College Degrees: Why Aren't More People Making the Investment?

Over the past 30 years, some of the benefits of furthering one's education have become more pronounced, specifically, higher earnings and lower unemployment. Some studies have even found a positive relationship between higher education and better health.1 Surprisingly, over the same period, high school dropout rates have declined only modestly, and close to one-third of all high school graduates still do not enroll in any form of college. Even though a greater percentage of high school graduates enter college today than 30 years ago, this rise has not been met by a proportional increase in completion rates. In the past few years, college graduation rates actually have fallen as a consequence of increasing college dropout rates. This begs the question: If the benefits to education appear to be so high, why don't more people seek a college degree?

Economists and policymakers have been particularly interested in trying to explain this phenomenon. Some possible factors that have been considered are: higher tuition costs, changes in assistance programs, fear of failure, earnings risk and, more recently, the recession and financial crisis. This article will pay special attention to failure and earnings risk, as these forces are particularly useful in understanding why one individual may choose college but another may not.

Measuring the Benefits of College

The skill premium measures the difference in the average earnings of four-year college graduates and that of nongraduates (i.e., dropouts and those who didn't enroll).2 Recent estimates suggest the skill premium is between 65 and 75 percent, but estimates vary depending on the data source.3 This skill premium implies that, on average, a college graduate earns between 65 and 75 percent more than a high school graduate.

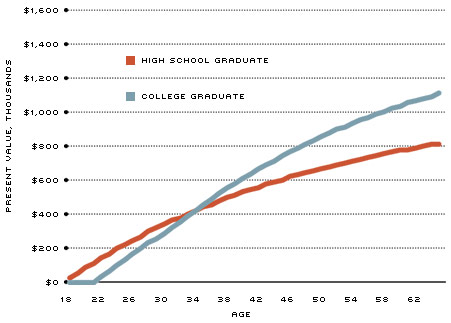

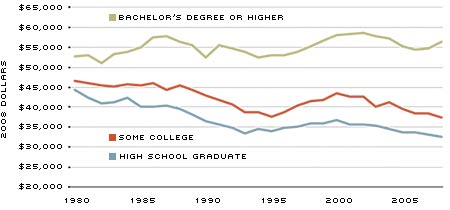

The skill premium exists due to differences in the supply and demand for different types of workers. Over time, the demand for college graduates (driven by factors such as better technology) has increased faster than the supply of graduates; at the same time, the demand for less-educated workers has declined. As a result, earnings have diverged: Figure 1 plots real median annual earnings of males from 1980 to 2008 by education level. The difference between each of the lines is a measurement of the skill premium.

The skill premium between college graduates and the other two groups has continued to increase. This is primarily due to a decline in real earnings of those without a college degree. Between 1980 and 2008, the college wage premium between male college graduates and those with some college increased by 26 percent. The gap between college and high school graduates grew even more: 33 percent.

The impact of further education on income is even more pronounced when the skill premium is compounded over time. Recent college graduates who completely finance their education with student loans will "catch up" to the total lifetime earnings of a high school graduate by their mid-30s. (See sidebar at end.)

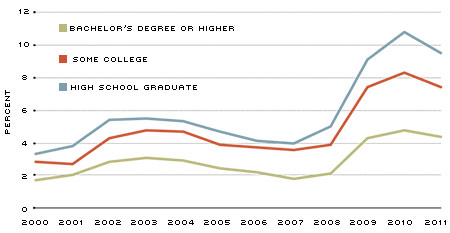

In addition to the difference in higher lifetime earnings, higher education is accompanied by a significantly lower rate of unemployment. (See Figure 2.) Between 2000 and 2007, the average unemployment rate for workers with a high school degree was 4.6 percent, while the rate for workers with a college degree was only 2.4 percent. The gap was especially pronounced during the recent recession, with a difference of six percentage points in the unemployment rates between the two groups.

Real Median Earnings for Men by Education Level

SOURCES: College Board Advocacy and Policy Center and authors' calculations.

Some college includes associate degrees. It is common to use male earnings due to female labor force selection bias and changes in labor force participation. Women with the potential for high earnings tend to enter the labor force, while women with the potential for low earnings elect to stay home.

Unemployment Rate by Education Level, Men and Women

SOURCE: Bureau of Labor Statistics, Table A-4. Some college includes associate degrees.

What Drives College Participation Rates?

A 2010 study by economist Gonzalo Castex analyzed the changes in the college participation rate between 1980 and 2000. Using data from the National Longitudinal Survey of Youth (NLSY), Castex found that the college enrollment rate increased from 41 percent in 1980 to 68 percent in 2000. More important, he found that the increase in enrollment rates was not the same for all groups of people. Variation was due to differences in cognitive ability and financial status.4 The increase in enrollment was more pronounced for students of high ability or from a high-income family. For example, the gap in college participation rates between students from the lowest-ability quartile and the highest-ability quartile was more than 60 percentage points.

Aiming to explain this change in enrollment rates and differences across groups, Castex used a decision-choice model. This type of model simplifies real-world decisions by identifying the important factors influencing a particular decision; the model assumes individuals make rational choices based on the information they have. In the model, there are four driving forces that can explain enrollment rates: increases in college wage premium, increased availability of merit-based aid for college, increases in tuition costs, and shifts in both the distribution of family income and individual ability.

A higher college wage premium increases the payoff of completing college and, hence, should have a positive effect on college enrollment. The model confirms this hypothesis: Increases in the college wage premium are the most influential factor affecting college participation among the four driving forces.

The increased availability of merit-based grants and scholarships reduces the cost of college education, making college more desirable. According to Castex, the number of recipients also increased. Between 1980 and 2000, the ratio of grants awarded to high-ability students (in dollars) to cost of education increased by 70 percent for low-income students and by 50 percent for high-income students. This ratio changed little for students in the low-ability groups. In the model, the redistribution of college subsidies accounts for 6 percent of the aggregate increase in college enrollment, and not surprisingly, it has a larger effect for students of high ability.

Tuition costs are another factor influencing the decision to attend college; this has been well-documented by economists.5 The average college tuition increased by about 150 percent between 1980 and 2000: from $9,000 to $23,000.6 Higher tuition should make college less desirable because it lowers the return on the investment and because the high price tag may put college out of reach for some families. However, higher tuition costs can be offset by more borrowing. As a result, the impact of higher tuition is smaller than one might expect. In the model, increases in tuition reduced the overall college participation rate by only 3 percent (by 7 percent for low-ability students).

The interaction between students' ability and their family income is also an important determinant of college participation. Holding ability constant, students in low- and middle-income families have greater access to need-based grants and scholarships, which reduce the cost of education. Since 1980, there has been significant change in the relationship between student ability and family income. Castex's findings suggest that more high-ability students now belong to middle-income families than did in 1980. This implies more grants for middle-income students and, therefore, an increase in college participation.

Using the same data set as Castex, but a different skill measure, Joseph Altonji and co-authors found that the skill premium provides even less motivation for individuals to acquire additional skills than Castex found.7 Specifically, only about 1.5 percent of the increase in skills can be explained by the higher skill premium (after controlling for factors such as race, gender, family structure and parental education).

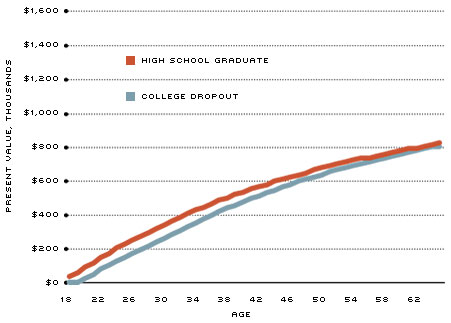

In the past, economists used self-selection (i.e., college may not be for some people) to explain the high return of college education but lower participation. However, college is a risky, irreversible investment, which makes some students hesitant to commit. Two recent papers, one by Castex and another by economists Kartik Athreya and Janice Eberly, explain this in terms of failure risk and earnings risk. Failure risk refers to the possibility that a student will not complete college. Earnings risk relates to a college graduate not being guaranteed anything in terms of future earnings or employment.

Failure Risk

It is important that one's ability to earn a college degree be taken into consideration when deciding about college. A 2009 study by economists John Bound, Michael Loevenheim and Sarah Turner found college failure rates close to 50 percent at four-year public colleges. The authors also found that increases in the rate of college enrollment had been accompanied by a decrease in completion rates. The costs of failure can be very high because uncertainty over eventual completion is not quickly resolved; generally, students who drop out do so after about two years. Those two years of tuition expenses and forgone earnings may deliver no return.8 Economists Fabian Lange and Robert Topel argued that many dropouts failed to earn any wage premium because most learning takes place in the later years of college.

In another part of his paper, Castex examined a sample of workers from the 1979 NLSY. He found that students who dropped out of college at the beginning of the 1980s owed financial and educational institutions $9,350 on average; 15 percent of this group owed more than $24,000. The average wage when joining the labor force for those students who dropped out and owed more than $15,000 was about $28,000, a wage comparable to that of a high school graduate. Therefore, incorporating the probability of failure into the decision to attend college could change an individual's decision.

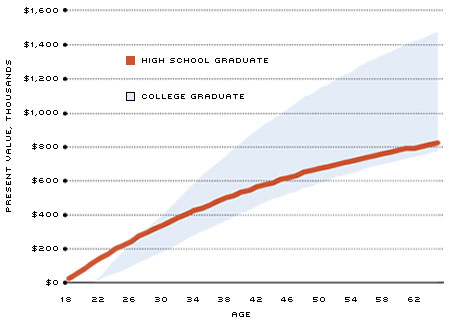

Earnings Risk

Even the young adults who earn college degrees are not given any guarantees. Uncertainty about future employment and earnings even exists on graduation day. A May 2011 article in The New York Times reported that in 2009 slightly over half of college graduates under the age of 25 were working on jobs that required a college degree. Moreover, 22 percent of this same group was not working at all, and the remaining 22 percent was underemployed.

Even though part of this underemployment may be due to the state of the economy, some graduates are unable to earn the wage premium they had invested in. This can be due to various factors, such as school performance, degree choice or quality of life issues. This implies that it is possible for relatively young college graduates to immediately earn less than they expected. These events substantially lower their present and future stream of earnings and, consequently, the present value of their remaining lifetime income.

Impact of the Recession

Traditionally, economic slowdowns have not been associated with declining college enrollment rates. This is because, during bad economic times, people are less likely to find a good job and, thus, choose to go to school instead. However, the experience during the last recession was different: College enrollment rates declined. The housing crash and financial crisis may explain the difference. Declining home prices and stock market wealth placed some families in a situation where college may have become unaffordable. In addition, college endowments lost significant value, which may have resulted in fewer scholarships. Compounding this problem, the financial crisis made it more difficult for households to borrow. In fact, part of the Federal Reserve's response during the financial crisis involved creating programs to improve the student loan market.9

Earnings risk likely has played a role, too. Since the recession, the unemployment rate for college graduates has more than doubled, from under 2 percent in 2007 to a peak of 5 percent at the end of 2010, and roughly one-quarter of recent graduates were underemployed. Making things even worse, the economy has experienced a jobless recovery, and four years after the recession began, the unemployment rate is still elevated. These factors have increased the aggregate risk of pursuing a college degree. In this new environment, even attaining a college degree may not result in the skill premium desired. Therefore, even though the skill premium may have gone up during the recession, the increase in unemployment rates for college graduates can certainly be an important factor explaining the slow growth in college enrollment rates and the elevated college dropout rates.

Endnotes

- See Hernández-Murillo and Martinek. [back to text]

- The skill premium will differ based on factors such as school choice, major, occupational choice and geographic location, among others. [back to text]

- Sixty-five percent is from Goldin and Katz and controls for multiple factors. Back-of-the-envelope calculations using the data in Figure 1 put the premium over 70 percent. [back to text]

- Castex measures cognitive ability by standardized test (AFQT) score. [back to text]

- For example, see Garriga and Keightley. [back to text]

- In 2007 dollars, according to the College Board. [back to text]

- The authors measure skills using a skill index based on wages and employment after 10 years of employment. [back to text]

- Hungerford and Solon find that the return of partial completion of college is low. [back to text]

- Specifically, the Fed created the Term Asset-Backed Securities Loan Facility (TALF), which supported the issuance of asset-backed securities collateralized by student loans (as well as auto and credit card loans). [back to text]

References

Altonji, Joseph G.; Bharadwaj, Prashant; and Lange, Fabian. "The Anemic Response of Skill Investment to Skill Premium Growth." VOXeu, May 6, 2008. See www.voxeu.org/index.php?q=node/1110

Athreya, Kartik; and Eberly, Janice. "Risk and the Response of College Enrollment to Skill Premia." January 2012, Northwestern University, mimeo.

Bound, John; Loevenheim, Michael; Turner, Sarah. "Why Have College Completion Rates Declined? An Analysis of Changing Student Preparation and Collegiate Resources."

National Bureau of Economic Research Working Paper 15566, December 2009.

Castex, Gonzalo. "Essays on Human Capital Formation." University of Rochester Ph.D. dissertation, August 2010.

College Board. See http://trends.collegeboard.org

Garriga, Carlos; Keightley, Mark P. "A General Equilibrium Theory of College with Education Subsidies, In-School Labor Supply, and Borrowing Constraints." Federal Reserve Bank of St. Louis Working Paper 2007-049A, November 2007.

Goldin, Claudia; and Katz, Lawrence F. "Long-Run Changes in the Wage Structure: Narrowing, Widening, Polarizing." Brookings Papers on Economic Activity, 2:2007.

Hernández-Murillo, Rubén; and Martinek, Christopher. "Which Came First—Better Education or Better Health?" The Federal Reserve Bank of St. Louis' The Regional Economist, April 2011, Vol. 19, No. 2, pp. 5-6.

Hungerford, Thomas; and Solon, Gary. "Sheepskin Effects in the Returns to Education." Review of Economics and Statistics, Vol. 89, No. 1, February 1987.

Lange, Fabian; and Topel, Robert. "The Social Value of Education and Human Capital." Handbook of Education Economics, Vol 1. Eds. Eric Hanushek and Finis Welch. 2006.

Rampell, Catherine. "Many with New College Degree Find the Job Market Humbling."

The New York Times, May 18, 2011.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us