The L3C: A New Business Model for Socially Responsible Investing

The L3C is one of several hybrid business organization models that have been developed in recent years, both in the U.S. and abroad, to help address the funding-related challenges experienced by a growing sector of charitable-purpose entities known as social enterprises.[1] A social enterprise is an organization that combines or supports a charitable mission with market-oriented methods. In other words, a social enterprise has a “double bottom line,” or double purpose of social benefit and financial gain. Dubbed the “Fourth Sector,” social enterprises are increasingly seen as filling a void left unaddressed by the traditional public, private, and nonprofit sectors. In particular, social enterprises are seen as straddling the for-profit business sector, which is generally constrained by the duty to generate profits, and the nonprofit sector, which is generally constrained by tax laws and the duty to fulfill social objectives.

At the heart of the social enterprise movement is the ongoing challenge of accessing investment capital for socially responsible purposes.[2]Acquiring start-up capital is a common issue for many nonprofits. It’s exacerbated by federal tax laws that restrict nonprofits from accessing traditional forms of equity, such as venture capital and, sometimes, commercial debt. For the most part, nonprofits must rely on private foundation grants, government support, and, for some, earned income such as fees for services. To subsidize their earned income, some nonprofits have set up separate social enterprise business sidelines.[3] For example, an animal shelter in Minneapolis recently opened a full-service day care, grooming, and boarding facility for pets.

The for-profit sector faces its own challenges in funding charitable activities because federal tax laws generally restrict private business entities from accessing foundation grants and government assistance. In addition, for-profit investors expect market-rate returns and maximized profits. Their expectations don’t align well with social mission-focused entities, which need “patient capital” and typically have slower, more modest growth.

There is a growing body of thought that new business models and possibly new tax incentives or structures are needed to effectively bridge the “sector” gap. These new models would eliminate the need for social entrepreneurs to either choose between the for-profit and nonprofit business models or create and manage both. One such model, the L3C, is a newly developed form of business that blends attributes of nonprofit and for-profit organizations in order to promote investment in socially responsible objectives.

The idea behind the L3C model grew out of a 2006 meeting convened by the Aspen Institute’s Nonprofit Sector and Philanthropy Program and titled “Exploring New Legal Forms and Tax Structures for Social Enterprise Organizations.” Legal, financial, and other experts gathered to discuss the myriad issues that the growing Fourth Sector faces. The key question that emerged was whether traditional business structures and nonprofit tax laws are hindering the growth of hybrid social enterprise models.[4]

It was at this meeting that Robert Lang, president of the Mary Elizabeth & Gordon B. Mannweiler Foundation; Marcus Owens, a partner with the Washington, D.C., law firm Caplin & Drysdale and former director of the Exempt Organizations Division of the Internal Revenue Service; and Arthur Wood, director of Social Financial Services for Ashoka, an international organization that promotes social entrepreneurship and socially responsible investing; met and began collaborating to create a business model that would address, among other things, two key challenges for social enterprise development: federal tax law and “patient capital.” According to Lang, “There was a whole portion of the for-profit sector which, while self-sustaining, produced too low a profit to induce normal for-profit investors to engage on their own. Yet this area is where a lot of socially beneficial enterprises fit.”

A Hybrid of a Hybrid

The trio of Lang, Owens, and Wood developed the L3C as a self-sustaining means to achieve a social mission at the lowest possible cost and with the greatest efficiency. An L3C can make a low profit of 1 to 10 percent, but this is secondary to its social purpose. Unlike a traditional charity, however, an L3C may distribute its low profits to its investors.

As its name suggests, the L3C is a hybrid form of a for-profit limited liability company, or LLC. The LLC is an established form of business entity in most states and U.S. territories and on several Native American reservations. Basing the L3C on the LLC model was a strategic decision that ensured the L3C would have the LLC’s flexible profit, loss, and taxation features. LLCs themselves are hybrids of corporations and partnerships. Like the liability of shareholders of a corporation, the liability of LLC owners, or members, is limited. The LLC is like a partnership, however, in that the organization can be structured to bear no direct tax consequences. For federal income tax purposes, the profit and loss tax liabilities may be passed through to the LLC’s members unless the operating agreement specifies otherwise.

The L3C modifies the standard LLC in a couple of important respects. First, an L3C’s organizing document, called articles of organization, must set forth as its primary business objective “one or more charitable or educational purposes,” as defined by the Internal Revenue Code. In addition, the term “low profit” is embedded in the title of the business form to put investors and philanthropic funders on notice that the entity is motivated first and foremost by its expressed social mission, but not necessarily to the exclusion of making money.

Second, the L3C’s articles of organization must state that the operating agreement among its members contain specific language that mirrors IRS regulations regarding program-related investments, or PRIs. Facilitating the use of PRIs is at the heart of the L3C structural concept. Authorized by Congress in the Tax Reform Act of 1969,[5] a PRI is an investment that a foundation makes in a nonprofit or for-profit venture to support a charitable project or activity, with the potential of a return on the foundation’s capital over a period of time. A PRI can be any type of investment vehicle, such as a loan or loan guarantee, line of credit, asset purchase, recoverable grant, or equity investment. Notably, foundations can use PRIs to meet their federally mandated 5 percent minimum payout obligation.[6] To deter investments in speculative deals, an investment must meet three tests to qualify as a PRI: 1) its primary purpose must be to further the tax-exempt objectives of the foundation, 2) the production of income or the appreciation of property cannot be a significant purpose, and 3) it cannot be used for political lobbying or campaigning.[7] By nature, PRIs are intended to be high-risk and/or low-return.

A Layered Investment Approach

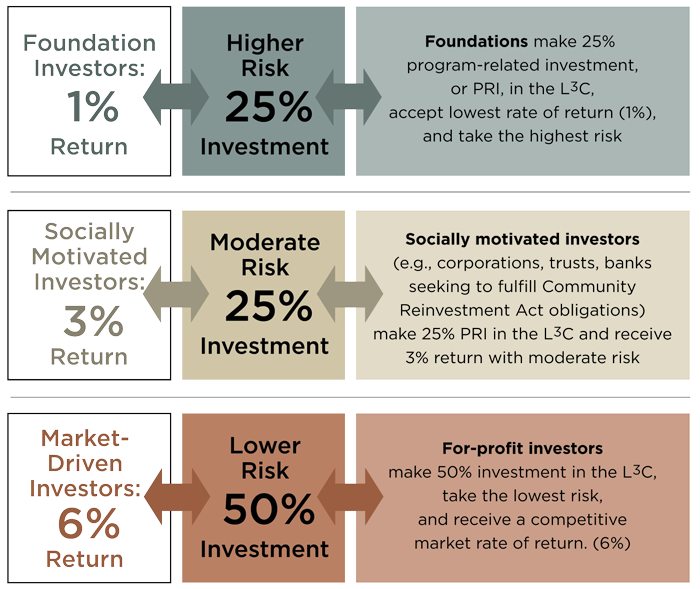

At the core of the L3C concept is the use of PRIs as part of a multiple-tiered, or layered, investment strategy that, theoretically, will help attract a wide range of both socially motivated and profit-oriented investments. Following this strategy, a foundation makes a PRI in an L3C and accepts a lower-than-market rate of return as well as a disproportionately higher risk—or “first risk”—position, which in turn attracts other for-profit investors by lowering their risk and increasing their potential rate of return. The diagram illustrates the mechanics of a sample L3C layered investment strategy and shows how different types of investors can formulate a plan that best suits the risk-to-reward ratios each is willing to accept.

A for-profit entity does not need to organize as an L3C to utilize PRIs for charitable purposes. But Lang and Owens contend that PRIs are significantly underutilized. Of the nearly 80,000 private foundations operating in the U.S. today, only 5 percent make PRIs, and these are primarily loans to charities.[8] According to Lang and Owens, foundations typically don’t engage in PRIs because of the perceived need to seek prior approval from the IRS to ensure compliance with PRI requirements. Upon request and for a fee, the IRS will issue a private letter ruling that states whether a proposed investment will qualify as a PRI. A private letter ruling is not required by law, but the risks of a post-investment determination by the IRS that a foundation’s investment does not qualify as a PRI may include financial penalties. In addition, when the investment is subsequently subtracted from the foundation’s calculation of tax-exempt purpose expenditures, the foundation may face more penalties or even lose its nonprofit status if the subtraction results in falling short of the 5 percent payout requirement. However, obtaining a private letter ruling can be very costly and time-consuming. The costs and perceived risks of seeking or failing to seek private letter rulings deter some foundations from making PRIs. The L3C is structured to help address these barriers and thus facilitate PRIs by requiring the operating agreement among an L3C’s members to include language that sets forth the federal legal requirements for PRIs. This is intended to provide assurance to foundations that their investments in L3Cs comply with federal tax requirements and thus qualify as PRIs without the added expense and time needed to obtain private letter rulings.

To further address the deterrents that keep foundations from making PRIs, Lang and Owens are lobbying for legislation that would amend the federal tax code so that a foundation’s investment in an L3C is presumed to qualify as a PRI unless proven otherwise. This rebuttable presumption is not intended to do away with a foundation’s need to exercise due diligence in its decision-making process, but it would arguably offer the added assurance foundations seek when considering investments in for-profit entities. In addition, Lang and Owens are advocating for L3C legislation at the state level through an informational organization called Americans for Community Development, L3C.

The L3C's Layered Investment Strategy

The percentages listed here are provided for illustration purposes and represent just one of many possible risk-return arrangements for L3Cs.

Possibilities vs. Concerns

The range of socially responsible purposes potentially suited to the L3C structure is broad, from affordable housing initiatives and mortgage assistance to historic building preservation and biotech development. For example, a recently chartered L3C in Vermont produces innovations in medical imaging technology. It has high research and development costs, but relatively low rates of return for its investors. An interesting L3C possibility in North Carolina involves plans to revive the flagging furniture industry. Many of the furniture manufacturing conglomerates in the state have moved production overseas, leaving behind struggling communities. Lang is working with parties in North Carolina to explore developing an L3C capitalized by foundations and for-profit investors that would buy the closed manufacturing plants, rehabilitate and re-equip them, and then rent them at low rates to local, start-up furniture manufacturers. Lang notes, “These would-be entrepreneurs are long on talent but short on cash.” The proposed L3C would provide up-and-coming furniture companies in North Carolina with affordable access to manufacturing capacity. Efforts to pass L3C legislation in that state are under way.

Despite the possibilities, the L3C has its critics and skeptics. Some argue that existing business forms are sufficient for the purposes discussed above, and adding yet another legal entity as an option will “muddy the waters.” Others express concern that the proposed legislation to amend federal tax law pertaining to PRIs in L3Cs entails a loosening of the tax laws for for-profit entities, and that it’s too early to consider amendments because L3Cs are still a relative unknown. Some concern has also been expressed that without the supporting federal tax legislation, the L3C movement will die out.

Proponents of the L3C stand by the new model as a potentially powerful tool for social entrepreneurs and an evolutionary step in social enterprise development. Many believe that as more jurisdictions enact L3C laws, the L3C brand will increasingly attract foundation and for-profit investment. Their belief could soon be tested, because L3Cs are gaining traction across the country. To date, five states and two Native American tribes have enacted some form of L3C legislation. Vermont took the lead, signing L3C legislation into law in April 2008. Michigan, Wyoming, Utah, Illinois, the Crow Tribe in Montana, and the Oglala Sioux Tribe on the Pine Ridge reservation in South Dakota followed suit in 2009. According to L3C Advisors, L3C, the first L3C chartered for the purpose of advocating for and supporting the development of L3Cs, some form of L3C legislation is pending or under review in 20 other states. As a matter of comity, an L3C chartered in one U.S. jurisdiction will be recognized as a lawful business in all other U.S. jurisdictions, whether or not they have enacted L3C legislation.

For more information about the L3C, visit www.americansforcommunitydevelopment.org.

>>More Online

Read The L3C: The For-Profit with the Nonprofit Soul by L3C creator Robert Lang and co-author Carol Coren.

This article is an excerpt from an article originally published in Community Dividend, a publication of the Federal Reserve Bank of Minneapolis. To read the entire article, visit www.minneapolisfed.org/publications_papers/pub_display.cfm?id=4305.

Endnotes

- Examples of hybrid business models in the U.S. include the Socially Responsible Corporation, introduced in Minnesota Senate Bill 3786 in 1986 (the bill failed), and the B-Corporation concept being developed by Jay Coen Gilbert and B-Lab. Examples from abroad include the “community interest company,” which was enacted into law in Great Britain in 2005. [back to text]

- A “socially responsible investment,” or SRI, is an investment made principally for a charitable, educational, environmental, community development, or ethical purpose and not primarily to maximize a return on the investment. [back to text]

- For more about nonprofits creating social enterprises, see “Earning income, serving the community: An introduction to social enterprises” in Community Dividend Issue 1, 2009. Available at www.minneapolisfed.org. [back to text]

- Thomas J. Billitteri, Mixing Mission and Business: Does Social Enterprise Need a New Legal Approach? Highlights from an Aspen Institute Roundtable, The Aspen Institute, January 2007. [back to text]

- See USC § 4944(c) for the statutory provision regarding PRIs. [back to text]

- Private foundations are required by federal law to distribute each year at least 5 percent of their endowments; specifically, their net investment assets. This is known as the minimum payout obligation, or payout rule. [back to text]

- To read the full regulatory definition of PRIs, see CFR § 53.4944-3(a). [back to text]

- IRS Business Master File system, January 2007. [back to text]

Bridges is a regular review of regional community and economic development issues. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other community development questions