Long-Term Household Income and Wealth Gains Favor Older Americans

Household income went up in 2016, and relatively fewer families were in poverty or were without health insurance, according to a Census Bureau report. And senior citizens benefited most of all.

According to the Census Bureau’s annual report on income, poverty and health insurance, inflation-adjusted U.S. median household income increased strongly in 2016 for the second straight year, reaching a new peak of $59,039.1 Also, the share of families in poverty and without health insurance declined.

The report’s findings reinforce long-standing trends toward improved household well-being that skew strongly toward older Americans. Key measures such as health insurance, poverty, wealth and income show that senior citizens are benefiting more than other age groups from improved living standards.

Health Insurance

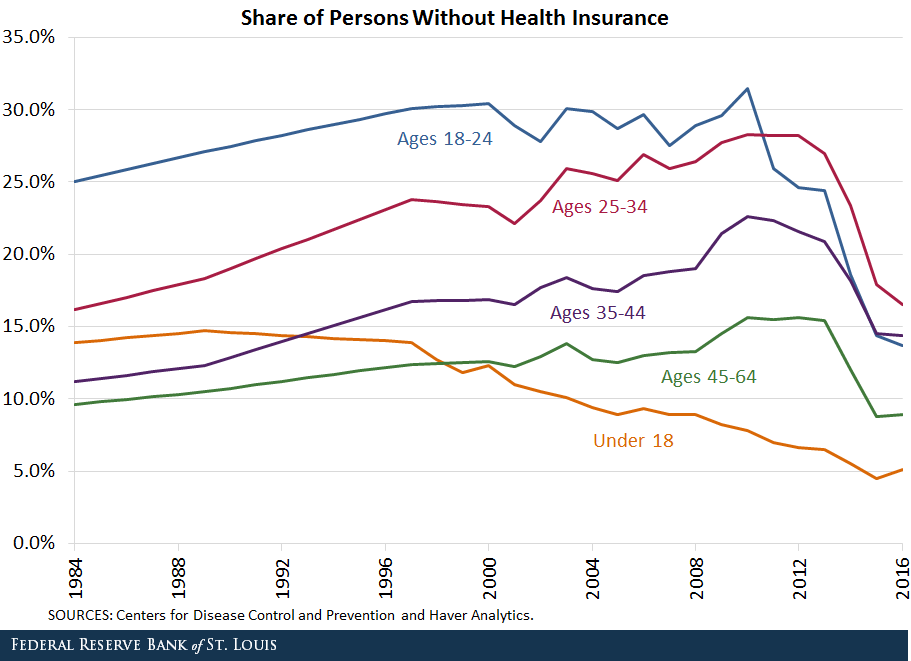

Nearly all Americans 65 years or older are covered by Medicare, which was created in 1965. Hence, their uninsured rate has approached zero during the past five decades.

Among people under 65, the uninsured rate was between 12 and 18 percent from the early 1970s until the advent of the Affordable Care Act. Last year, it fell to a new low of 10.4 percent.

Within the under-65 population, the uninsured rate is lowest among children because of two government programs:

- Medicaid

- The Children’s Health Insurance Program

Older working-age people (ages 45-64) faced the second lowest uninsured rate at 8.9 percent. Although they have declined recently, the uninsured rates for all three age groups between 18 and 44 remained in double digits, as seen in the figure below.

Poverty

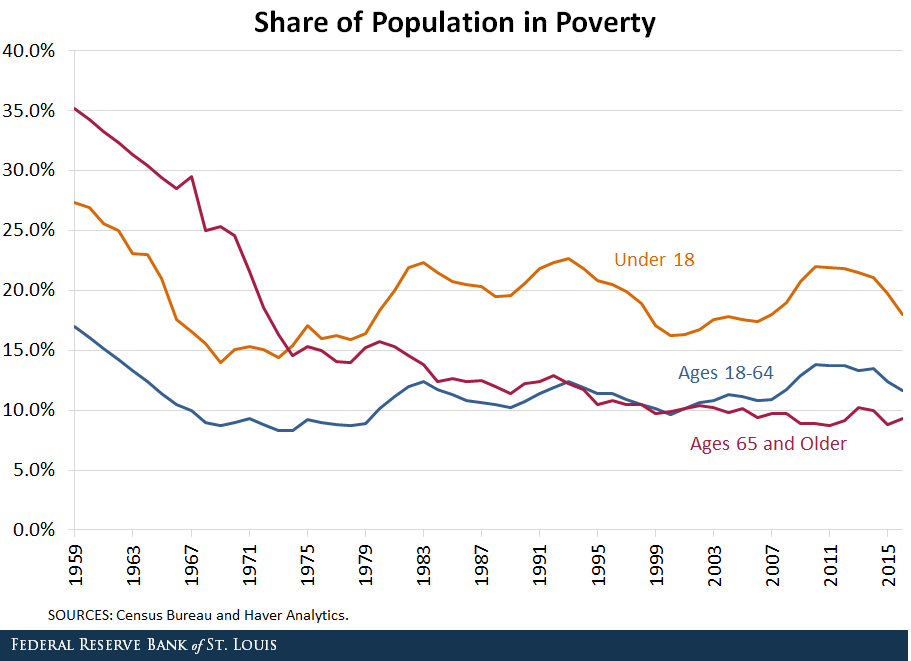

The overall poverty rate declined to 12.7 percent in 2016, slightly below its 13.2 percent average of the past 50 years. Children were more likely than adults to live in poverty, while people 65 years and older had the lowest poverty rate of all age groups.

As shown in the figure below, this is quite a change from before the mid-1970s, when older Americans were the most impoverished age group.

Median Household Wealth

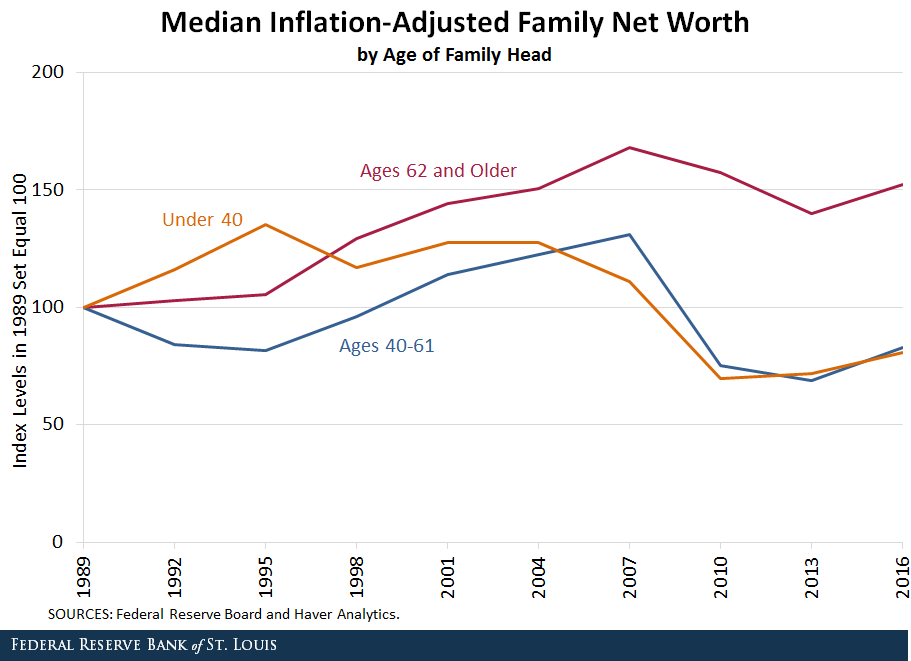

The household wealth of a typical older American family is much greater today than the wealth of its counterpart of the same age a quarter-century ago. The median inflation-adjusted net worth of a family headed by someone aged 62 or older was 52 percent greater in 2016 than in 1989.

Meanwhile, among younger families, the typical family today has lower wealth than its counterpart a quarter-century ago:

- The median family headed by someone aged 40-61 in 2016 was about 17 percent less wealthy than its counterpart in 1989.

- The median wealth of a family headed by someone under 40 was about 19 percent lower in 2016 than its counterpart in 1989.

Median Household Income

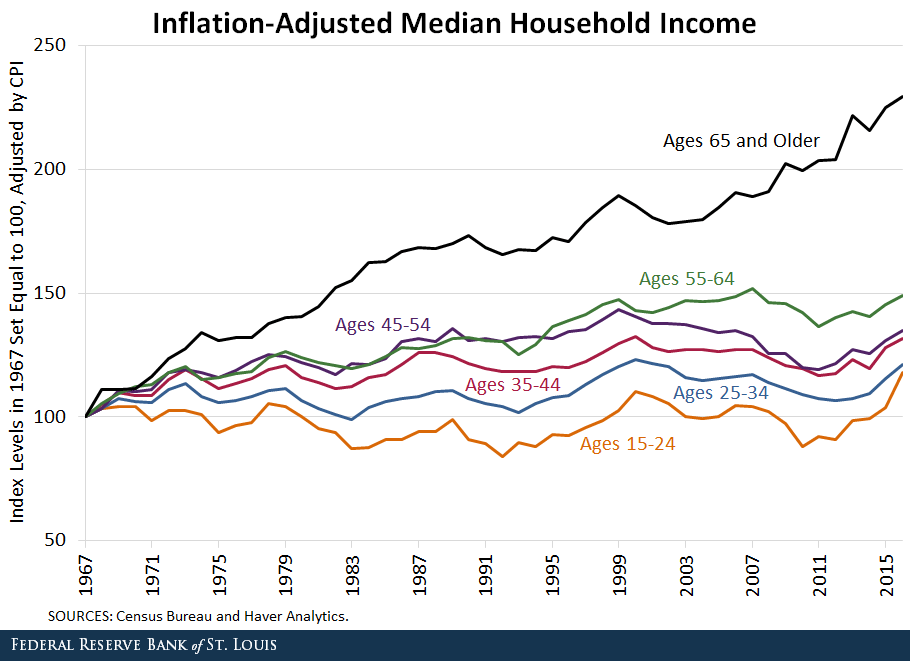

As shown in the figure and table below, several age groups had higher income in 2016 than they did in 2000, while the others had almost recovered from earlier losses. This is due to four consecutive years of growth in the median family’s inflation-adjusted household income. However, as recently as 2014, every age group (except those 65 and older) earned a lower real income than they did in 2000.

Indeed, the exceptional nature of household income growth among older Americans extends far back in time. Beginning in 1967 (with the advent of the current Census Bureau data series), the median real income among households headed by someone 65 years old or older has increased much more than among any other age group.

As seen in the table below, it’s not only the oldest age group that has benefited, though the older the age group, the greater the long-term gain in real median household income since 1967.

| Changes in Household Income | ||

|---|---|---|

| Age Group | Change in Median Real Household Income Since 2000 | Change in Median Real Household Income Since 1967 |

| 15-24 | 7% | 18% |

| 25-34 | -2% | 21% |

| 35-44 | -1% | 32% |

| 45-54 | -4% | 35% |

| 55-64 | 4% | 49% |

| 65 and Older | 24% | 130% |

| SOURCES: Census Bureau and Haver Analytics | ||

| Federal Reserve Bank of St. Louis | ||

What’s So Special about Older Americans?

Why are these (and other) measures of well-being improving most rapidly for the oldest Americans?

Three factors seem particularly important:

- The low starting point

- Public policies

- Demographic change within the ranks of the elderly

A Low Starting Point

A century ago, or even 50 years ago, older Americans arguably were the most disadvantaged age group:

- Health insurance was rare among the elderly before Medicare.

- Old-age poverty was rampant before Social Security began in 1935.

- Even as late as the 1960s, about one-third of people over 65 lived in poverty.

- Median household wealth and income were low compared to middle-aged Americans.

Thus, improvements in each of these measures of elderly well-being have been impressive, in part because they each started from a low base.

Public Policies

Public policies such as Social Security and Medicare have transformed the lives of older Americans almost beyond recognition. In addition to providing income security and insurance against catastrophic medical expenditures, government policies focusing on education, medical research, housing and wealth accumulation have helped millions of older Americans build better lives than any previous generation of senior citizens.

Demographic Changes among the Elderly

Today’s elderly are different than previous older generations. They are healthier, live longer and are much better educated than any previous generation. Together with supportive public policies and decades of strong economic growth, people born in the first half of the 20th century enjoyed unprecedented increases in their measured well-being.

There also may be aspects unique to today’s senior citizens—such as financial conservatism resulting from experience of the Great Depression and World War II and the small sizes of their birth cohorts—that make them different from other groups. Thus, for a variety of reasons and on a range of measures of well-being, today’s older Americans continue to enjoy unusually rapid progress toward higher living standards.

Notes and references

1 U.S. Census Bureau, Income, Poverty and Health Insurance Coverage in the United States: 2016, released Sept. 12, 2017.

Additional Resources

- Center for Household Financial Stability: The Demographics of Wealth

- On the Economy: An Even Wider Generational Wealth Gap?

- On the Economy: Wealth Gap Widens between Young and Old Families

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions