How Important Have Employment Revisions Been the Past Two Years?

Today’s employment report from the U.S. Bureau of Labor Statistics (BLS) will be closely scrutinized by Federal Open Market Committee (FOMC) participants as the committee gauges the strength of the economy at the beginning of the second quarter.1 Likewise, private forecasters and financial market participants will be using the same approach—not only to ascertain the economy’s strength but also to help assess the future direction of monetary policy. But how much weight have policymakers, forecasters and financial market participants attached to initial payroll employment numbers? Maybe too much, if recent history is any guide.

Recent speeches by Federal Reserve officials suggest that the FOMC continues to closely monitor the health of labor market conditions.2 The reason, in short, is that labor market conditions are useful for identifying emerging strengths or weaknesses in the pace of aggregate economic activity. For most economists, a key barometer of the health of labor market conditions is the monthly change in the number of jobs created each month.

BLS Monthly Employment Report

In today’s release, the BLS reported that payroll employment rose by 288,000 in April. An often underappreciated aspect of the monthly payroll estimate is that it is subject to several revisions. For example, in the April report, the March estimate (or last month’s initial estimate) of payroll employment was revised from 192,000 to 203,000, and the February estimate was revised from 197,000 to 222,000. In fact, the current estimate of February’s job growth is quite different from the initial estimate (175,000). These revisions are par for the course. Although often challenging for forecasters and policymakers, they nonetheless improve the accuracy of the estimates because they incorporate new information that was not available at the time the initial estimates are reported.3

Payroll Employment Estimate Revisions

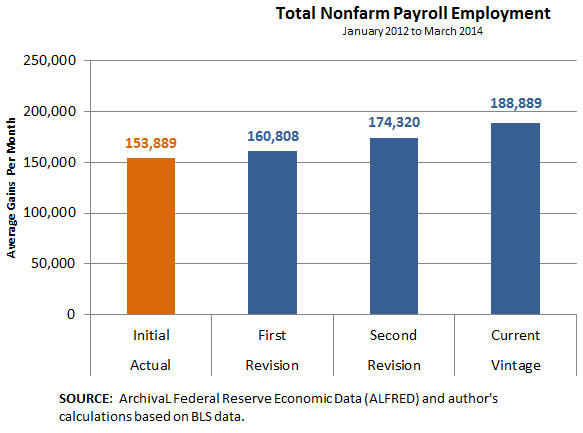

The chart below plots the average monthly change in total nonagricultural (nonfarm) payroll employment since the January 2012 report (released on Feb. 3, 2012).

The leftmost bar in the chart plots the average monthly gain over this period as recorded by the initial estimate. These are the numbers that garner the most attention. Since January 2012, the initial estimates show that nonfarm payrolls increased by an average of about 153,900 jobs per month.

However, the chart also shows that the initial estimate over this period appears to be downward-biased by a substantial amount. The average of all first revisions was about a 4.5 percent increase from the initial estimate, or a revised estimate of 160,800 jobs. The average of all second revisions was even higher, showing a monthly gain of 13.3 percent more than the average initial estimate, or a revised estimate of about 174,300 jobs. Perhaps even more remarkable, the current estimate—which accounts for all previous revisions—shows that total payroll employment gains averaged nearly 188,900 a month over this two-plus year period, or 35,000 (22.7 percent) more than the initial estimate.

The pattern of the revisions shown in the chart is consistent with the evidence showing that revisions tend to be procyclical. That is, during an expansion, revisions to payroll employment tend to be positive; and, during periods of slow economic growth and recessions, the revisions tend to be negative.4 From this standpoint, then, three points are worth noting:

- First, the outlook for the economy remains positive.5

- Second, while the initial monthly estimates of nonfarm payroll employment are important for policymakers and financial market participants, they would be wise to remember that these estimates can be (and often are) revised—by a lot.

- Third, the numbers in the chart exclude the jobs numbers for April that were released today. If the recent past is any guide, then April’s nonfarm job gains could eventually be revised from 288,000 to something close to 325,000.

Notes and References

1 This is a modestly revised version of my Economic Synopses, “Signs of Improving Labor Market Conditions.”

2 See Fed Chair Janet Yellen’s speech, “Monetary Policy and the Economic Recovery,” April 16, 2014; http://www.federalreserve.gov/newsevents/speech/yellen20140416a.htm.

3 See the Frequently Asked Questions section of the monthly employment report.

4 See Michael T. Owyang and E. Katarina Vermann, "Employment Revision Asymmetries," Federal Reserve Bank of St. Louis Economic Synopses, No. 11, 2014.

5 See “Economic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents, March 2014." http://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20140319.pdf

Additional Resources

- On the Economy: The Rise and Fall of Labor Force Participation in the U.S.

- On the Economy: Employment Is Back? It Depends

- Economic Synopses: Signs of Improving Labor Market Conditions

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions