National Overview: Mixed Signals, but Moving Forward

Despite pockets of strength, the U.S. economy continues to struggle to build consistent momentum. Real GDP growth rebounded in the first quarter of 2013 after ending 2012 on a relatively weak note. Real GDP grew at a 0.4 percent annual rate in the fourth quarter but then sped up to a modest 1.8 percent annual rate in the first quarter. The momentum swing in the first quarter, though, was not expected to carry into the second quarter. According to the May Survey of Professional Forecasters, real GDP growth was expected to slow to about 1.75 percent in the second quarter before rebounding to an average of about 2.5 percent over the second half of this year.

Housing's Strength Spreads

Breaking down the GDP data indicates that housing continues to be a source of strength. Through the first five months of 2013, new and existing home sales, as well as housing permits, posted double-digit annualized growth rates compared with the same period in 2012. Moreover, house prices rose sharply, boosting the confidence of home builders. By contrast, commercial construction exhibited much less vigor.

Brisk gains on the housing front are beginning to boost other segments of the economy. For example, the housing boom appears to be triggering an upswing in household spending. Through the first four months of 2013, sales of household furnishings and durable equipment like appliances increased at about a 3.5 percent annual rate—much stronger than the 1.9 percent growth in total personal consumption expenditures. Elsewhere, automotive manufacturers have boosted production of light trucks, which are used extensively in the construction industry.

The rebound in consumer spending, at first glance, is perhaps not too surprising, given other key developments. First, consumer confidence and household wealth rose sharply over the first half of 2013. Second, gains in private-sector jobs averaged a little more than 200,000 per month over the first six months of 2013.

However, other factors were working in the opposite direction. These include the payroll tax increase in January, higher gasoline prices over the first half of the year, tepid growth of real average hourly earnings over the past few years and the relatively high levels of long-term unemployment. These factors may help explain some of the unexpected softness in total consumption spending that occurred in April and May.

Despite healthy profit margins and a relatively low cost of capital, real business fixed investment increased at just a 0.4 percent annual rate in the first quarter and was up only 3.7 percent from four quarters earlier. Similar to April's weak consumption data, production of business equipment fell by 0.5 percent in April. However, there are signs that business investment is picking up, as new orders to manufacturers for capital goods increased strongly in April and May.

Thus, consistent with most forecasts, the data point to modest growth in the second quarter. Moreover, with abundant levels of cash on corporate balance sheets, it appeared that many firms still harbored a considerable amount of uncertainty about the near-term outlook. Financial market conditions, though, remain healthy, according to the St. Louis Fed's Financial Stress Index.

Few Worries on the Inflation Front

Reflecting a notable slowing in food price gains and sizable drop in consumer energy costs, headline inflation has been exceptionally modest thus far in 2013. Through the first five months of the year, the consumer price index (the headline version, which factors in food and energy) increased at only a 0.7 percent annual rate—about

1 percentage point slower than for the same five-month period in 2012. Core inflation (excluding food and energy) also slowed relative to last year, but by not as much as the headline inflation rate. Over the first five months of 2013, the core consumer price index (CPI) advanced at a 1.8 percent annual rate, 0.5 percentage points slower than last year's gain over the same period.

Blue Chip forecasters don't expect these exceptionally low levels of inflation to persist: The headline CPI is projected to increase at about a 2 percent annual rate over the second half of this year. But, signals from the bond market suggest that longer-term inflation concerns appear relatively muted. In early June, yields on inflation-sensitive 30-year Treasury securities remained well below their peak of 4.9 percent (in early April 2010) during this business expansion.

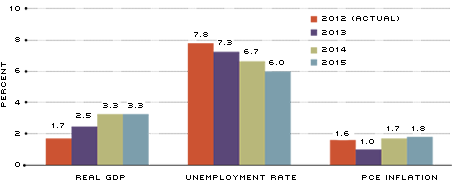

On balance, stable inflation expectations and a lessening of some of the uncertainties and headwinds that have hampered hiring and business investment the past year or more should lead to faster growth and low inflation going forward. Indeed, this is the takeaway from the latest economic projections of the Federal Open Market Committee. (See chart.)

FOMC June 2013 Economic Projections for 2013-2015

SOURCE: Board of Governors of the Federal Reserve System.

NOTES: Projections are the midpoints of the central tendencies. The actual and projected unemployment rates are for the fourth quarter. The growth of gross domestic product (GDP) and personal consumption expenditures (PCE) is the percentage change from the fourth quarter of the previous year to the fourth quarter of the indicated year.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us