularick, Moritz. “The College Wealth Divide: Education and Inequality in America, 1956-2016.” Working Paper, Dec. 13, 2018.

3 Hardy, Bradley L. and Marcotte, Dave E. “Ties that Bind? Family Income Dynamics and Children’s Post-Secondary Enrollment and Persistence.” Working Paper, November 2018.

4 Pfeffer, Fabian T.; Gross, Matthew; and Schoeni, Robert F. “The Demography of Rising Wealth Inequality.” Working Paper, November 2018.

Additional Resources

- Center for Household Financial Stability: Is College Still Worth It?

- On the Economy: The College Boost: Grads Still Do Better Than Nongrads Financially

- On the Economy: The College Boost: Is the Return on a Degree Fading?

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions